1 of 3

What do you need help with?

1 of 3

Enjoy more than S$4,000 worth of savings with essential solutions. T&Cs apply.

Explore UOB Business Kityou are in GROUP WHOLESALE BANKING

Receive funds securely via your UEN without disclosing your bank account details.

Provide your customers a convenient mode of payment with QR scan-and-pay.

Make payments easily via mobile number/NRIC/UEN/Virtual Payment Address.

Pay and receive in real time via PayNow FAST anytime, anywhere

| Type | Features |

| PayNow Corporate Transactions | Enjoy fee waivers on all incoming PayNow Corporate transactions from now till 31 December 2025. Terms & Conditions apply. |

| SGQR Registration | Receive 4 free SGQR labels when you register for SGQR with UOB. |

| Type |

| PayNow Corporate Transactions |

| SGQR Registration |

| Feature | Outgoing | Incoming |

| PayNow via FAST | Transaction Fee - S$0.50 per item PayNow Lookup Fee - Waived |

S$0.20 per transaction (Waived until 31 Dec 2025) |

| PayNow via GIRO | Transaction fee - S$0.40 per item Return fee - S$1.00 per item |

FREE for incoming transactions |

| Feature |

| PayNow via FAST |

| PayNow via GIRO |

To find out more about UOB Corporate Fees, please click here.

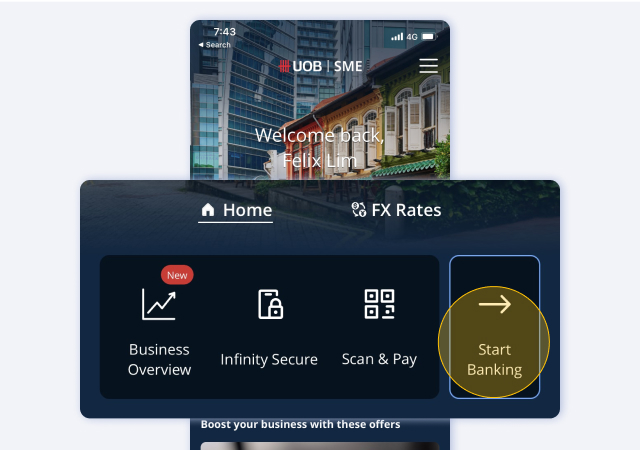

Launch UOB SME App, select 'Start Banking' and login with your digital IDs.

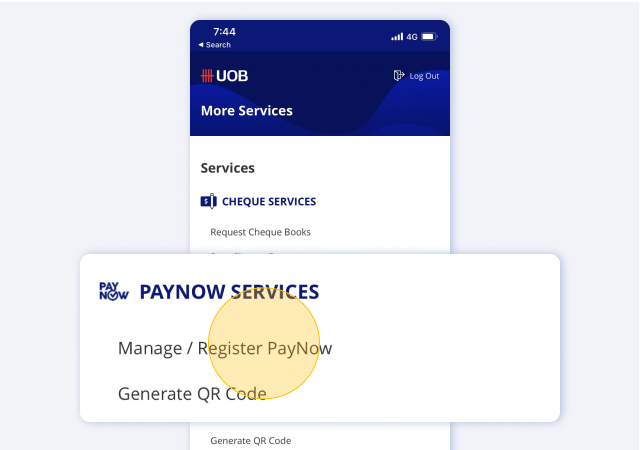

Tap on 'More Services'. Select 'Manage/Register PayNow'.

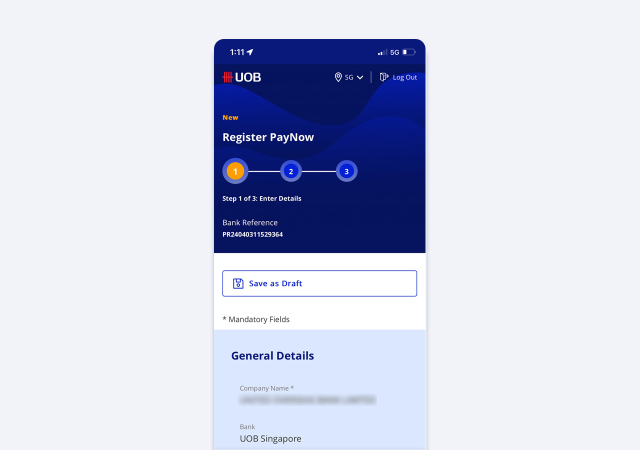

Fill in the required information and send for approval. Once status is 'Registered', you can start using PayNow.

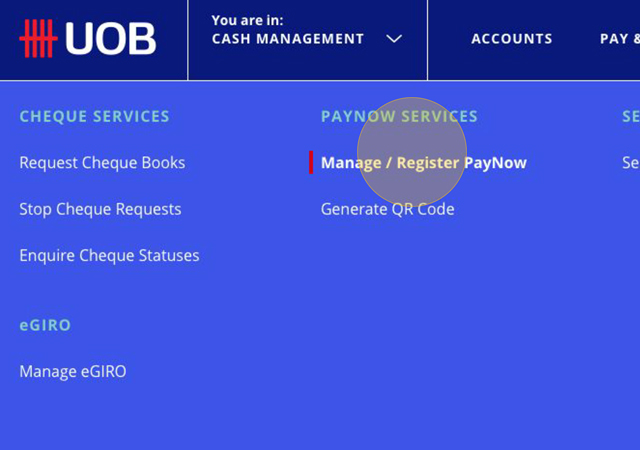

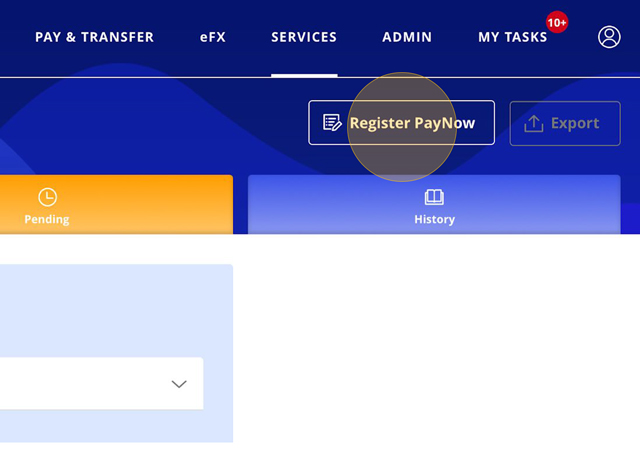

Log in to UOB Infinity, click 'Services'. Under PayNow Services, select 'Manage/Register PayNow'.

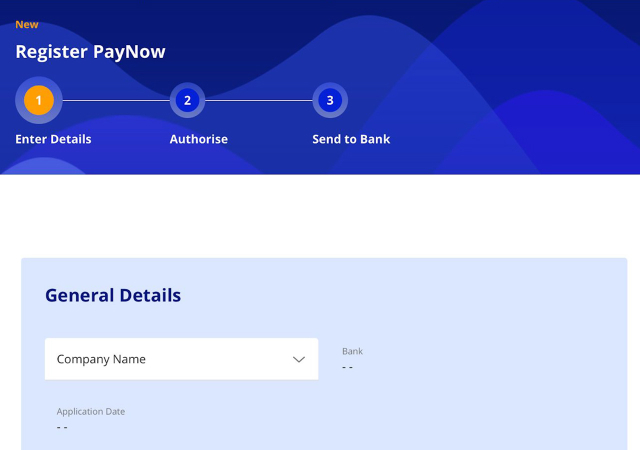

On the 'Manage/Register PayNow' screen, select 'Register PayNow'.

Fill in the required information and send for approval. Once status is 'Registered', you can start using PayNow.

PayNow is an initiative by The Association of Banks in Singapore (ABS) and the banking industry, in response to the increased demand for more convenient and efficient funds transfer methods from customers. With PayNow, the sender no longer needs to know the recipient’s bank and account number in order to make a funds transfer. They can simply send money to individuals using the recipient’s mobile number and/or Singapore NRIC/FIN, and to businesses using Unique Entity Number (UEN), or Virtual Payment Address.

PayNow is secure and adopts the same high security standards established by the banking industry in Singapore for funds transfer.

List of participating institutions

Please refer to ABS website for the latest list of participating institutions – www.abs.org.sg/PayNow

The Proxy ID refers to the unique indicator of the recipient which may be used to receive payments via PayNow. Please refer to the table below for the supported proxy types.

UEN is a standard identification number for entities such as businesses, local companies, LLPs & societies. Businesses and local companies currently registered with ACRA will retain their ACRA Registration Number as their UEN. UEN can also be issued by agencies such as Registry of Societies, People’s Association, Singapore Land Authority, Ministries, etc.

| Bank | Non-Banking Financial Institution (NFIs) | |

| Consumers | • Mobile Number • NRIC/FIN number |

+<Mobile Number> # Unique Participant Identifier E.g. +6591234567#GRAB |

| Corporates | • Unique Entity Number (UEN) or UEN + Suffix |

UEN <UEN> # Unique Participant Identifier E.g. UEN12345678X#DASH |

| Consumers |

| Corporates |

PayNow will enable businesses, corporates and the government to (1) receive Singapore Dollar payments via its registered Unique Entity Number (UEN) to their bank account and (2) make Singapore Dollar payments to a PayNow registered recipient through FAST or GIRO. This will do away with the need to know the recipient's bank and account number when transferring funds.

Corporates can make single or bulk payments using PayNow via electronic channels such as UOB Infinity, Host-to-Host connectivity or UOB APIs. Corporates will have the option to process the payments via FAST or GIRO.

No. Funds can only be transferred using PayNow between participating institutions. Funds transfers between a participating and non-participating institution have to be made via other channels such as FAST or Interbank GIRO.

Payments via PayNow are processed either via FAST or GIRO. There is no minimum transaction limit for payments.

The maximum transaction limit is S$200,000 for payment made via FAST. There is no maximum transaction limit for payment made via GIRO.

PayNow payments made via FAST are available 24x7.

For PayNow payments made via GIRO, the existing GIRO cut-off time applies.

Make payments

To make payments using PayNow, corporates are NOT required to register their UEN to their SGD Current Account. Corporates only require the mobile number/NRIC/UEN/Virtual Payment Address of their payee in order to make a payment via PayNow.

Before making payments, corporates should inform their payees that payment will be made using PayNow, and payees should have registered for PayNow. The payment will be rejected if payee is not registered with PayNow.

Receive payments

Corporates must first register their UEN and their SGD Current Account that they wish payments to be made to, before they can start receiving payments. PayNow is available for Singapore incorporated entities, government agencies, associations, and societies who have a UEN issued in Singapore.

Corporates who perform single payments via UOB Infinity would be presented with the beneficiary’s registered PayNow display name for confirmation before submitting to the bank.

The PayNow display name for individuals is usually their name, unless it has been overwritten with a preferred name.

The PayNow display name for corporates will be the account name from the bank’s record. Corporates will not have the option to indicate a preferred name as opposed to individuals.

For bulk payments, the beneficiary’s registered PayNow display name will be provided in the transaction status file after the transactions are processed.

Bank customers should exercise caution and due care when keying in the amount and details of their recipient.

If an incorrect funds transfer has been made, please contact our Corporate Call Centre at 1800-226 6121 immediately.

Yes. Corporates can include an optional 3 character suffix to their UEN if they wish to link more than one account to PayNow.

Example

A corporate can link Bank A’s Account A to PayNow ID: <UEN>. The corporate can also link Bank A’s Account B to PayNow ID: <UEN><Suffix B>. The corporate can also link Bank B’s Account A to PayNow ID: <UEN><Suffix C>

When the payer keys in the UEN and the corresponding suffix to make payments, the transfer will be made to the corresponding account.

The 3 character suffix supports uppercase alphanumeric, which would be sufficient to allow for many PayNow registrations, if required.

Corporates may register via the following modes:

Quick Response (QR) Code is a type of matrix barcode. It can be scanned (e.g. using a phone camera) to pick-up information and use them to auto populate a form to reduce manual input.

The use of QR codes to receive payments via PayNow is optional. When the payers scan a QR code provided by the company, they can avoid manual input of the corporate’s UEN and suffix. In some cases, the payers may not even need to input the amount and bill reference as the QR codes can allow payment reference to be automatically included during the payment so as to facilitate reconciliation for the company.

Consumers will be able to use the personal banking mobile app of PayNow participating institutions to scan and make payments to corporates via PayNow.

Corporates may also use their business banking mobile app to scan and make payment, if such function is offered by the PayNow participating bank. UOB customers can use UOB Infinity Mobile to scan and make a payment.

For assistance on the creation of dynamic QR code (e.g. online website, bills / invoices, etc), please reach out to us at TransactionBanking@UOBgroup.com.

PayNow, along with other payment modes, has been integrated under the Singapore Quick Response (SG QR) code initiative. SGQR enables businesses to adopt multiple QR payment solutions (e.g. PayNow, NETSPay, credit cards, e-Wallets, etc) through a unified QR code. This will allow retail customers to make instant PayNow transfers by scanning the merchants’ SGQR via their bank’s mobile banking app.

Corporates can sign up for UOB eAlerts! to receive emails and/or SMS notifications upon receiving payments into their accounts held with UOB. For more information on UOB eAlerts!, click here.

Alternatively, corporates can check their transaction history on UOB Infinity to ensure that they have received the payment.

Payments made by payers to companies via PayNow are usually via FAST. Hence, funds would be credited immediately after payer has completed the payment.

If the PayNow payment is made via GIRO, payments will be received in 2-3 business days. Only corporates have the option to effect a PayNow payment via GIRO.

The inward credit will be reflected on the bank statement with “PayNow” as a reference.

Corporate should first try to reach out to the payer for clarification.

If the corporate is unable to settle with the payer, they can request for the funds to be returned by the bank. Please contact our Corporate Call Centre at 1800-226 6121 if you need further assistance.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.