You are now reading:

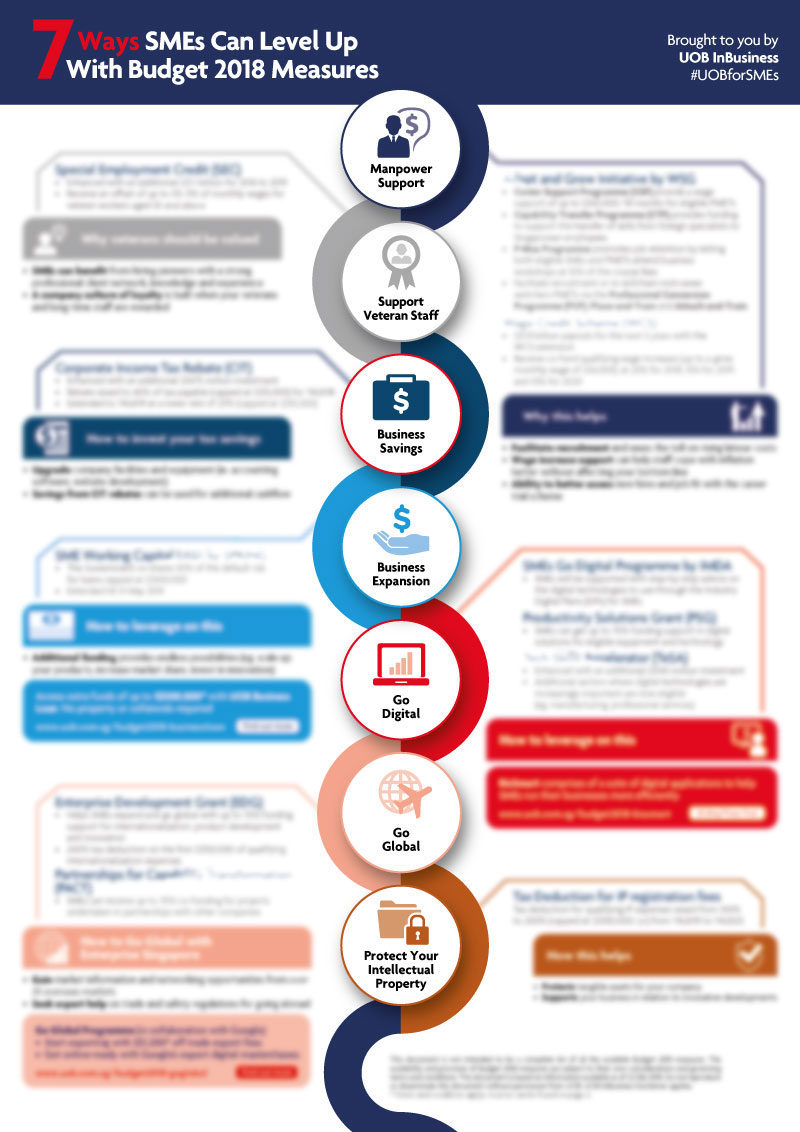

7 Ways SMEs Can Level Up with Budget 2018 Measures

1 of 3

you are in GROUP WHOLESALE BANKING

You are now reading:

7 Ways SMEs Can Level Up with Budget 2018 Measures

The focus of this year's Budget was to carry on efforts started in recent years to restructure the economy and help businesses become more competitive in the face of technological disruption and intensifying competition.

We have prepared a 1 pager infographic guide highlighting Budget 2018 measures SMEs can consider applying for in 7 key areas of business needs; why and how they can help your businesses level up.

Pushing on with restructuring

Budget 2018's measures for SMEs were designed to help local enterprises capture future opportunities in three ways: fostering pervasive innovation; building deep skillsets and capabilities; and forging strong partnerships.

With the economy's good showing last year and the given planned budget, the Government plans to focus on long term aid and assistance for SMEs. UOB economist Francis Tan estimates that the focus on shorter-term measures fell to 13% of total economic measures, from 25% in Budget 2017.

Instead, the government "pressed on with its multi-year efforts on longer term economic restructuring," said Mr Tan.

The ability to innovate is now the key competitive advantage for all businesses, regardless of size and industry.

To help companies in this area, a new Productivity Solutions Grant (PSG) was announced that will provide funding for up to 70% of qualifying costs for SMEs who want to adopt ready-made technologies that can help ramp up their efficiency.

Productivity Solutions Grant (PSG) will provide funding for up to 70% of qualifying costs for SMEs who want to adopt ready-made technologies that can help ramp up their efficiency.

The PSG comes into effect from 1st April this year and is a follow-up to the popular Production and Innovation Credit (PIC) scheme, which expired this year.

Business solutions such as BizSmart, a suite of digital applications to help SMEs run their businesses more efficiently can be considered. Interested SMEs can sign up for a 30-Day free* trial here.

The PSG comes into effect from 1st April this year and is a follow-up to the popular Production and Innovation Credit (PIC) scheme, which expired this year.

The Budget also unveiled new tax measures to help companies become more innovative and internationlise. These include increased tax deduction on licensing payments for the commercial use of intellectual property (IP), the doubling of a tax deduction for IP registration fees to 200% and capped at S$100,000 of fees per year, and the raising of the tax deduction for qualifying expenses incurred on R&D done in Singapore to 250%, from 150% previously.

The double tax deduction for internationalisation has also been enhanced. The amount of expenses that qualify for this rebate will be raised to S$150,000 per year from S$100,000, with effect from year of assessment 2019.

The Budget also sought to help firms build capabilities to internationalise, digitalise and become more productive. A new Enterprise Development Grant (EDG) targeted at larger companies will provide up to 70% of co-funding for enterprises to build a range of capabilities. It will be run by Enterprise Singapore, the new agency that will be formed in April 2018 from the merger of government agencies of SPRING Singapore and IE Singapore.

SMEs looking to develop their ability to compete on an international stage can also tap on Go Global, a programme from UOB Business Banking in partnership with Google. This initiative offers companies a learning platform such as Google's Export Digital Masterclasses to better understand international trade and become globally competitive.

SMEs ready to start exporting can sign up here to get S$1,200* worth of trade services vouchers that can be used to discount transaction fees payable for trade services.

Equipping workers with relevant skills for the digital economy is another key aspect of building capabilities. To help more Singaporeans get trained in digital skills like data analytics, artificial intelligence and the Internet of Things, an existing scheme known as the TechSkills Accelerator (TeSA) will be expanded into new sectors like manufacturing and professional services. Since its launch in 2016, over 27,000 training places have been taken up or committed under TeSA.

To quicken the pace in employees acquiring new skills, the Government is also piloting a scheme known as the Capability Transfer Programme (CTP), to support the transfer of skills from foreign specialists to Singaporean trainers and trainees.

Some other programmes under Workforce Singapore's "Adapt and Grow" initiative includes:

The above helps facilitate talent recruitment and retention, and ease the toll on rising labour costs.

Workforce Singapore's Adapt and Grow Initiative can help facilitate recruitment, ease the toll on rising labour costs. SMEs can better assess new hires and job fit with the Career Trial Scheme.

Meanwhile, veteran workers (aged 55 and above) will also be given help to contribute amid a changing economy. The Government has raised the re-employment age to 67 and extended the Special Employment Credit (SEC) scheme, which will see employers receive an offset of up to 3% - 11% of monthly wage for veteran workers.

The Government has been pushing for greater collaboration between the government and enterprises, as well as between larger corporates and SMEs, to help meet the challenges ahead.

In Budget 2018, it streamlined various partnership support measures into a single PACT scheme. This initiative will allow companies can receive up to 70% co-funding for projects undertaken in partnership with others.

PACT Scheme will allow companies to receive up to 70% co-funding for projects undertaken in partnership with others.

Partnerships will be particularly important in capturing a slice of the burgeoning infrastructure market in Asia. As such, an Infrastructure Office will be set up later this year to bring together local and international firms to develop, finance and execute projects in the region.

Despite the focus the longer term restructuring, there were some short-term relief measures for businesses.

The Wage Credit Scheme (WCS) that was rolled out in 2013 will be extended to 2020. The scheme co-funds wage increases for Singaporean employees up to a gross monthly wage of S$4,000. The WCS will provide 20% co-funding for 2018, 15% for 2019 and 10% for 2020. This support from the Government can allow staff to cope better with inflation and rising daily costs without affecting your bottom line.

Wage Credit Scheme (WSC) allows for employee welfare enhancement as wage increase support can help staff cope with inflation and rising daily costs better without affecting your bottom line.

SMEs can also look forward to some tax relief, as the Corporate Income Tax (CIT) rebate will go up to 40% of tax payable and capped at S$15,000 for the Year of Assessment 2018. This is up from the 20% of tax payable and capped at S$10,000 currently.

Companies who require more financial assistance in the short term can also tap on existing schemes such as the SME Working Capital Loan, where the Government co-shares 50% of the default risk of bank loans capped at S$300,000.

SMEs looking to access financing above S$300,000 can consider UOB Business Loan here as it provides extra funds of up to S$500,000*, with no property or collaterals required.

Here is a quick look at the 7 areas of business needs this handy 1-page guide will be addressing. Download the high resolution version now.

*Terms and conditions apply for the UOB promotions listed here.

29 Apr 2025 • 3 mins read

23 Apr 2025 • 3 mins read

22 Apr 2025 • 12 mins read

10 Apr 2025 • 3 mins read