You are now reading:

3 ways to manage foreign exchange risk for your business

1 of 3

Receive up to 3g of UOB Gold Bars worth more than S$900 with UOB eBusiness Account opening and online FX transactions. T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

You are now reading:

3 ways to manage foreign exchange risk for your business

Over eight out of ten SMEs and large enterprises in ASEAN and Greater China seek to expand across borders, according to UOB’s Business Outlook 2024 for SMEs and Large Enterprises. Business owners pursuing such a goal will need to pay closer attention to foreign currency fluctuations and how they impact expenses and revenue.

Fluctuating FX rates can significantly impact the day-to-day operational costs of businesses that rely on international supply chains, which include the prices of raw materials, machinery, and other inputs needed to produce goods or provide services.

Transacting internationally increases your exposure to currency risk—the possibility of financial loss when exchange rates fluctuate to your disadvantage. Say, for example, that you, a Singaporean SME owner, ordered products worth US$1,000 from a supplier. You paid a 50% downpayment at a time when the exchange rate was US$1 = S$1.30. That means you paid an equivalent of S$650. However, by the time you pay the balance of US$500, the exchange rate has gone up to US$1 = S$1.35. As a result, you pay S$675 for the balance, instead of S$650.

This creates a domino effect, as you will either have to accept lower profit margins once you sell the final product, or raise your selling price and risk losing customers.

Here are three ways to manage your FX risk effectively.

The first step towards effective foreign exchange management is understanding your business’s currency exposure. Firstly, you need to identify the currencies you trade in, the countries you operate in, and the extent to which currency fluctuations impact your revenue and costs. This awareness will enable you to make informed decisions and develop appropriate strategies to address potential risks, protect your investments and navigate the FX market more confidently.

The next step is to monitor conversion and financial market trends to determine whether or not it is an ideal time to act. Returning to the example above: if you see that the trend between the SGD versus the USD exchange rate is rising, you could proactively look for options in other markets, such as within ASEAN. In the event of a strengthening Euro, where you might have a large customer base, you could increase marketing efforts to sell more products in this region, thus increasing profitability.

s

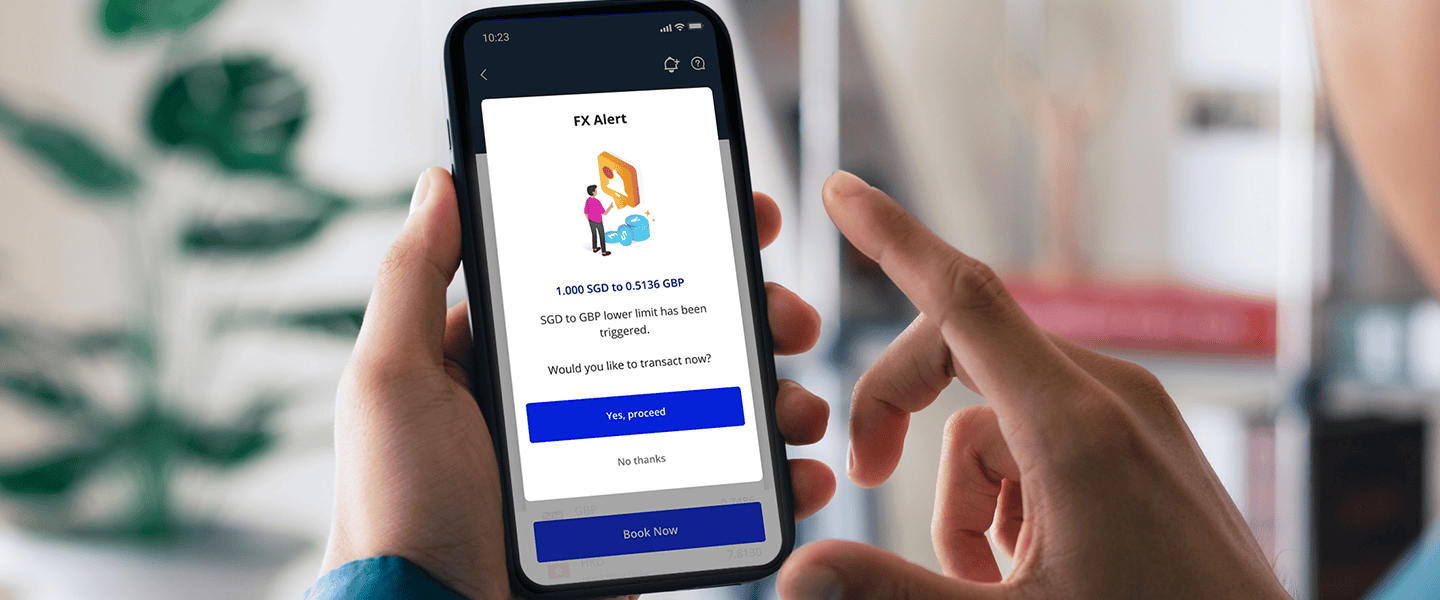

SMEs can consider using an FX trading app or online platform to help track FX fluctuations. The UOB SME App, for example, has a Watchlist feature that lets you choose currency pairs that you want to keep an eye on. You can set your desired range of exchange rates and get alerted through the app when a currency pair meets your desired criteria. You can then instantly book FX on the app when the currency rate is favourable to your business. In this way, you save valuable time and can book transactions directly in response to real-time exchange rates, minimising potential losses and protecting your profits.

Band World (Asia), a retailer of musical instruments, uses the UOB SME App to get such information and manage foreign currency risk. Mr Brando Tan, the company’s Director, says, “The UOB SME app helps me manage wholesale and supplier transactions from Europe and Japan, as well as retail distribution markets in ASEAN. I can now make trade finance transactions conveniently with submission and approval through this all-in-one app. Managing foreign currency risks is also key given the changing currency environment, and the app allows me to set up a personalised foreign currency watchlist plus receive alerts when my limits are reached. I can now secure the best foreign currency rates instantly without having to check the rates repeatedly. With a real-time view of business transactions, I can make strategic business decisions much more efficiently.”

UOB offers more than 30 currencies for trading with competitive exchange rates and low fees to effectively help you manage risks and meet your foreign exchange needs. Interested SME owners can easily start booking rates online via the UOB SME app, in person at any UOB branch or directly through your UOB Relationship Manager.

Download the UOB SME app to get real time information, data-driven insights and customised alerts, secure your preferred FX rates and manage your transactions and cash flow conveniently.

IMPORTANT NOTICE AND DISCLAIMER

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results.

The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. This publication is not an offer, recommendation, solicitation or advice to buy or sell any product or enter into any transaction and nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any transaction/ investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

This publication has not been reviewed by the Monetary Authority of Singapore

Start your UOB eBusiness account today, and enjoy zero fees* and more than S$500 of annual savings on FAST and GIRO transaction fees.

23 Jan 2026 • 5 mins read

14 May 2025 • 5 mins read

23 Sep 2024 • 3 MINS READ