You are now reading:

Embracing New Norm for Growth

1 of 3

Starting or growing a business? Enjoy more than S$4,000 savings now with essential solutions. T&Cs apply.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

You are now reading:

Embracing New Norm for Growth

When COVID-19 hit, previously manageable processes in business cycles like manpower, production, and materials came to a standstill.

Fast forward 2 years, we are now in the re-opening phase where businesses will need to re-orientate their perspective to the accelerated changes in the digital space and the new narrative of consumer behaviour.

Source: Silicon Valley Bank: Retail industry trends from 2022 and

beyond

With the current consumer landscape, an omni channel strategy is necessary to have a better outreach and engagement with customers under the new norm.

To any business owner, the need to re-orientate might seem overwhelming, while managing the day-to-day operations. Here are 3 areas that you can look into, as a first step to making your business relevant and sustainable.

With many companies forced to pivot, a key focus on digitalisation, re-engineering of work processes, and diversifying supply chains emerged. SMEs were also hit hard with the lack of manpower and resources needed to transform their business.

National Business Survey 2021/2022 data from Singapore Business

Federation

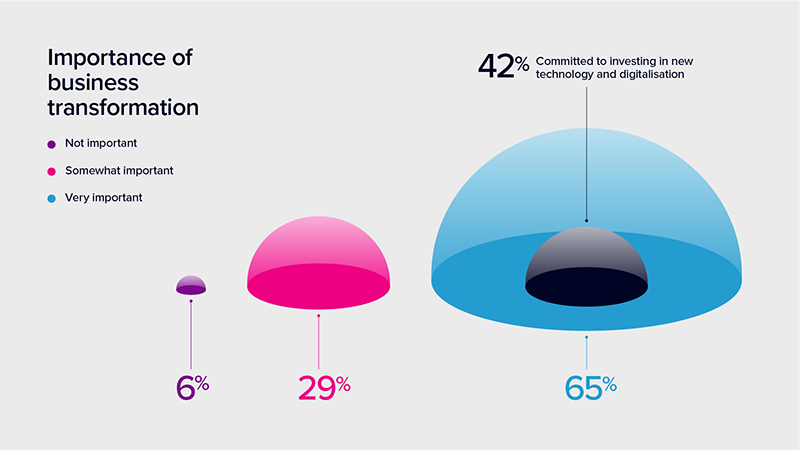

Despite concerns, SMEs can still find workable strategies to grow sustainably. Running the digital race is something that SME owners know they cannot avoid. 65% of SME owners rated tech as a priority for business transformation, with 42% of them committing to invest in new technology and digitalisation. This has also seen the government

committed to building up digital literacy and encouraging businesses to leverage on tech platforms and solutions.

The food and beverage industry was hit the hardest, with more than

20,000 jobs lost by the third quarter of 2021. However, businesses who took on the challenge of digitalising their operations during the downtime caused by COVID-19, have seen rewards.

One such example is White Restaurant. With five outlets in Singapore, they knew that business would be hit hard when safety measures ramped up in early 2020. With the help of UOB solutions, they acted swiftly to set up online delivery capabilities, including centralised order-processing in addition to digital marketing. As a result, sales during the

circuit breaker period remained resilient, at about 70% of pre-pandemic levels.

A 2022 Paypal survey which measured how Singapore’s resilient SMEs survive and thrive during the pandemic showed that social media was

the top way to grow businesses. 53% of SMEs pivoted to social media as a selling channel. This has seen increased productivity, optimised operations, and reduced costs, while remaining relevant and accessible to customers.

PPP Coffee’s retail store at Funan which took huge hit in sales when the Circuit Breaker started in 2020

A good example is how this has paid off for local SME, PPP Coffee. Despite being one of Singapore’s big players in the coffee industry, they saw more than 90% loss in business when COVID-19 hit.

Founder Leon Foo and his team had to innovate to connect with consumers. Without the ease of reaching them in-store previously, initiatives like the care pack rolled out through social media and their online store. With the help of UOB, these initiatives provided food and beverage options to Leon’s consumers in their homes and saw extensions into the community. It also reaffirmed Leon’s belief in wanting to connect people with coffee.

National Business Survey 2021/2022 data from Singapore Business

Federation

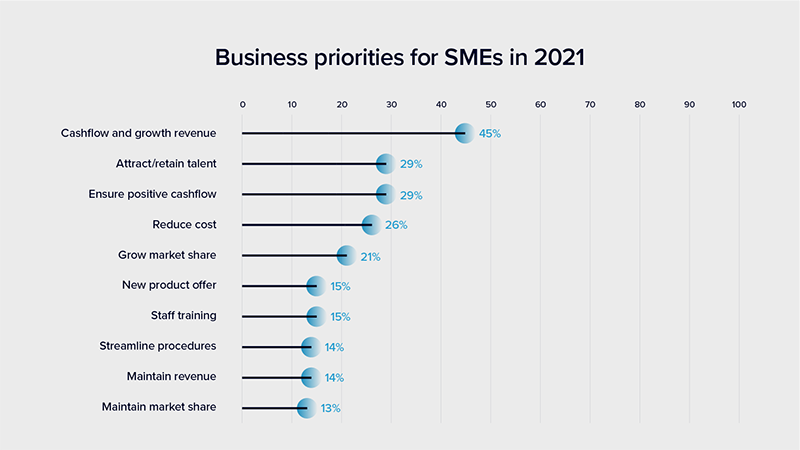

Cash flow emerged as one of the top three priorities for SMEs in 2020 and 2021, where having positive cash flow remains top of mind for many business owners. These include costs from manpower, right down to training and rent. Hence, it’s no wonder that many SME owners prioritise survival through cutting cost measures and downsizing. 4 in 10

businesses have reported that they have insufficient liquidity for the next 6 months. This has seen SME owners try to control the flow of outgoing payments, boost collection capabilities, and consider the use of credit facilities.

MusicGear got a cash flow boost that enabled increase in trade

Pictured: Brandon Tan and Sean Tan, directors at MusicGear

With only 26% of SME owners saying that they were willing to use credit facilities, it comes as a surprise that the directors at MusicGear, Brandon Tan and Sean Tan were open to loans. Through UOB, they opted for a business loan that came with the option of extended trade facility, which helped with facilitating their international trade and commerce. It also boosted cash flow and enabled their business to trade and distribute in comfort without worrying too much about liquidity.

“As a distributor, we have to expand to stock up more inventory so that we have variety for our customers,” says Brandon.

Running an SME is no small business, and SME owners know this best. With time, cost, and manpower as huge priorities, efficiency and timeliness of financial solutions are instrumental in sustaining and growing business.

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results.

The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. This publication is not an offer, recommendation, solicitation or advice to buy or sell any product or enter into any transaction and nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any transaction/ investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

This publication has not been reviewed by the Monetary Authority of Singapore.