1 of 3

What do you need help with?

1 of 3

Enjoy more than S$4,000 worth of savings with essential solutions. T&Cs apply.

Explore UOB Business Kityou are in GROUP WHOLESALE BANKING

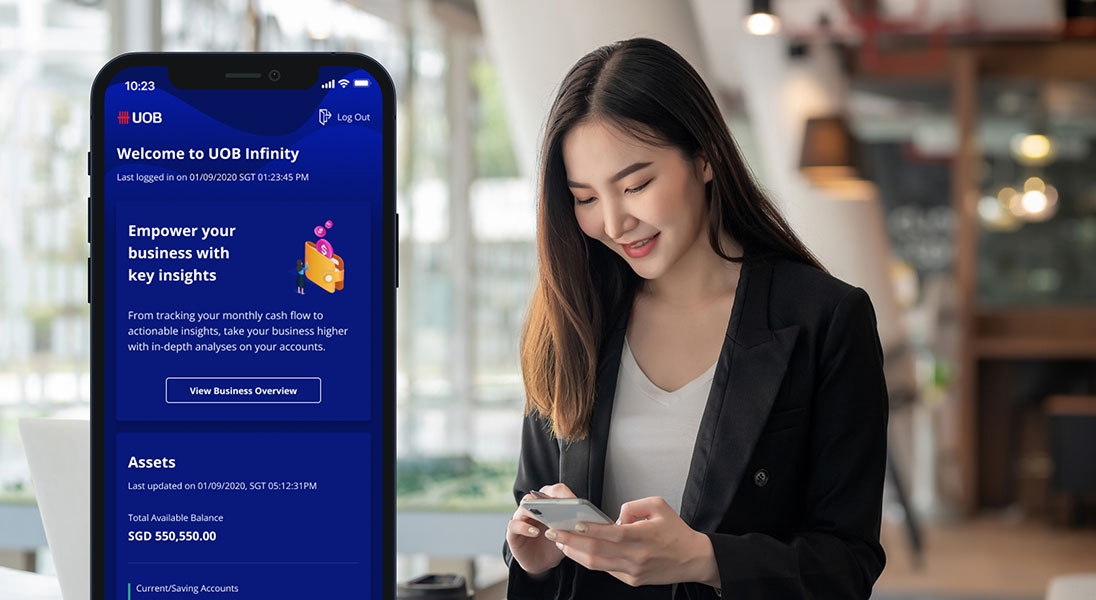

The UOB SME app, powered by UOB Infinity, provides a single point of access for your banking needs.

The UOB SME app, powered by UOB Infinity, provides a single point of access for your banking needs.

Book FX contracts on the UOB SME app in three easy steps.

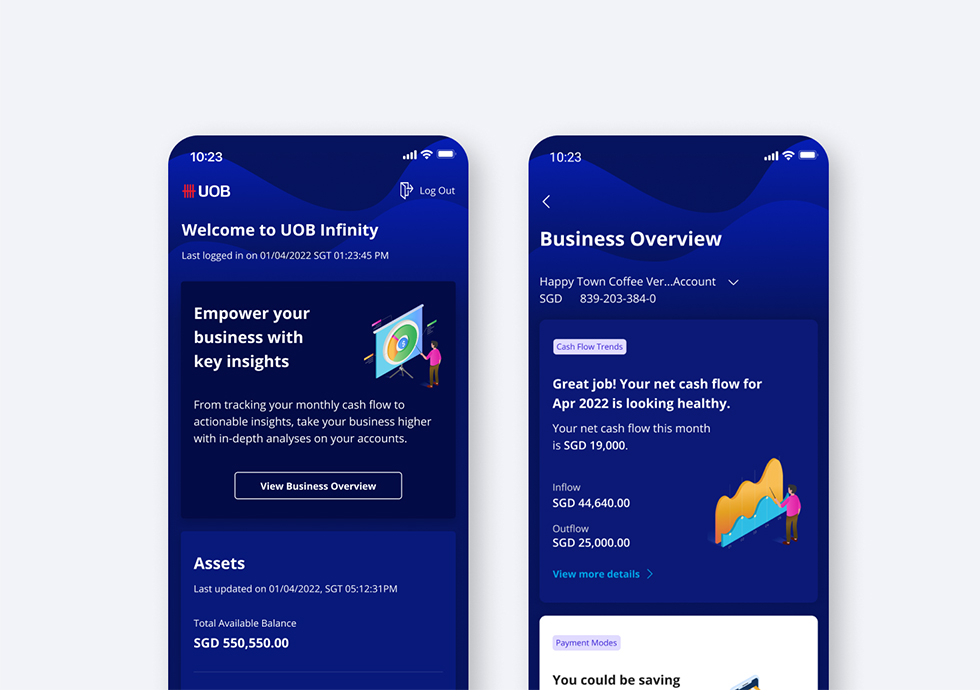

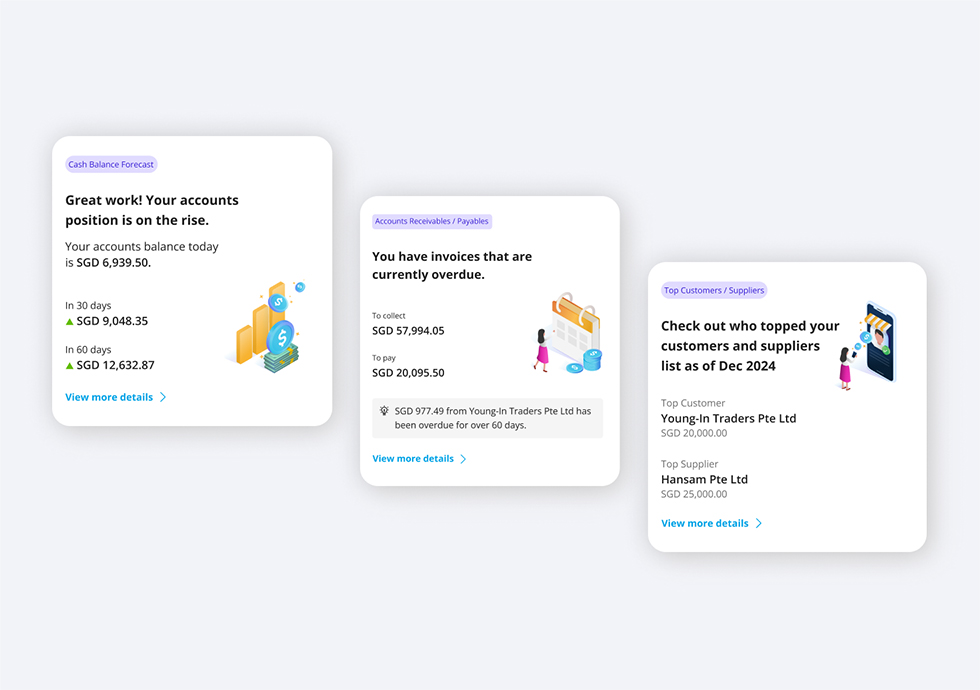

View your account balance, past 6 months’ cash inflow and outflow, all in one dashboard. Personalised insights give you expert advice on what to do next.

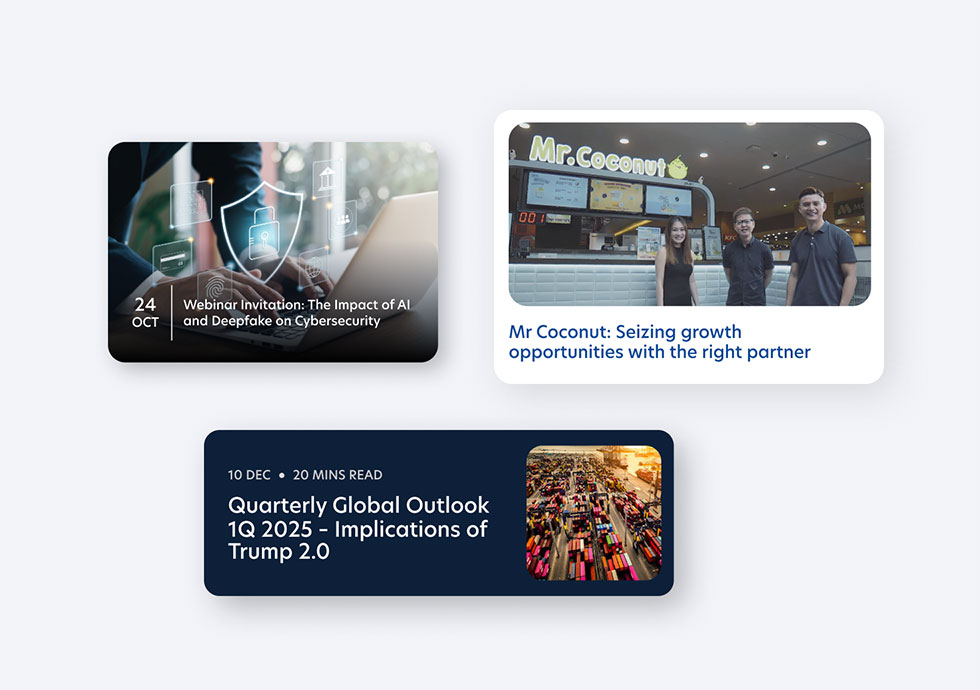

Stay up to date on business trends, insights from peers and industry leaders as well as invites to events curated for your industry.

By linking your business data from selected accounting solutions, you can gain quick and secured reconciliation and an integrated cashflow dashboard.

Access preferential FX rates and book contracts instantly on the UOB SME app.

Not a UOB customer yet? Save more than $4,000* when you bank with us and get essential solutions with the UOB Business Kit now.

*T&Cs apply.

The UOB SME app allows you to bank conveniently while on-the-go. Access and apply for business accounts and loans quickly.

Browse any products or services from your UOB SME app. Quickly access and apply to the most popular business accounts and loans.

Log in with your UOB Infinity credentials and setup your Infinity Secure (digital token) on the UOB SME App.

Follow these simple steps to get your Infinity Secure all set up on your UOB SME app.

Setup your personalised watchlist, alerts and instant FX booking.

Seamless integration to selected accounting solutions and get access to personalised insights.

Hear from Lyn Lee, founder of homegrown chocolatier, Awfully Chocolate, on how UOB has supported her business towards expansion in Singapore and overseas.

Hear from Lucas Lin, Vivian Yeo and Andrew Cai, founders of homegrown beverage business Mr Coconut, on how they have accelerated business growth from one to 40 outlets across Singapore, powered by UOB’s financing and digital solutions such as the UOB SME app.

“Embarking on the digitalisation journey with UOB has been enriching for our businesses. With the UOB SME app, we can manage wholesale and supplier transactions from Europe and Japan, as well as retail distribution markets in ASEAN. I can make trade finance transactions conveniently with submission and approval through this all-in-one app. I can also upload trade finance applications online via web-based internet banking and track our trade finance due date. These capabilities help us ensure that we are maximising growth and not stretching our cash flow.”

Mr Kelvyn Chee

CEO and Founder, Decks

“As a retail company, we handle a high volume of transactions and the interactive cash flow dashboard shows the last six months of our business’ performance. This provides us with a real-time view of our cash flow trends. We source supplies from multiple countries, hence managing foreign currency risks is very important to my business, given the changing currency environment. Through the app, I am able to track the Foreign Exchange rates by setting up a personalised watchlist and receive alerts when the currency pair I’m monitoring has reached the desired rate pegged.”

Mr Brando Tan

Director, Band World (Asia)

Hear from Lyn Lee, founder of homegrown chocolatier, Awfully Chocolate, on how UOB has supported her business towards expansion in Singapore and overseas.

Hear from Lucas Lin, Vivian Yeo and Andrew Cai, founders of homegrown beverage business Mr Coconut, on how they have accelerated business growth from one to 40 outlets across Singapore, powered by UOB’s financing and digital solutions such as the UOB SME app.

“Embarking on the digitalisation journey with UOB has been enriching for our businesses. With the UOB SME app, we can manage wholesale and supplier transactions from Europe and Japan, as well as retail distribution markets in ASEAN. I can make trade finance transactions conveniently with submission and approval through this all-in-one app. I can also upload trade finance applications online via web-based internet banking and track our trade finance due date. These capabilities help us ensure that we are maximising growth and not stretching our cash flow.”

Mr Kelvyn Chee

CEO and Founder, Decks

“As a retail company, we handle a high volume of transactions and the interactive cash flow dashboard shows the last six months of our business’ performance. This provides us with a real-time view of our cash flow trends. We source supplies from multiple countries, hence managing foreign currency risks is very important to my business, given the changing currency environment. Through the app, I am able to track the Foreign Exchange rates by setting up a personalised watchlist and receive alerts when the currency pair I’m monitoring has reached the desired rate pegged.”

Mr Brando Tan

Director, Band World (Asia)

New to UOB Business Banking?

View our accounts.

On top of transactional capabilities of UOB Infinity, the UOB SME app provides value-added features to SMEs, all in one single app.

With the app, you can open a business account or apply for a working capital loan using Singpass and Myinfo business.

In addition, you can view your business cash flow through an interactive dashboard, get customised insights and events based on your industry, and book your preferred FX rate instantly through watchlist alerts.

Yes, you can download the UOB SME App to stay connected with the latest business insights and product promotions.

If you are interested to open a business account or apply for a working capital loan, you may tap on the top right menu bar of the App’s home screen and access self – service options to ‘open an account’ or ‘Apply for a loan’ with us.

You may fill up the application form here and submit to your nearest UOB branch.

On the App’s home screen, tap on “Start Banking” button, then tap on “Activate Account” and follow the on-screen steps to activate your digital banking ID.

If you are already an existing UOB infinity user and you are interested to use UOB SME App, you will need to switch over by registering your digital token(Infinity Secure) on the UOB SME App. In doing so, your account information and existing banking arrangements will not be affected.

For a step-by-step guide to activate your digital token on UOB SME app, please click here.

For existing customers: Log in with your UOB digital banking credentials (this is the same as your UOB Infinity banking credentials).

For new customers: Apply for a new account that comes with business internet banking.

Visit the UOB SME app and tap on hamburger menu (top right) to access these useful features.

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.