1 of 3

What do you need help with?

1 of 3

Receive up to 3g of UOB Gold Bars worth more than S$900 with UOB eBusiness Account opening and online FX transactions. T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

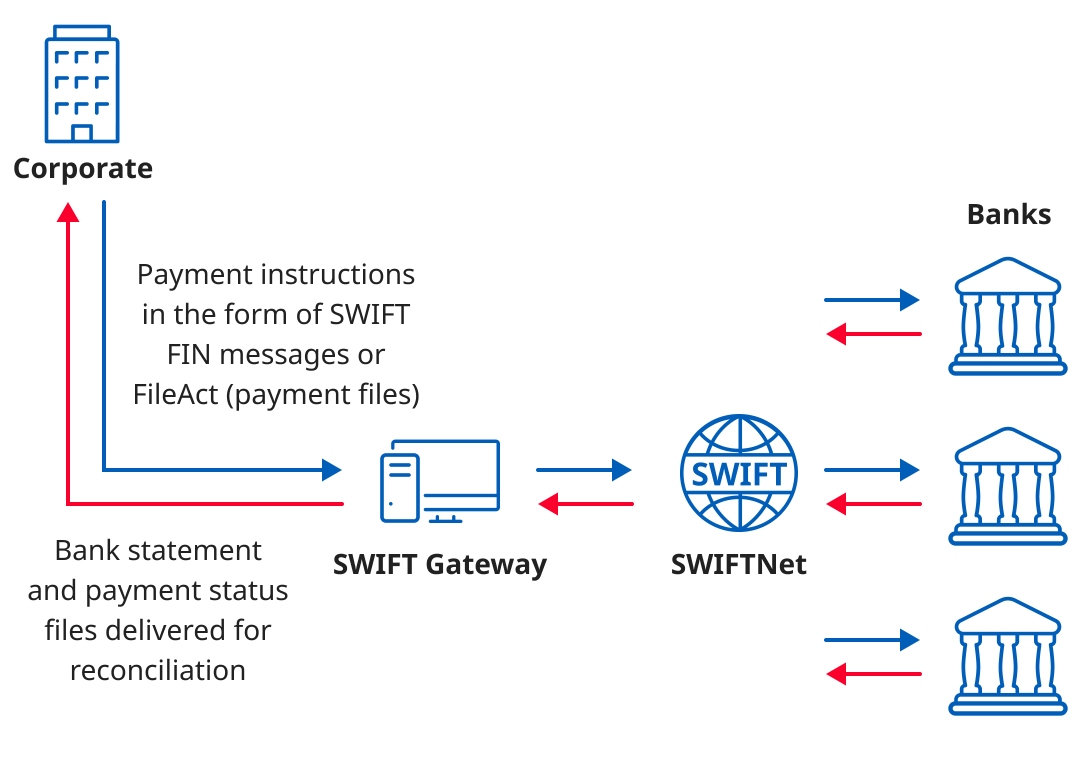

A streamlined communication channel to send collection/payment instructions.

Visibility over your accounts allows you to manage cash balances optimally.

Onboard a new banking provider or switch between providers easily.

Have the ability to automate your operation and reduce connectivity risks.

SWIFT Standard Corporate Environment (SCORE) is a closed user group administered by SWIFT, where corporates can interact with Financial Institutions.

In order to transact with UOB over SWIFT, the corporate needs a member of SWIFT and have given your SWIFT Business Identification Code (BIC).

SWIFT SCORE membership criteria can be found on the official SWIFT website - https://www.swift.com/join-swift

UOB supports the following products over the respective SWIFT Messaging Services.

FIN

For sending single standard SWIFT message, one at a time. Limited to 10k characters (including spaces).

FileAct

For sending multiple messages in one file with no character limits. Ideal for bulk transactions.

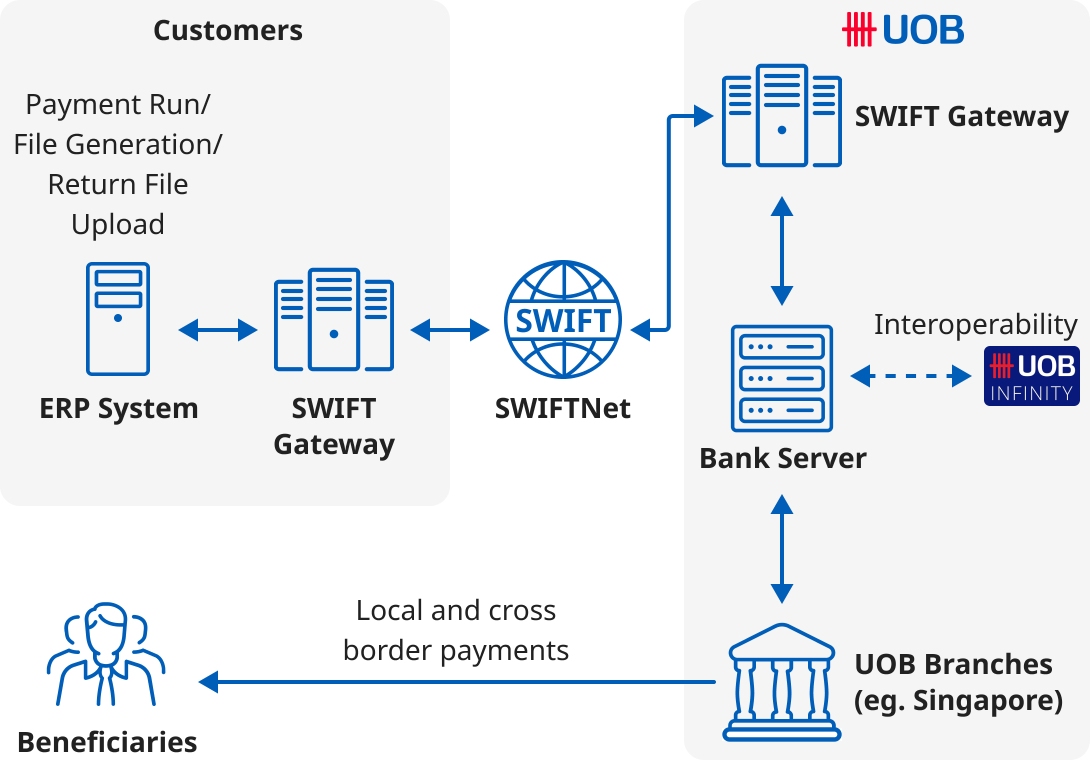

Payment services include:

It is suitable for Corporates who are members of SWIFT, have high transaction volumes and looking for a single channel to connect to UOB and other bank partners.

Initiate payment instructions or receive account statements through SWIFT in the following formats:

Interoperability with UOB Infinity

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.