Asia is entering its most critical chapter of wealth. The region is the world’s fastest-growing financial hub, with private wealth projected to reach USD99 trillion by 2029. Singapore, with its tax-friendly regime, and Hong Kong, as a gateway to Mainland China, anchor this rise. The challenge now is no longer just creating wealth but ensuring it is passed down smoothly across generations.

The Asia Generational Wealth Report 2025: Succession in a New Era – published in collaboration with Boston Consulting Group (BCG) and the National University of Singapore (NUS) Business School, surveyed more than 220 high-net-worth individuals and conducted nine in-depth interviews with families across seven markets in Asia. The report explores the evolving dynamics of intergenerational wealth transfer and succession planning among Asia’s UHNW families.

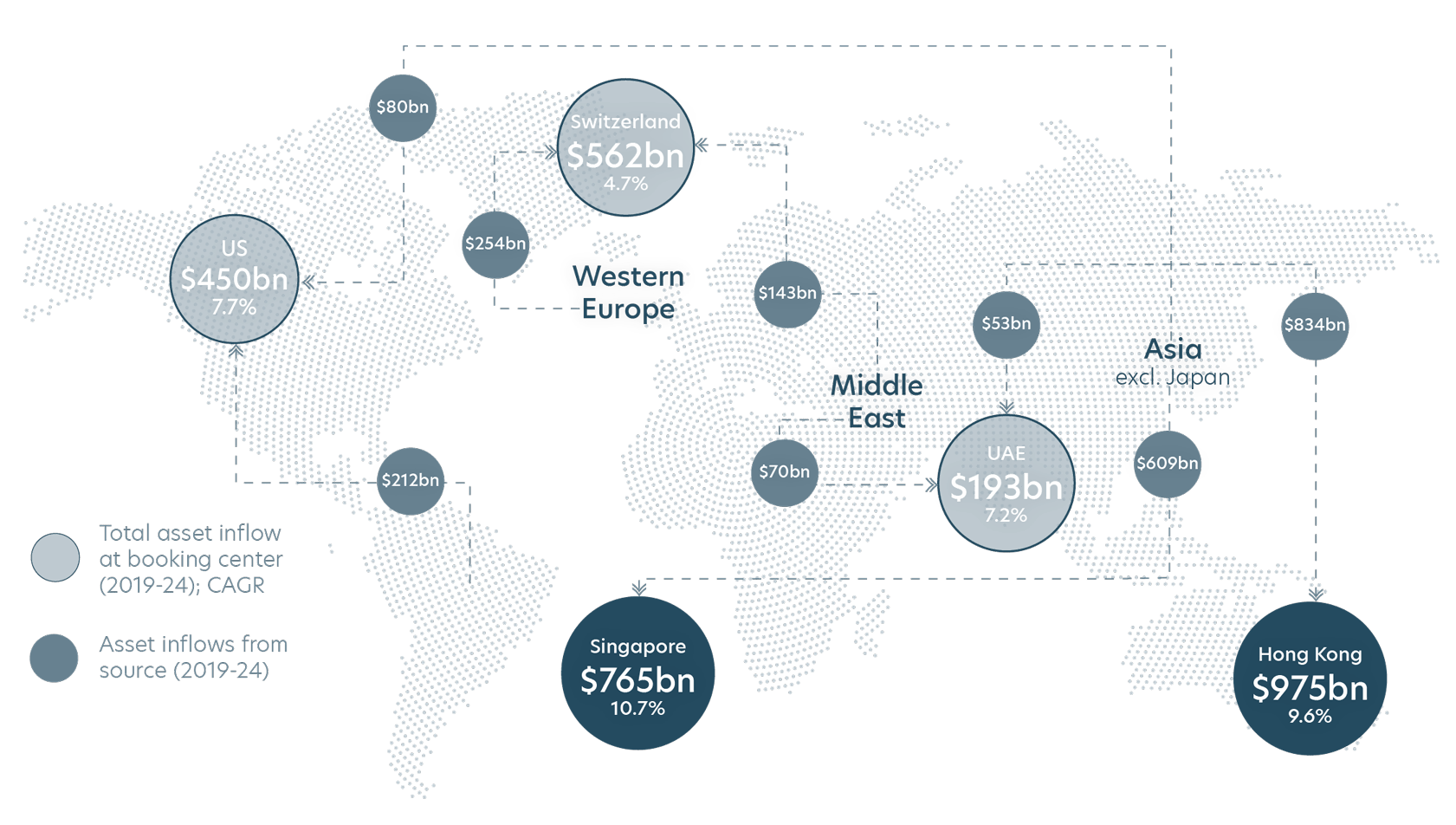

Asia as the fastest-growing wealth hub

Source: Primary flows from source markets into top booking centres 2019–2024 (USD), BCG Global Wealth Market Sizing 2025

Key themes

Diverging generational aspirations complicates succession planning

Succession planning is increasingly complex as NextGen priorities shift. While many founders aim to preserve the family business, younger generations often prioritise entrepreneurship and pursue social impact. Families must balance continuity with these ambitions.

Succession is a complex process

Succession isn’t just about passing titles. Within families that see their children as likely successors, 24% believe the NextGen are underprepared. Sustainable wealth and enterprise require governance frameworks – family charters, councils, and shareholder forums—to ensure consensus and real transfer of decision-making power.

The wealth transfer process is often underestimated

Equal division of estates may seem fair but often fragments ownership. 48% of families cite structuring as a challenge, rising to 63% for estates above USD 30 million. Opacity adds risk: 37% of founders retain sole authority over wealth decisions, and 28% keep Wills undisclosed.

Featured

Quarterly Outlook

4Q 2025 Investment Outlook: Finishing Strong

10 October 2025

Despite market turbulence, global risk assets have delivered solid year-to-date returns, with the S&P 500 hitting over 20 new highs since April. As the Federal Reserve shifts into an easing cycle, and historical trends point to stronger equity performance in the next six months, the outlook remains constructive for investors.

Explore our 4Q 2025 Investment Outlook report for insights on macro trends, asset class perspectives, and strategies to help investors navigate uncertainty and finish the year strong.

Podcast

Navigating volatility in private credit

30 October 2025

Private credit has come under the spotlight amid recent market volatility, with Business Development Companies (BDCs) leading the sell-off. Dawn Leong from our Chief Investment Office speaks with Eleanor Tan, Fund Due Diligence Analyst, to unpack what is driving the headlines and explain why the long-term outlook for private credit remains compelling.

Market Update

Private Credit BDCs sell-off unlikely to be systemic

The recent sell-off in Business Development Companies (BDCs) has sparked concerns about potential stresses in the credit environment. At the same time, several high-profile defaults outside of private credit compounded worries.

Read more to find out what are the market implications of this sell-off.