Foreword by CIO

Global markets continue to evolve, shaped by uneven economic recovery and rapid technological progress. Investors today face a landscape where shifting growth patterns, innovation, and policy changes present both challenges and possibilities. Amid this complexity, opportunities often emerge for those who remain disciplined and forward-looking.

In our 1H 2026 Investment Outlook, we share the themes we believe will be most influential in the months ahead. We also outline how a diversified and selective approach can help portfolios capture growth while maintaining resilience against potential shifts.

This is also an opportune time to review your investment strategy and ensure it remains aligned with your long-term objectives. I encourage you to speak with your Senior Client Advisor for tailored guidance on positioning your portfolio for the evolving environment.

We hope these insights guide your investment journey and reinforce our shared focus on long-term success. Thank you for your continued trust. We look forward to partnering with you in 2026.

Dr Neo Teng Hwee

Chief Investment Officer and

Head of Investment Products and Solutions

UOB Private Bank

Outlook at a glance

Key themes to watch

A K-shaped economy

The US recovery remains distinctly K-shaped, marked by a divergence between booming corporate profits and AI-linked capital expenditure on one hand, and persistent weakness in lower-wage segments on the other.

This environment favours extending bond portfolio duration and focusing on sectors resilient to uneven demand, such as AI infrastructure and niche consumer plays, while avoiding deep cyclicals tied to global trade or lower-income spending.

AI: From digital to physical

AI continues to dominate headlines, but the narrative is shifting from hype to monetisation. The most compelling opportunities lie in bottlenecks such as AI chips, high-bandwidth memory and power infrastructure, where supply remains tight. Beyond software, AI’s next phase is “Physical Intelligence,” embedding cognition into the real world through frictionless interfaces, autonomous systems and mobility solutions.

Going global: EM (China) and Singapore

Global diversification remains critical as competitive dynamics evolve. China’s ascent as a manufacturing and innovation hub is underscored by its growing Fortune Global 500 presence and leadership in sectors like electric vehicles and telecoms.

Meanwhile, Singapore equities should also benefit from governance reforms and global monetary easing. Sectors investors should keep an eye on are banks, REITs and industrials.

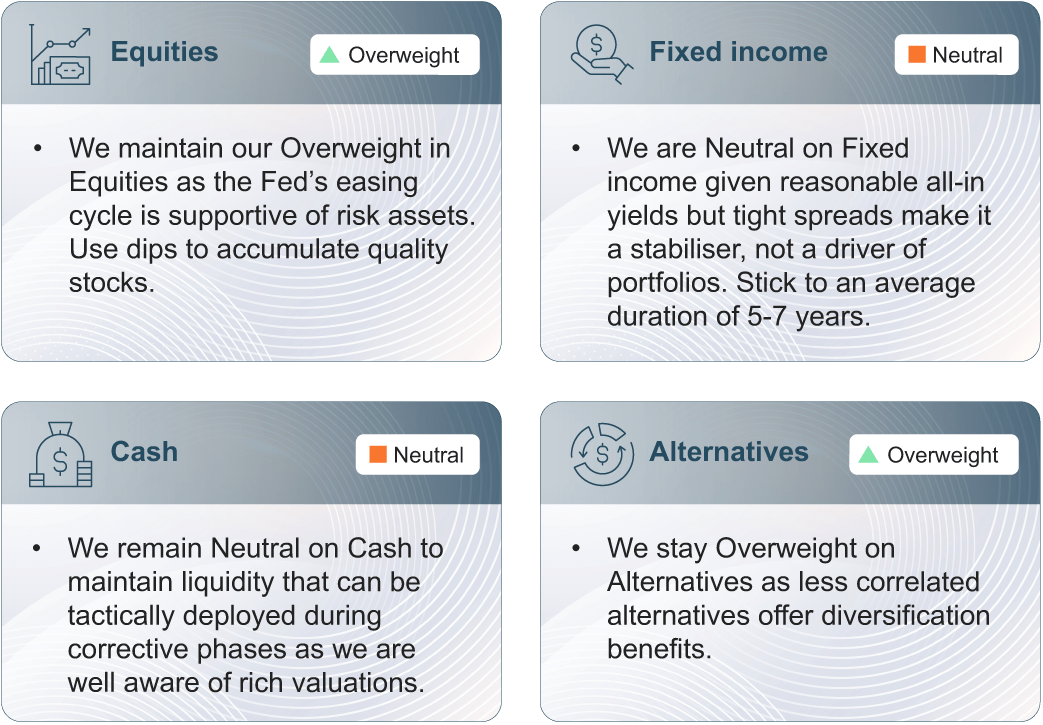

Asset allocation for 1Q 2026

Discover more insights

Report

Navigating Global Divergences

Discover our 1H 2026 Investment Outlook for perspectives on global macro trends, sector themes and opportunities shaping today’s shifting markets.

Article

The age of uneven prosperity – opportunities and risks in 2026

Uneven prosperity will shape 2026 as rising wealth drives high-income spending while lower-income households grapple with real wage stagnation. Dr Neo Teng Hwee shares key insights into the opportunities and risks investors should watch out for in 2026.