Over 88 years of long-term thinking behind you

From the moment our doors first opened at UOB, it was always about the generations to come. Making sure we would be here for the long term and help other Asian families do the same.

The focus of our founder, Wee Kheng Chiang, was helping families secure their future, personally and through business.

Today, we have built a leading network across ASEAN and a unique One Bank system to maximise your financial growth.

Closely linked to all you value

We understand and appreciate the many vibrant and varied cultures throughout Asia. As it is with you, it is part of our heritage and one of our strengths as we tap into Asia’s growth, values and opportunities.

One bank. Many strengths.

Life is never simple. Your needs and aspirations often rely on ideas and advice from various parts of our bank. To make access easy and to ensure there are no barriers between business teams, we created our unique One Bank approach. It simply means we harness resources, networks and capabilities across business segments within the UOB group to bring you combined expertise for your business and personal needs.

A truly connected ASEAN.

Join the dots to get the full picture.

At UOB, our roots may be in Singapore but our growth has spread across Asia and beyond. We are where you need to us to be.

Our strong presence in major Asian cities, our global network of more than 500 offices across 19 countries provides strong connectivity for your companies, families and personal interests. Joining the dots from market to market, industry to industry and business to business creates seamless opportunities.

The strength of stability

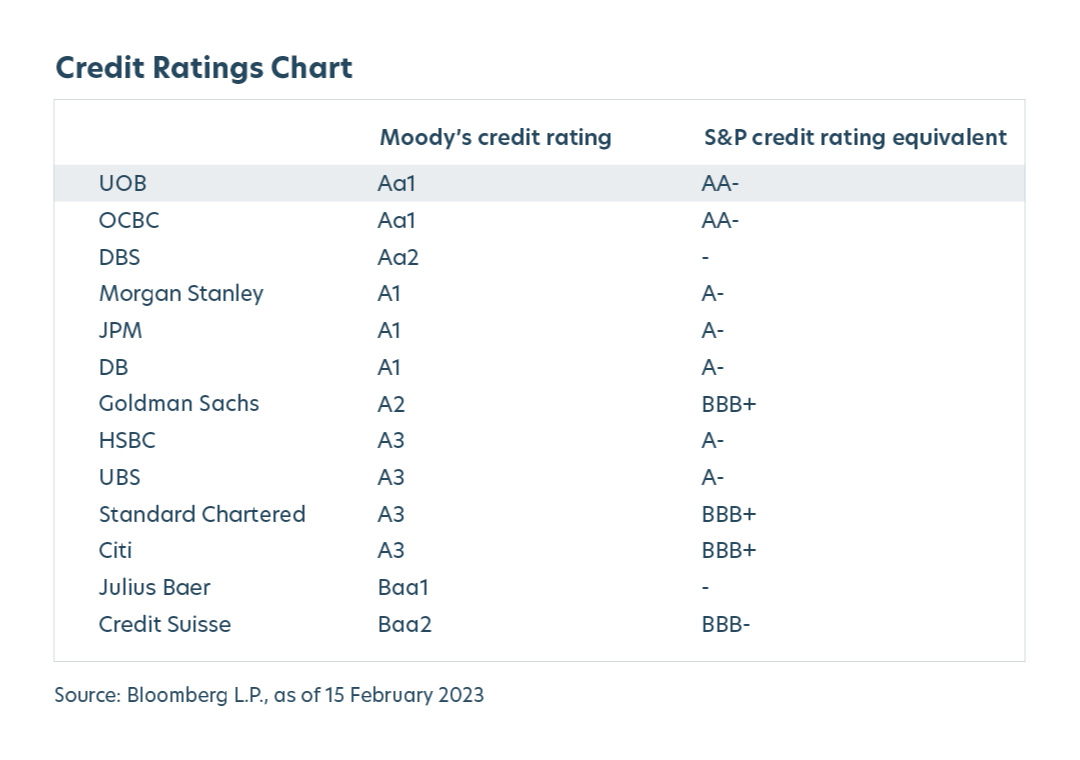

Stability is a great asset in this forever changing world and UOB is among the strongest, with an Aa1 rating from Moody’s and AA- from Standard & Poor’s (S&P) and Fitch Ratings.

Steadfast principles. Strategic advantage. Solid reliability.

These are what enables us to preserve and manage your wealth for the long haul. Our values of honour, enterprise, unity, and commitment, guide us in growing your wealth sustainably have been developed over time, from generation to generation. While they have served us well, the most important part is how they guide us to always do Right By You.

Awards and accolades

Euromoney Private Banking Awards

Asiamoney Private Banking Awards

- Best Private Bank for Wealth Transfer and Succession Planning in Singapore

- Best International Private Bank in Malaysia

WealthBriefing Asia Awards

- Innovative Client Solution (Data Analytics) - South East Asia

WealthBriefing Asia Awards

- Best Domestic Private Bank - Malaysia

It takes a shared vision and focus to achieve all you aspire to.

The kind we have with all of our clients.

It takes a shared vision and focus to achieve all you aspire to.

The kind we have with all of our clients.

For a forward thinking Private Banking experience with a uniquely ASEAN heritage, contact us.

The Private Bank experience

Our investment approach

Your plans for the long term are yours, and only yours. So we design solutions around you and only you. This forms the basis of our investment philosophy.

Our insights

Make sense of world events and market movements that impact your investment journey with regular insights from our Chief Investment Office.

Our regional presence

A relationship with our Private Bank stretches across the region, encompassing experiences, insights and vast opportunities.