Annual Report 2017

Group Retail

Group Retail provides Personal and Business Banking customers with financial solutions essential for them to achieve their financial goals and aspirations. Our products and services include deposit, insurance, secured and unsecured loans, investment, treasury and wealth advisory services. We also provide our Business Banking customers with loans, cash management and trade financing products to help them manage their business and to support their growth ambitions. Our customers can easily access our services across our global network of branches, automated teller machines (ATMs) and internet and mobile banking platforms.

2017 Highlights

Registered an 8.8 per cent year-on-year increase in operating profit, supported by strong growth in our credit card and wealth management businesses;

Helped more customers grow their savings faster and invest more wisely through the launch of innovative banking solutions:

-

The UOB Young Professionals Solution helps our millennial customers to invest by “sweeping” earned interest from their UOB One Account and rebates from spending on the UOB YOLO credit card into a low-risk unit trust. This first-of-its-kind solution gives customers a headstart in building their wealth;

-

The KrisFlyer UOB Debit Card and Account, another first in Singapore, enables customers to earn KrisFlyer miles on their savings and spending;

-

The UOB Stash Account, a saving account which rewards customers with bonus interest when they maintain or increase their account balance; and

-

The UOB One Account, which won the Deposit Product of the Year at The Asian Banker Excellence in Retail Financial Services International Awards 2017, was extended to our customers in Indonesia and Malaysia to help them achieve sustainable yield on their deposits.

Continued to lead the market in contactless payment and mobile banking solutions:

-

Worked with The Association of Banks in Singapore (ABS) to launch PayNow which enables people to transfer money through their mobile or internet banking with just the recipient’s mobile phone number or identification number;

-

First bank in Singapore to enable the use of PayNow via social media messaging apps through the launch of UOB MyKey, a customised mobile phone keyboard;

-

First and only bank in Singapore to enable customers to donate to charity through PayNow;

-

First bank in Asia to enable our customers to make contactless payments through Fitbit Payᵀᴹ; and

-

Increased the number of our Near Field Communication (NFC) contactless ATMs to 270 across Singapore.

Registered a 12 per cent increase in total wealth management assets under management (AUM) to $104 billion. Also recorded a three-fold increase in our Private Bank’s Discretionary Portfolio Management (DPM) service AUM;

First bank in Asia to tie up with SAP to offer SAP Business One, an enterprise planning tool, to small- and medium-sized enterprises (SMEs) through UOB BizSmart; and

Launched Business Banking service in Vietnam to support the growth of local SMEs.

2017 Performance

In 2017, our Group Retail business performed strongly, with our total income and operating profit rising 9.4 per cent and 8.8 per cent year on year respectively. Core to this growth was our ability to serve the financial needs of Asia’s rising middle class and to support the growth ambitions of small businesses through our comprehensive range of financial solutions.

We continued to manage our expenses prudently and maintained our cost-to-income ratio at 50 per cent as we stepped up our investments in technology to drive performance and to enhance the customer experience. Our return on assets for 2017 improved 11 percentage points year on year to 1.48 per cent.

From our Personal Banking customers, we continued to see stable and active current account and saving account balances, as well as active card use. The UOB Stash Account and the KrisFlyer UOB Debit Card and Account were key product launches during the year. Our total retail deposit base grew by 6.4 per cent compared with the previous year while our credit card fee income rose by 10 per cent.

On the home loan front, we outpaced market growth rates and gained share in new mortgage sales. Riding on the more upbeat property market sentiment and our customers’ increasing use of online research, we were able to facilitate an additional $100 million in new loans in Singapore through the provision of online education and home loan tools.

In wealth management, our total AUM as at the end of 2017 was $104 billion, up 12 per cent from the previous year. Wealth management fees rose by 36 per cent, driven by higher sales of treasury products and unit trusts. For our Private Bank, we continued to invest in our people, products and platform, resulting in an increase in both income and profit in excess of 20 per cent year on year.

Business Banking posted healthy growth of 7.9 per cent in operating profit in 2017, driven by our continued efforts in support of our customers’ digitalisation and internationalisation plans. About 40 per cent of Business Banking’s operating profit came from Indonesia, Malaysia and Thailand, where we continued to support our customers’ businesses and growth plans. In tandem with our growing customer base and distinctive solutions, our deposits rose 8.3 per cent year on year.

Outlook

In 2018, we will ensure that our financial solutions remain relevant to meet the ever-changing needs of our customers. With market expectations of rising interest rates, our focus will be on helping our Personal Banking customers grow their wealth by investing wisely.

We will continue to use UOB’s Risk-First wealth advisory approach with our customers across different wealth segments. Our Risk-First managed solutions help customers to meet their core financial goals without taking on excessive risks.

In line with Singapore’s Smart Nation agenda, we will extend our digital banking capabilities to make banking simpler, smarter and safer. As we do so, we will leverage our successes from one market and adapt them to others. We will continue to integrate digital and traditional channels to offer customers intuitive, omni-channel experiences, all the while wrapping technology in the warmth of the human touch.

Our commitment towards digital innovation also extends to our Business Banking customers. Together with our ecosystem of strategic partnerships, we will help small businesses use digital solutions to meet their needs, to overcome their challenges and to scale their operations.

Personal Financial Services

Harnessing Technology to Make Banking Simpler, Smarter and Safer

UOB has been a leader in providing innovative payment choices for our customers since the launch of our first payment card in 1988. Since then, we have pioneered many payment firsts including:

-

First in Singapore to support all five global payment schemes (Visa, Mastercard, American Express, JCB and UnionPay);

-

First in Singapore to offer contactless payments at merchants;

-

First in Singapore to facilitate contactless payments for commuters;

-

First in Singapore to offer EZ-Link card top ups with credit cards or smartphones;

-

First in Singapore to turn a mobile phone into a security token;

-

First in Singapore to provide unified point-of-sale terminals for merchants;

-

First in the world to offer instant card issuance; and

-

First in Southeast Asia to offer contactless ATM withdrawals through a smartphone.

In 2015, we again led the industry when we launched Singapore’s first all-in-one mobile application (app), UOB Mighty. UOB Mighty combines banking services, contactless payments, dining and rewards in a single, unified mobile app. UOB Mighty continues to set the benchmark for innovation, having won

Retail Banker International’s Excellence in Mobile Banking in Asia every year since the app’s launch.

In 2017, we built upon our UOB Mighty innovations with the launch of PayNow, an industry-wide initiative to enable peer-to-peer funds transfers based on a mobile number or identification number. In keeping with our strategy to provide one mobile app to fulfil our customers’ financial needs, we integrated PayNow into UOB Mighty.

Our customers were among the first in Singapore to pay for their meals at hawker centres by scanning NETS QR codes with their mobile phones.

We also took the service further when we became the first bank in Singapore to make it possible to use PayNow through any social messaging app. With our partner PayKey, we created UOB MyKey, which uses the default keyboard within social messaging apps such as WhatsApp and Facebook Messenger to connect quickly and conveniently to PayNow. As UOB MyKey is built within our UOB Mighty infrastructure, it also uses the same security standards our customers enjoy when using our mobile app.

Tapping the simplicity, speed and security of PayNow, we also launched PayNow for a Cause in Singapore to give our customers a convenient way of donating to charity using just a mobile number. UOB’s campaign coincided with the National Volunteer & Philanthropy Centre’s Giving Week and together with our customers, we raised more than $120,000 for infants and children from SPD.

Another UOB Mighty innovation launched during the year was the inclusion of NETS Quick Response (QR) codes into our app. UOB customers were among the first in Singapore to be able to use QR codes to pay for their meals at hawker centres in Singapore using their mobile phones.

For the times when our customers still need cash, we continued to increase the number of contactless ATMs. We now have 270 ATMs in Singapore where customers can withdraw cash with a tap of their smartphones.

Taking the lessons we learned in Singapore, we have since launched UOB Mighty in Malaysia, Thailand and Vietnam.

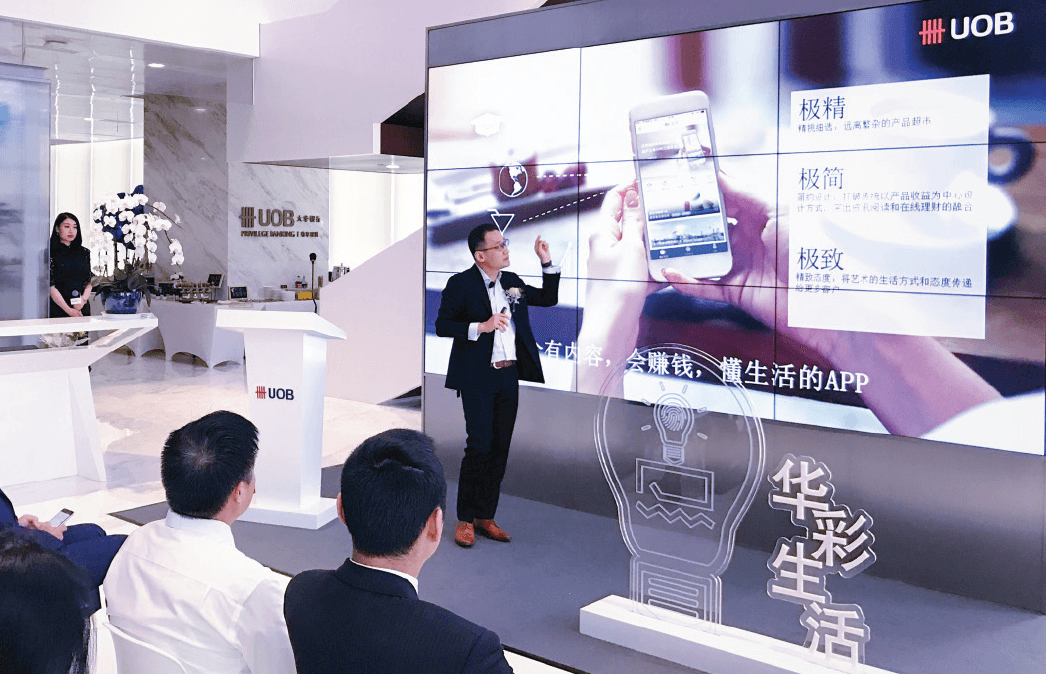

In addition to digital banking services, our Direct Banking mobile app in China offers customers comprehensive information on wealth management solutions and lifestyle offerings.

In Malaysia, UOB Mighty is the first to incorporate banking, dining and payment features in a single app, while in Thailand it is the first banking mobile app to offer contactless payments with a credit or debit card, a feature that supports Thailand’s national e-payments initiative to promote a cashless society.

In China, where cashless payments have become mainstream, we launched the UOB Direct Banking mobile app. We were the first foreign bank in China to offer an app that integrates wealth management solutions and lifestyle offerings for emerging affluent customers. Customers can open a bank account, manage their finances and make investments with the app while on the go. They can also make appointments with their relationship manager to sign up for other UOB products and services. In addition, the app provides customers with lifestyle recommendations ranging from travel and entertainment to parenting and education.

We were also one of the first foreign banks to offer WeChat Pay, one of China’s major mobile payment services, to our customers. By linking their UOB debit card to their WeChat account, our customers can transfer funds and make payments easily and conveniently.

In addition to mobile payments, we also made it easier for our customers to make payments using wearable devices. Our customers in Singapore were the first in Asia to be able to use Fitbit Payᵀᴹ to make contactless payments using the new Fitbit Ionicᵀᴹ smartwatch, combining their interest in staying fit and healthy with their preference for simple and quick payments.

We were also the first bank in Asia to enable commuters to pay for train and bus rides by simply tapping their Mastercard contactless credit or debit cards at the fare readers. The pilot programme, in partnership with the Land Transport Authority and TransitLink in Singapore, was part of our continued efforts to facilitate contactless credit and debit payments for public transport services.

The KrisFlyer UOB Debit Card and Account brings together two Singapore brands in creating an innovative banking solution that earns customers KrisFlyer miles when they save and spend.

Creating Financial Solutions Essential for the Lifestyles of Our Customers

To help our customers across the region extract the most value from their money, in 2017 we launched our award-winning UOB One Account in Indonesia, Malaysia and Thailand. The UOB One Account offers customers higher-than-average interest rates when they pay with the credit or debit card linked to the saving account. The UOB One Account, which was first launched in Singapore, was named Best Deposit Product of the Year at The Asian Banker Excellence in Retail Financial Services International Awards 2017.

Building upon the success of the UOB One Account, we launched a new saving account in Singapore during the year – the UOB Stash Account. While the UOB One Account rewards customers for their payment habits, the UOB Stash Account rewards customers with bonus interest when they maintain or increase their monthly saving balance.

Also during the year we launched the UOB Young Professionals Solution, Singapore’s first banking solution to help young professionals start building their wealth in an easy and convenient way, based on their existing lifestyle choices. The UOB Young Professionals Solution uses an innovative “sweep” function to collect the interest earned on a UOB One Account and the rebates from spending on a UOB YOLO credit card into a low-risk unit trust. The UOB YOLO card continued to be popular among millennials and during the year we crossed the milestone of 100,000 customers. One feature of the UOB YOLO card that has proved popular is the innovative quick-read card face, which makes it easier for our customers to make online purchases.

With travel named consistently as one of our customers’ favourite things to do, UOB launched Singapore’s first banking solution that rewards customers with frequent flyer miles for their saving and spending behaviour. With the KrisFlyer UOB Debit Card and Account, our customers can earn miles under the Singapore Airlines Group’s frequent flyer programme when they use their debit card to make purchases or put their money into their saving account. Customers can use the KrisFlyer miles they earn for award flights and upgrades on Singapore Airlines and SilkAir, or for travel vouchers on Scoot.

Helping Our Customers Safeguard and Grow Their Assets

To ensure our customers understand the risks before they consider any potential return when investing, we use a Risk-First approach and proprietary investment allocation methodology to help them ascertain their risk appetite and tolerance. This approach, which has been implemented in our Southeast Asian markets, helps customers meet their investment needs, safeguard their assets and build sustainable income streams before taking on more risks through tactical investments.

Our Risk-First approach also extends to how we create structured deposits. In 2017, we were the first retail bank in Singapore to offer our customers a structured deposit linked to a low-risk unit trust which provides customers 100 per cent principal guarantee if they hold the five-year tenor investment to maturity. Through such first-to-market solutions, we aim to protect our customers from potential market volatility and to provide attractive yields via an underlying option strategy. To complete our structured product services, during the year, we also piloted our UOB Equity Trading Service to meet our customers’ trading needs in the Singapore and US markets. Our Risk-First approach in developing structured products was recognised when we received the Best Distributor and Best Performance awards in Singapore at the Structured Retail Products Asia-Pacific Structured Product and Derivative Awards 2017.

Drawing On Data to Design Intuitive Customer Experiences

We continue to extract meaningful insights from data and to tap our understanding of our customers’ lifestyle preferences. These enable us to develop distinctive solutions and experiences to support how they chose to live, to work and to play.

For instance, recognising that more potential home owners are doing more of their research online than before, we curated content online and through social media to provide advice on how customers could maximise their savings, understand the obligations of taking out a home loan and manage mortgage payments. This online engagement strategy facilitated an additional $100 million in new loans in Singapore.

Recognising Singaporeans’ love of dining out, in 2017 we launched The Dining Advisor, an online food guide designed specifically to help them search for the best dining experience and card deals. We integrated it into our UOB Mighty app to ensure optimal use of our customers’ mobile screen. The Dining Advisor is complemented by YOLO EAT!, an online tool that provides UOB YOLO cardmembers with recommendations on relevant dining offers based on their preferred locations. The innovative features of the UOB YOLO card won it the Credit Card Initiative of the Year award at the Asian Banking and Finance Retail Banking Awards 2017.

A pioneer in recognising the power of the female dollar, we launched the UOB Lady’s Card 27 years ago. In 2017, we used our insights into the needs and wants of women and gave the card a new look and campaign. The makeover, initially for our Singapore card, was subsequently rolled out in Indonesia, Malaysia and Thailand.

Our range of UOB Lady’s Cards, designed by acclaimed designer Vivienne Tam, received a makeover in 2017.

UOB Private Bank

Growing and Preserving Wealth for the Next Generation

UOB Private Bank is dedicated to managing the wealth of high-net-worth individuals with $5 million and above of investment assets. As part of UOB’s one-bank approach, our clients can tap the Group’s comprehensive suite of personal, business and investment product and services to meet their financial objectives.

The strong performance of our Private Bank in 2017 was the result of our regional expansion efforts, the deepening of our relationships with clients and the close collaboration with Group Wholesale Banking.

As part of strengthening our Private Bank capabilities, we continued to invest in our people, products and platform. On the people front, we doubled the number of bankers managing our clients’ wealth in 2017. We also embarked on a three-year digitalisation programme to enhance our client engagement infrastructure to help our bankers be more effective in advising our clients and in providing them personalised and up-to-date information.

On the product front, our investment team continued to create innovative investment solutions for our clients. We launched our DPM service in 2016 and since then have provided an average return of 10 to more than 30 per cent for our DPM portfolio. The confidence our clients are placing in us resulted in a three-fold increase in our DPM AUM in 2017.

We also organised several investment forums for our clients in Bangkok, Jakarta, Kuala Lumpur, Manila, Shanghai and Singapore to share global market trends and investment strategies.

Business Banking

Helping Small Businesses Improve Their Productivity Through Digital Capabilities

UOB’s eight decades of experience in serving SMEs gives us a deep understanding of the opportunities and challenges that companies face today and may face in the future. To that end, our Business Banking team focuses on creating small business solutions that enable companies to progress through different stages of growth.

For example, in managing their day-to-day operations more efficiently, our customers can choose the UOB BizTransact Account or the UOB eBusiness Account both of which enable them to enjoy rebates on transactions such as remittances and fund transfers. They can also use the UOB Payroll solution to pay their employees promptly and conveniently.

UOB BizSmart, a suite of cloud-based integrated business solutions, was launched in 2016 and since then, more than 1,300 small businesses in Singapore have benefitted from it. UOB BizSmart helps companies to manage key operating processes such as accounting, human resource management, inventory management, employee management and information security. The automation of these processes also captures data to help businesses improve efficiency.

In 2017, we stayed focused on helping small businesses succeed in their digitalisation journey by collaborating with SAP to offer SAP Business One – a scalable solution providing key functionalities to help businesses digitalise back-office processes such as accounting and sales – within our BizSmart solution. The UOB-SAP tie-up is the first time SAP has collaborated with an Asian bank to offer SAP Business One.

“Once the processes for UOB BizSmart were all set up, I could imagine the inefficiencies we might have had to deal with if we had used a more traditional system where you need to do data entry every day. The important data of the business is now always at our fingertips.”

Mr Lwee Jia Wei

Co-Founder, Boulder Movement

During the year, we also signed a Memorandum of Intent with the Infocomm Media Development Authority in Singapore to help small businesses improve their digital capabilities under the SMEs Go Digital initiative. As part of the collaboration, UOB will provide SMEs access to financial instruments such as bridging loans to help them defray the cost of investing in digital capabilities. We have also trained 50 of our business bankers so that they can better advise and guide small businesses which want to take advantage of the scheme.

To help small businesses seize more opportunities in the digital economy, we also partnered Google, Spring Singapore, International Enterprise Singapore and other industry players for the second consecutive year on Go Global, an initiative that helps Singapore’s SMEs expand their businesses internationally. Through a web-based learning platform, SMEs in Singapore can access digital tools and banking solutions to take advantage of export opportunities. In 2017, this initiative enabled more than 2,500 SMEs, including 350 UOB customers, to digitalise their business and to venture overseas.

In Indonesia, we worked with DOKU, an electronic payments provider, to create an e-Payroll mobile app to help SMEs shorten the time needed to process salary payments from an average of three days to just one day. Our partnership with DOKU is the first between a bank and a local financial technology company in Indonesia to create a solution for small businesses.

Creating Financial Solutions Specifically for Small Businesses

For many small businesses, cash flow is a concern. Understanding that companies need working capital quickly for their day-to-day operations, we launched UOB BizTrade+ in Singapore and Thailand. Through UOB BizTrade+, UOB is the first bank to provide trade loans of up to $1 million with simpler and faster application and approval processes. We also introduced the Express Banker’s Guarantee (BG) for our non-borrowing customers in Singapore so that they can receive a BG within three working days instead of the previous standard of two weeks.

UOB BizMoney, our collateral-free unsecured business loan, continued to meet the needs of small businesses which are looking to extend their cash flow. In 2017, we disbursed a total of $280 million of such loans to close to 2,000 customers in Singapore, Malaysia and Thailand.

To help our customers manage rising business costs, our virtual marketplace, BizExchange, offers small businesses a one-stop shop for a wide range of business essentials, such as travel, stationery, general insurance as well as courier and logistics services. BizExchange also enables our customers to enjoy cost savings from bulk-purchase deals and preferential rates negotiated by UOB with suppliers. In 2017, we saw close to 9,000 customers in Singapore access BizExchange to procure their business essentials.

To increase engagement with our customers, during the year, we also launched UOB InBusiness, a dedicated website which provides essential insights on key topics that small businesses should be aware of in order to stay relevant in today’s competitive market.

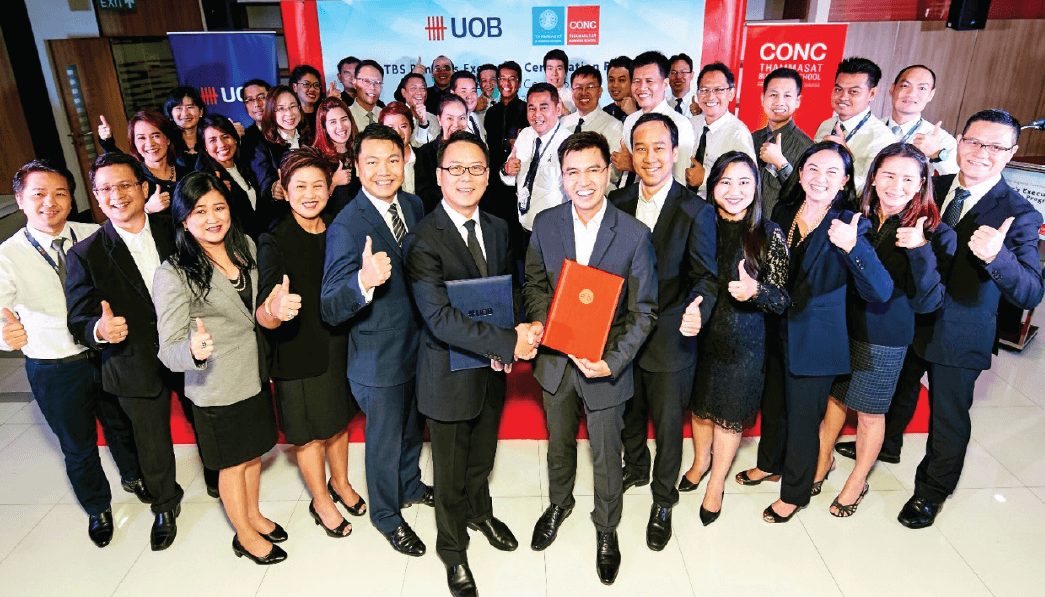

Through the Banker’s Executive Certification Programme, our business bankers are better equipped to help small businesses in Southeast Asia meet their business needs and overcome challenges.

Developing the Skills of Our Business Bankers

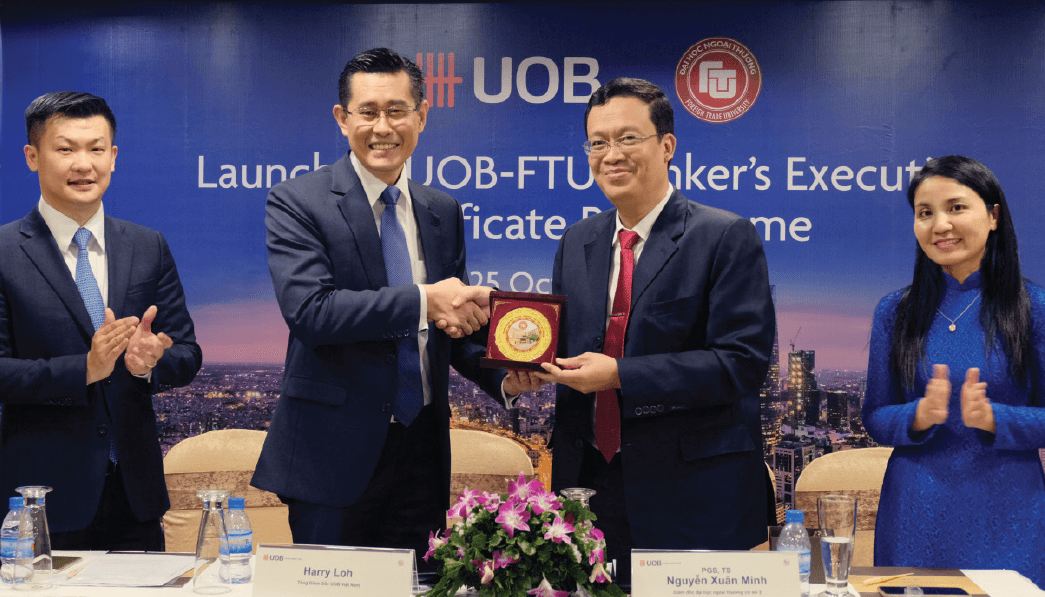

In 2017, we continued to equip our business bankers in the region with deeper skills in various areas including financial management, credit knowledge and trade financing so that they can better support the domestic and cross-border demands of small businesses. During the year, we launched the Banker’s Executive Certification Programme in Thailand and Vietnam in collaboration with the Thammasat Business School and the Foreign Trade University respectively. One hundred bankers from across five of our markets – Singapore, Indonesia, Malaysia, Thailand and Vietnam – have graduated from the programme.

Deepening our Presence in Vietnam

Following the awarding of a foreign-owned subsidiary bank licence in Vietnam to us, we launched our Business Banking service to help small businesses in Vietnam prosper. The range of services we provide includes transaction accounts to help small businesses manage their day-to-day expenses and operations, small business loans to finance the growth of the business and to extend cash flow, and trade financing solutions to manage import and export supply chain payments.

We also made it easier for small businesses to apply for the services they need through digital means. For example, a company can easily submit its account or loan application through UOB Vietnam’s website or our mobile app for businesses, UOB Business, without needing to visit the branch. If approved, the company will be able to activate its UOB business account or receive in-principle approval for its loan application in one business day.

We were also the first bank to partner the SME Vietnam Network, which aims to help its SME members share best practices and exchange business opportunities. Under this partnership, the Bank will extend exclusive offers for business accounts and lending schemes to members of the SME Vietnam Network until the end of 2018.

In addition, we signed a Memorandum of Understanding with Toong, Vietnam’s first professional large-scale co-working space, to provide our customers with preferential lease rates at any of Toong’s five co-working office spaces in Ho Chi Minh City, Hanoi and Da Nang. Our customers will also have access to Toong’s business partners, including legal and accounting firms, for advice on matters such as local incorporation.

“We have been growing our business steadily through online sales channels and recognised that we needed new products to meet the increasing demand from our customers. We faced many difficulties in trying to secure the funding needed until we started working with UOB. We received prompt approval from the Bank and the funds enabled us to expand our product range to grow our business.”

Ms Dang Thi Khanh Le

Managing Director, Grown Tech Company