You are now reading:

UOB Business Outlook Study 2025 (Malaysia): Optimism holds as companies recalibrate

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2025 (Malaysia): Optimism holds as companies recalibrate

As businesses navigate a complex economic landscape, the latest sentiment trends in Malaysia reflect cautious yet persistent optimism.

According to the UOB Business Outlook Study 2025, business leaders are positioning themselves for growth despite rising operational costs, workforce constraints, and continued supply chain disruptions. They are focusing on sustainability, digitalisation, and overseas expansion to build long-term resilience.

However, the imposition of new US tariffs has altered the outlook for 2025. While underlying confidence remains, businesses are bracing for fresh challenges.

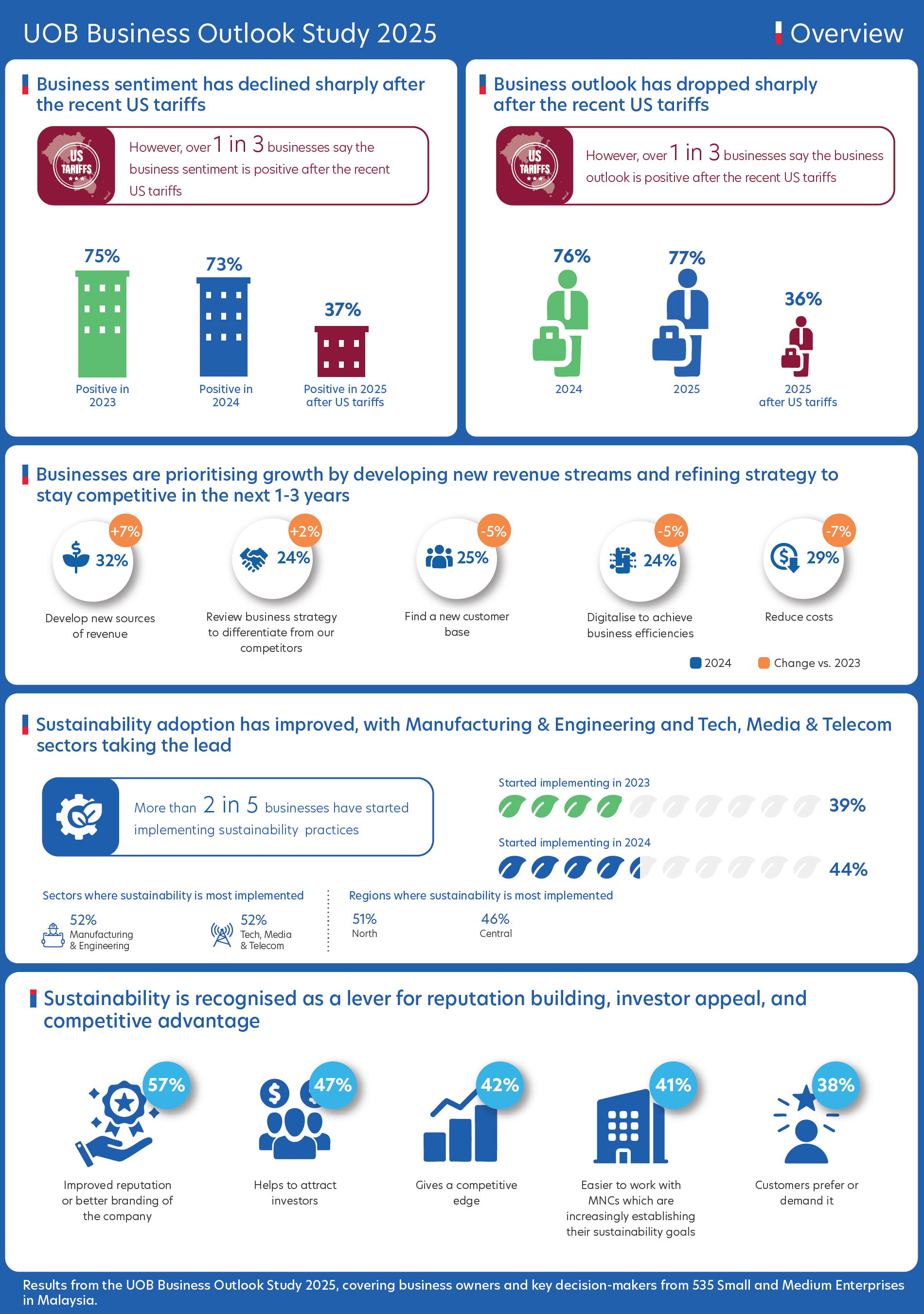

Figure 1: Snapshot of the key findings from businesses in Malaysia

While the Malaysian business environment remains broadly positive, around four in 10 of respondents continue to express positive sentiment following the US tariffs, a sharp drop from previous levels. In particular, the Business Services and Healthcare & Medical Services sectors are more optimistic than the others.

The impact is more acute among small enterprises compared to medium-sized businesses. Even so, companies anticipate an improved business environment from 2027 onwards, reflecting underlying resilience.

About half of businesses expect sharp increases in inflation, raw material, and production costs following the tariffs. These pressures are prompting one in two businesses to implement cost-cutting measures while contending with customer retention issues and insufficient cash flow.

To unlock growth, many businesses are sharpening their focus on enhancing product offerings and customer service. At the same time, they are calling for greater support, with more businesses seeking financial assistance to tackle potential tariff impact.

Sustainability continues to gain importance across sectors, though progress remains incremental. Around four in 10 businesses have integrated sustainability practices into their operations – a figure that has remained consistent over the past two years.

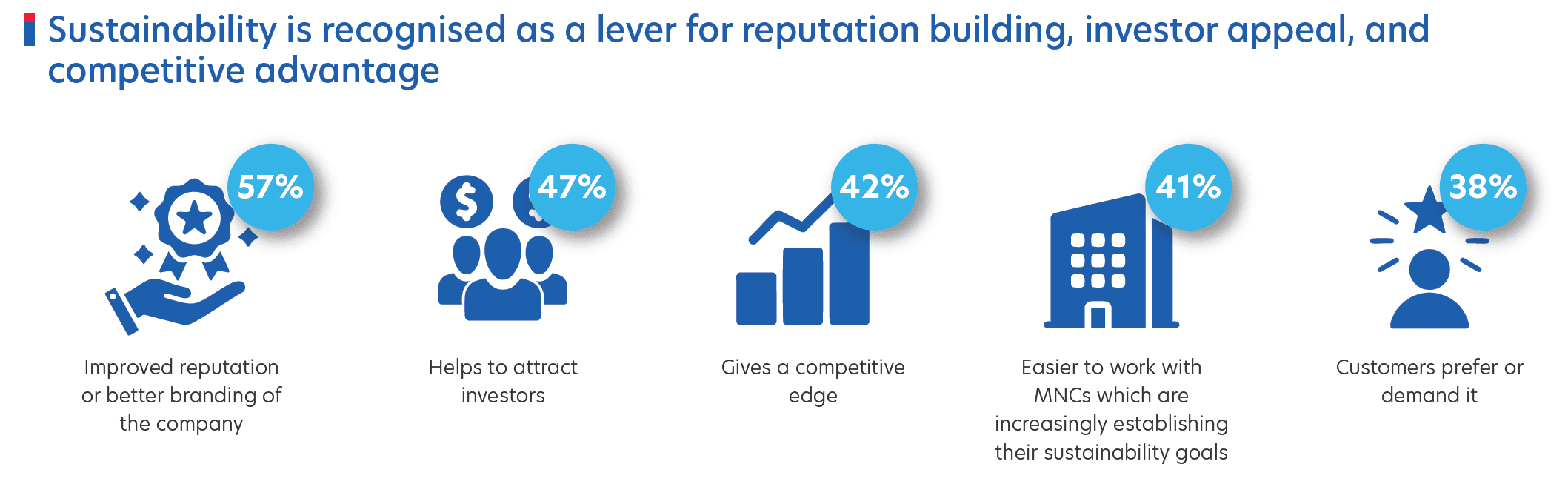

For many, the business case for sustainability is clear: it boosts brand reputation, attracts investors, and provides a competitive edge. Tangible initiatives such as waste reduction, energy efficiency, and employee wellbeing top the list of priorities.

Figure 2: Reasons why Malaysian firms are adopting sustainable practices

Following the introduction of US tariffs, about half of businesses now expect to accelerate the pace of sustainability adoption. Yet, deeper adoption is hindered by common barriers, including costs, a shortage of specialised manpower, and limited infrastructure for renewable energy. Knowledge gaps also persist, underscoring the need for more comprehensive support to advance the sustainability agenda.

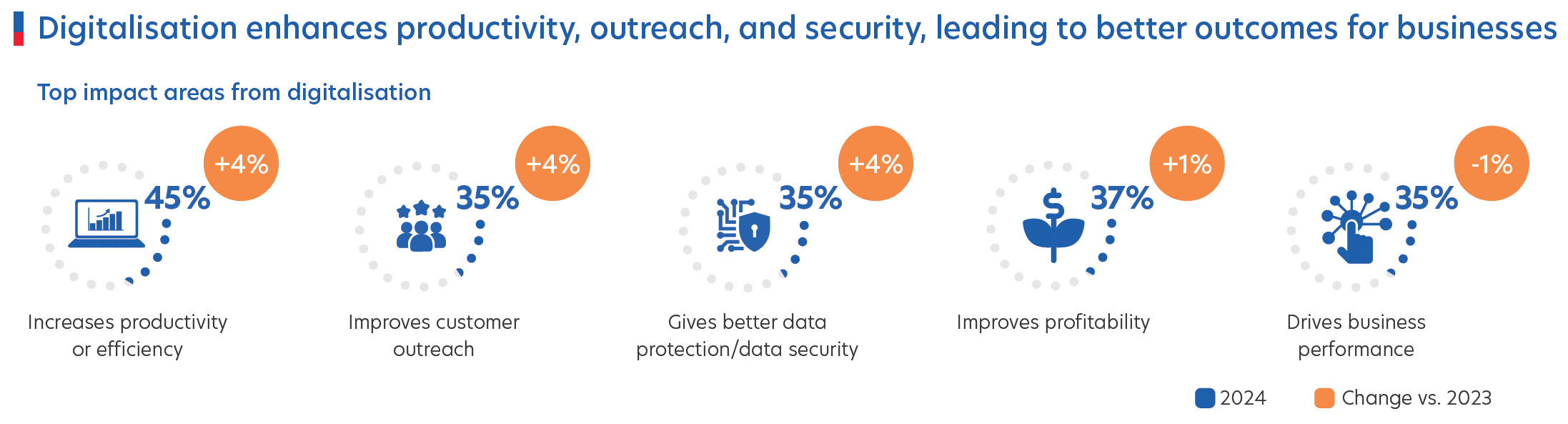

Digital adoption continues to gain traction, with eight in 10 businesses now digitalising at least one department. The benefits are widely acknowledged: greater productivity, improved profitability, and enhanced customer engagement. However, despite strong digital adoption rates, only half report seeing measurable success.

Still, digitalisation remains a key pillar of business transformation, and the urgency has heightened further since the tariff announcements – particularly among medium-sized enterprises.

Figure 3: Key benefits for businesses due to digital adoption

Affordability remains a significant roadblock: four in 10 businesses cite digitalisation as expensive, with cost concerns becoming more prominent than in previous years. Despite this, businesses still hope to streamline their operations with digital tools. Beyond funding, businesses are also seeking access to training and knowledge to support effective implementation.

“By the end of 2025, we aim to digitalise the entire company to at least 80 per cent, including processes like sales and procurement. This will ease a lot of paperwork.”

Owner, Consumer Goods Sector, Malaysia

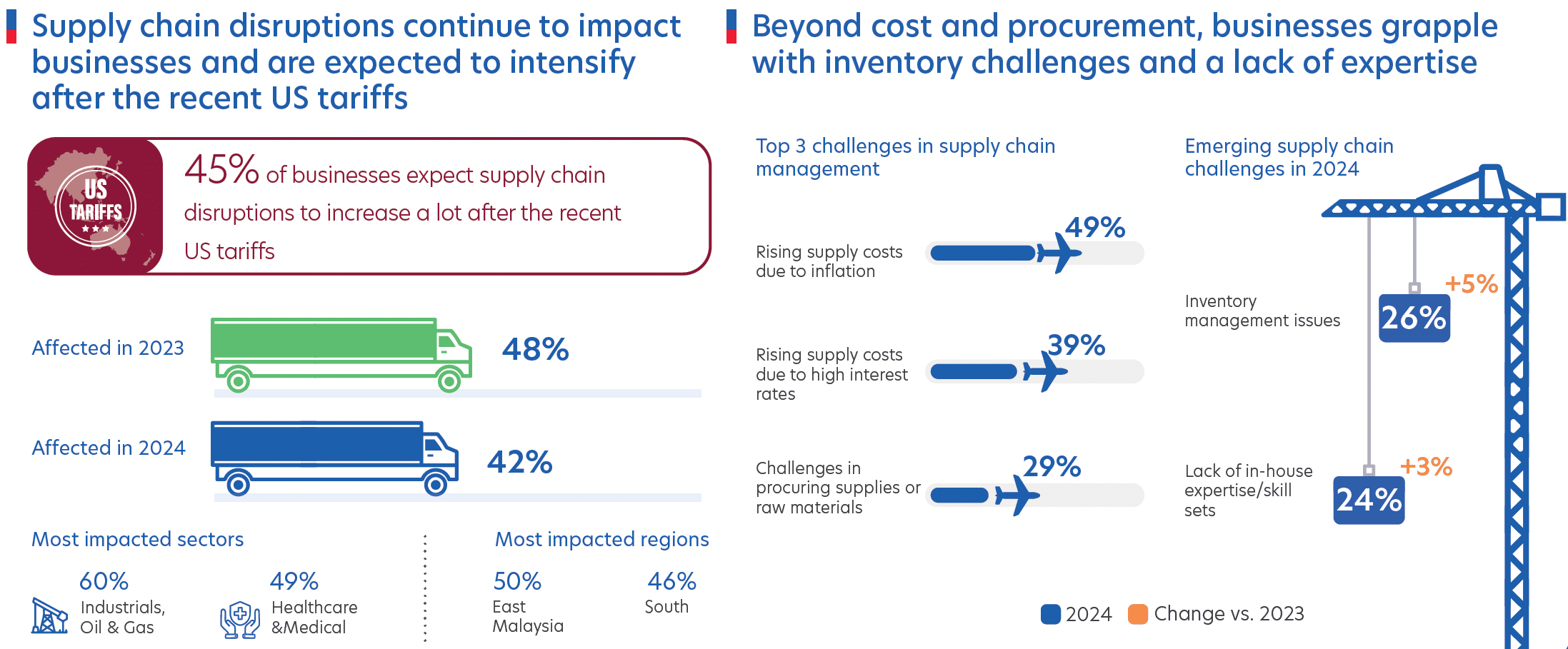

More than four in 10 businesses continue to be impacted by supply chain disruptions, underscoring the enduring importance of robust supply chain management (SCM). Inflation and high interest rates have further intensified the strain, with escalating supply costs now the top challenge across sectors.

As tariff negotiations continue, Malaysian businesses foresee even greater supply chain disruptions. In response, they are localising and diversifying their supplier networks to build resilience. Intra-ASEAN trade is also expected to receive a boost as businesses strengthen regional ties.

Figure 4: Supply chain pressures are expected to persist in the near future

Medium-sized enterprises are sharpening their focus on inventory management and adopting real-time tracking tools to maintain “just-in-case” supplies. Even with these efforts, funding remains a critical enabler. One in two businesses are seeking financial support, and two in five look to partner with large organisations to stabilise their supply chains.

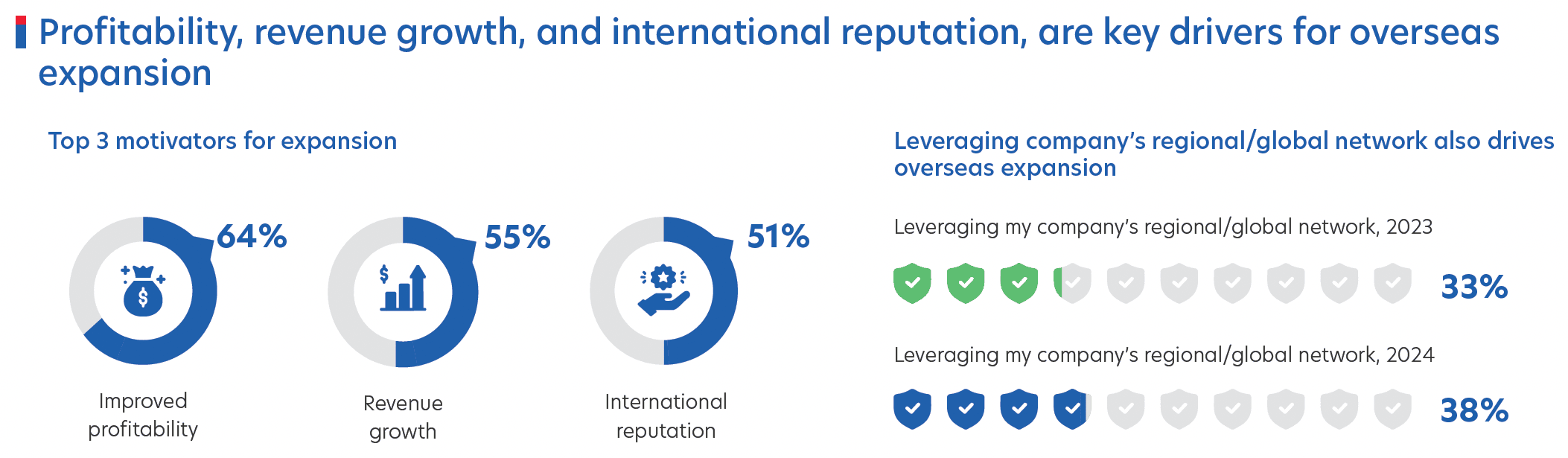

Interest in overseas expansion remains high, with more than seven in 10 businesses viewing it as a strategic growth lever. Businesses are primarily pursuing international markets to improve profits (67 per cent), grow revenue (55 per cent), and build reputation (51 per cent).

The ASEAN region and Mainland China continue to dominate expansion plans. Within ASEAN, Singapore, Thailand, and Indonesia have emerged as top target markets. Following the tariff imposition, the pace of overseas expansion is expected to increase further as businesses look to tap new opportunities and offset domestic market risks.

However, familiar hurdles persist, including inadequate funding, limited market intelligence, and challenges in finding the right partners.

Figure 5: Top three factors driving overseas expansion for companies

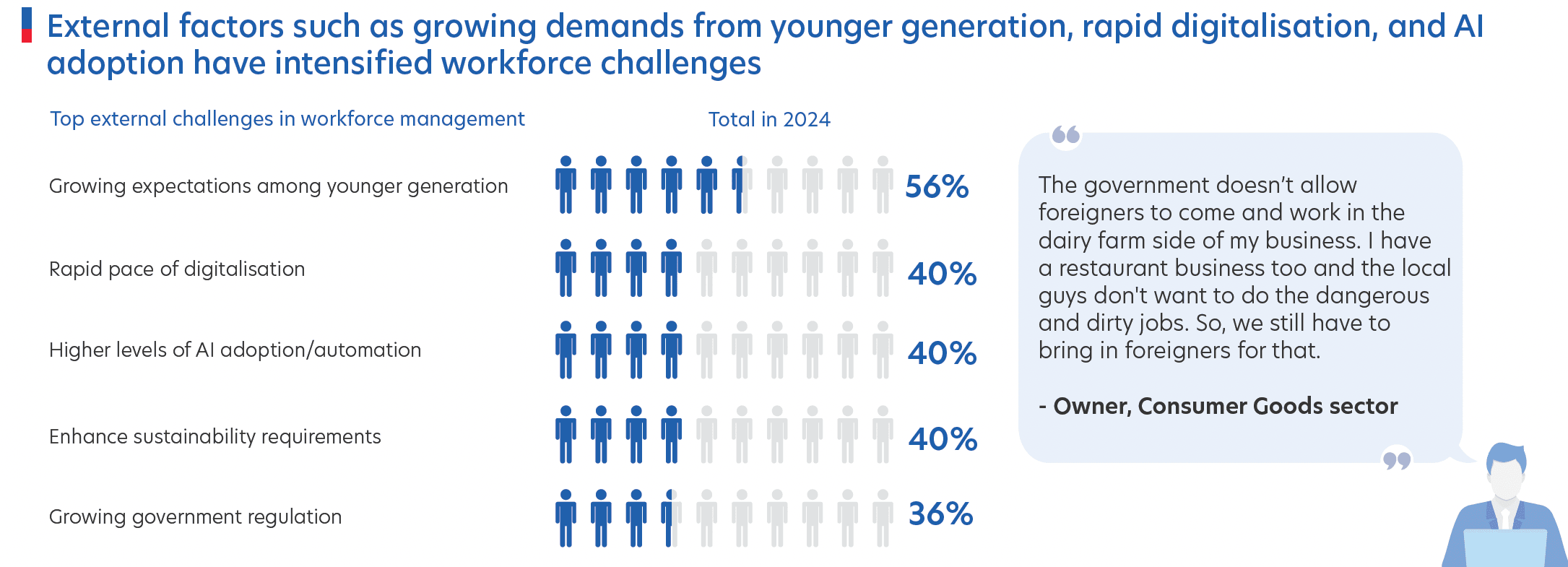

Workforce management has become a critical pressure point, with more than four in 10 businesses reporting manpower issues. Key challenges include evolving employee expectations – around compensation, remote work, and flexible arrangements – and difficulties in attracting and retaining talent.

Figure 6: Younger talent expectations and rapid digitalisation are contributing to workforce challenges

These pressures are particularly acute among younger employees, whose growing expectations for cross-department exposure and work-life balance add to the challenge. The post-tariff environment is expected to intensify workforce pressures, driven by inflation and higher costs.

To remain competitive, businesses are offering higher pay and investing in upskilling initiatives.

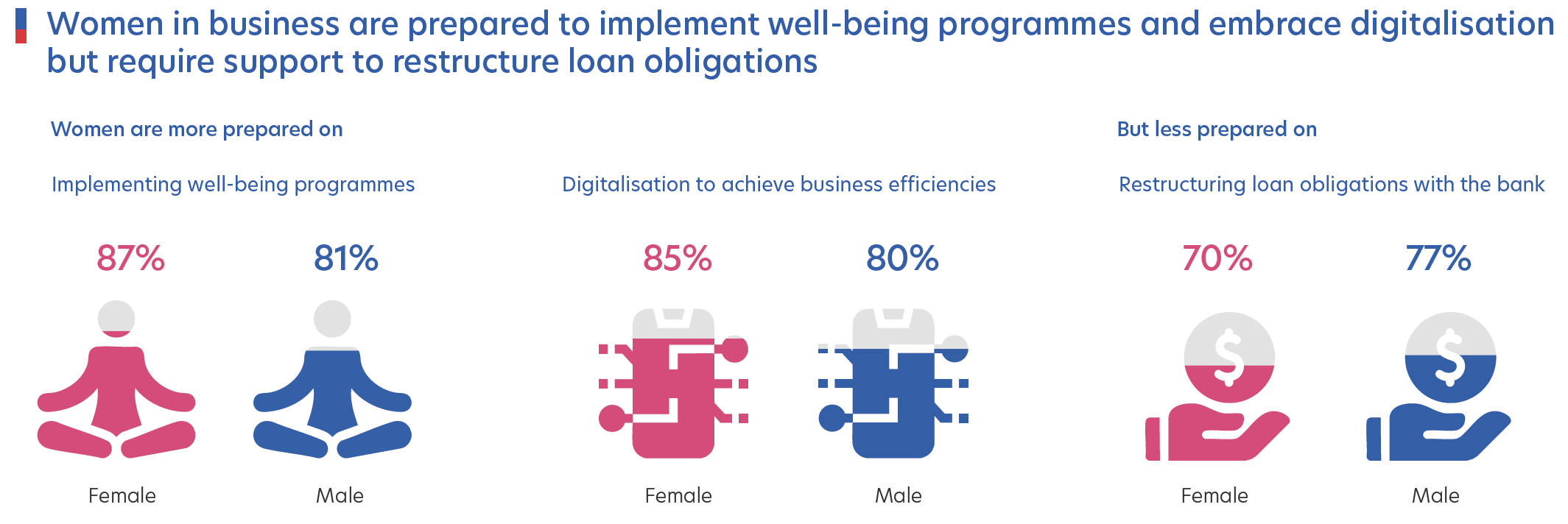

Women-led businesses in Malaysia continue to demonstrate stronger optimism than their counterparts, especially in navigating customer retention and employee wellbeing. They are more focused on diversifying their customer base and strengthening internal operations, including employee health and sustainability initiatives.

Figure 7: Areas of strengths of women in business and key challenges they face

Malaysia’s next-generation leaders – comprising a significant portion of leadership across SMEs – are showing strong optimism for both current and future outlooks. As they take over their family business, Next Gen leaders are prioritising long-term strategies such as digital transformation, governance, and employee development, and are more open to new technologies such as AI and blockchain.

Their leadership is marked by a forward-thinking approach that balances resilience with innovation. By focusing on people and progress, these leaders are helping businesses remain agile and competitive in an evolving environment.

The outlook for 2025 remains largely positive, with businesses showing strong intent to innovate, digitalise, expand, and go green. However, turning ambition into action requires targeted support.

As Malaysian businesses adapt to rising costs, global uncertainties, and workforce pressures, many are recalibrating for sustainable growth. With tailored financial solutions, regional expertise, and cross-border capabilities, UOB stands ready to help Malaysian enterprises unlock their full potential. Contact us to find out more.

The UOB Business Outlook Study 2025 (Malaysia) surveyed 535 business owners and senior executives from SMEs and Large Enterprises in Malaysia. Conducted online in January 2025, with a follow-up dipstick study in April 2025 after the US tariffs, the study offers insights into:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

30 Jun 2025 • 6 mins read

25 Jun 2025 • 5 mins read

12 Jun 2025 • 6 mins read