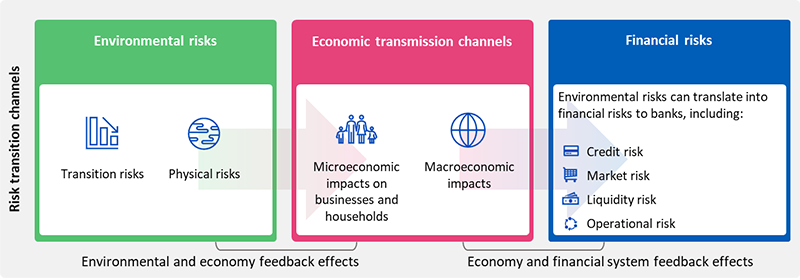

At UOB, we recognise the vital role that we play, through our financing practices, in shaping responsible actions from our customers as we collectively forge a sustainable future. This is why we embed environmental, social and governance (ESG) risk in our approach to risk management, and integrate ESG considerations into our credit evaluation and approval processes.

Robust responsible financing standards

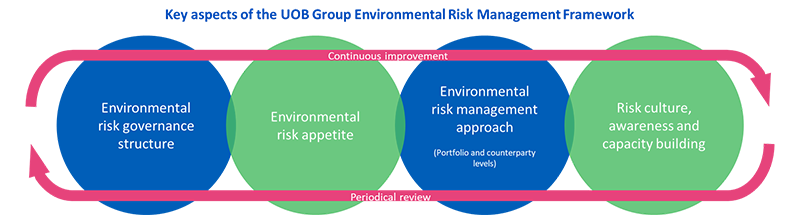

We continually strengthen our approach to responsible financing. We have established structured frameworks, policies and standards to embed ESG risk assessment across the Group, with support from resources in across the Three Lines.

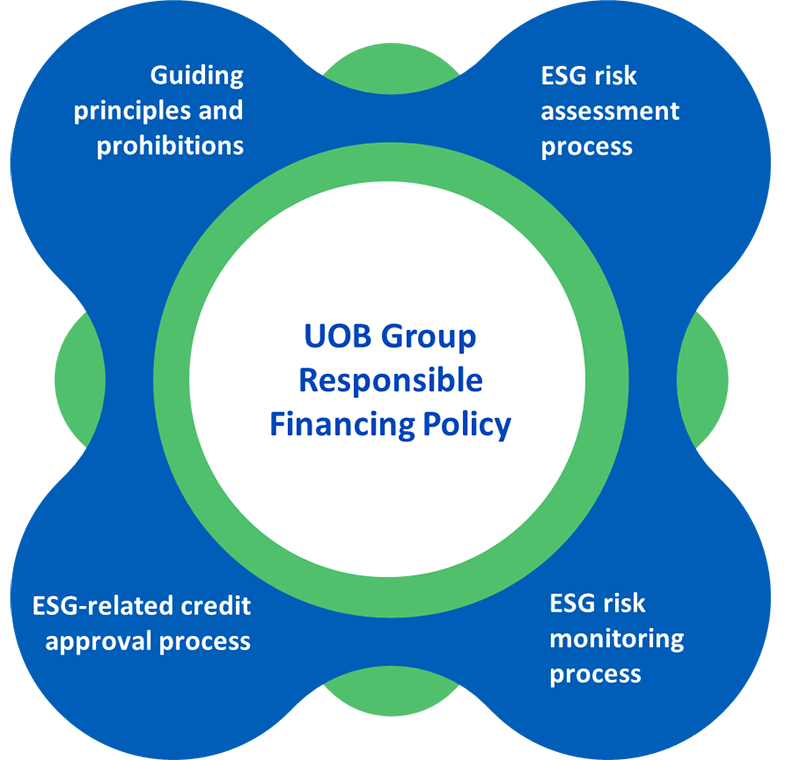

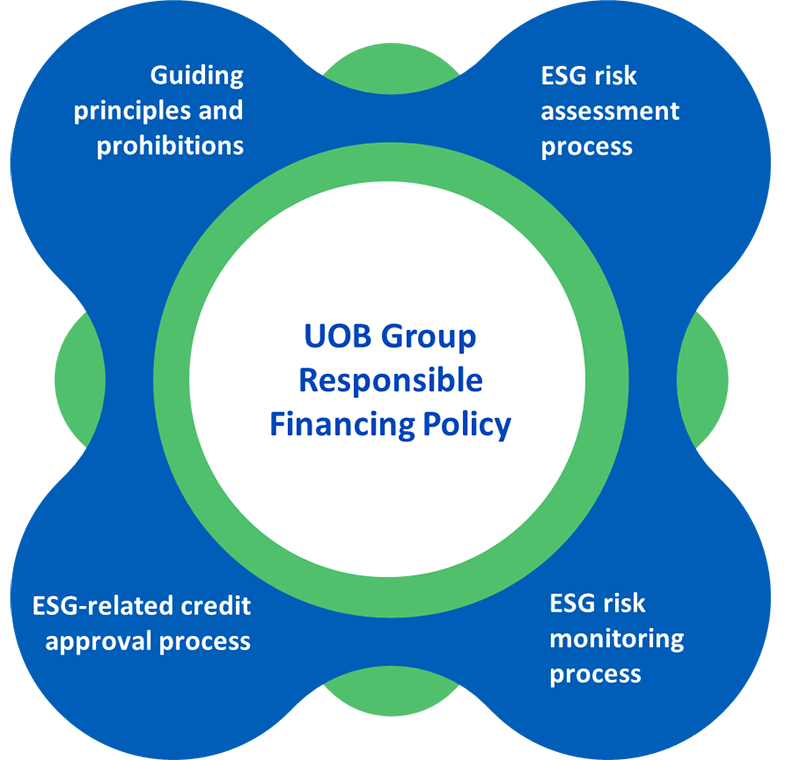

Group Responsible Financing Policy

We adopted, since 2016, the principles of The Association of Banks in Singapore (ABS) Guidelines on Responsible Financing and continue to enhance our ESG risk management approach in line with best practices.

Our Group Responsible Financing Policy applies to all borrowing customers of Group Wholesale Banking and to the Bank's capital market underwriting activities. It is embedded within UOB Group's corporate credit policy, thereby ensuring ESG considerations are integrated into our credit evaluation and approval processes. The policy states clear roles and responsibilities to ensure effective implementation through our Three Lines Model control structure with approval from the Group Credit Committee.

Guiding principles and prohibitions

Our Group Responsible Financing Policy requires our customers to:

- fully comply with ESG laws and regulations in the respective countries in which they operate;

- commit to implement a sustainable sourcing policy and/or a process to exclude sourcing from controversial sources; and

- implement or work towards implementing an appropriate Environmental and Social Management System (ESMS) to address key environmental and social risks in their operations and/or projects.

In addition, our Group Responsible Financing Policy prohibits our financing of companies:

- where their operations or projects threaten the outstanding universal value or special characteristics of UNESCO World Heritage Sites, Ramsar Wetlands, forests of high conservation value (HCV), or would impact critical natural habitats significantly;

- involved in animal cruelty and the trade of endangered species as defined by the Convention on International Trade in Endangered Species (CITES) of Wild Fauna and Flora;

- without measures in place to manage or to mitigate the risk of air, soil and water pollution which may negatively impact terrestrial or marine ecosystems;

- involved in the exploitation of labour, including forced labour and child labour, taking reference from the International Labour Organization (ILO) standards;

- in violation of the rights of local or indigenous communities; and

- involved in open burning for land clearance.

These financing prohibitions are cross-cutting commitments applicable to all new and existing customers and help to bolster our efforts in fostering sustainable development through responsible financing.

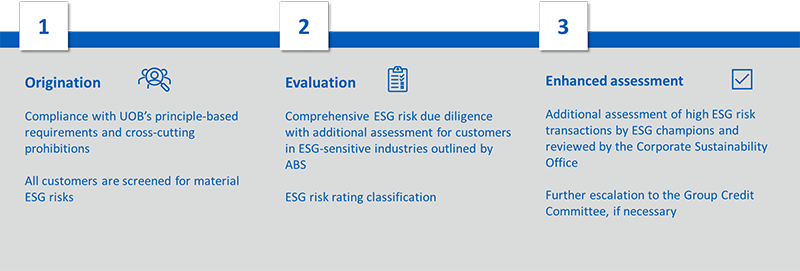

ESG risk assessment process

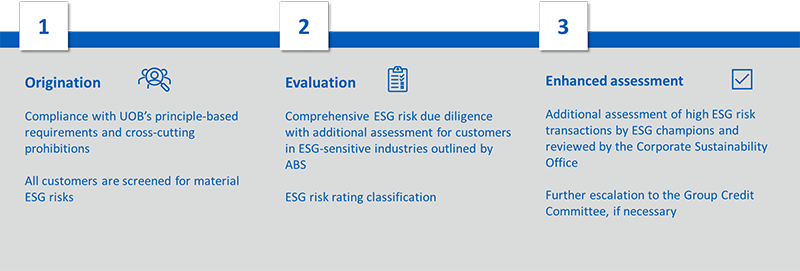

Under our Group Responsible Financing Policy, account officers are required to conduct due diligence on all new and existing customers during the customer onboarding process and annual credit review. Customers are assessed for material ESG risks as well as their capacity for, commitment to and track record in sustainability. ESG checklists have been developed to help account officers identify, assess and review ESG risks.

To identify, to measure and to manage better the ESG risks in our portfolio, we classify our customers as ‘high’, ‘medium’ or ‘low’ ESG risk. This is based on the level of ESG risk inherent in their business operations and the residual ESG risk after assessing their ability to mitigate the inherent risk through policies and measures.

ESG risk monitoring process

ESG risk is monitored at the individual customer as well as the portfolio level.

Individual customer monitoring

We engage with our customers proactively and continually work with them to improve their ESG practices. Our customers are monitored on an ongoing basis, through periodic assessments and reviews of any adverse ESG-related news. Customers with any known material ESG-related incidents will trigger an immediate review with ESG risks to be addressed and managed appropriately.

We require customers to rectify any policy unconformities within a reasonable timeframe and account officers are responsible for monitoring their progress. However, if we deem that our customers are unable or unwilling to commit to managing adequately the potential adverse impact of their operations, we are prepared to review and to reassess the relationship, or reject the transaction.

Portfolio monitoring

We periodically report to senior management our exposure to ESG-sensitive sectors, high environmental risk business operations, as well as any customers under heightened monitoring due to ESG-related incidents.

ESG-related credit approval process

Credit applications are reviewed by credit approvers upon completion of required ESG assessments. Credit approvers will approve those within the Bank’s ESG risk appetite. High risk transactions in sensitive sectors may be escalated to the Group Credit Committee for further review.

Our Group Responsible Financing Policy references international standards and conventions such as the Roundtable on Sustainable Palm Oil, Forest Stewardship Council, World Heritage Convention, and best industry practices provided by the International Finance Corporation (IFC) and the ABS Haze Diagnostic Kit.

We recognise that the financial sector has a pivotal role in driving the transition towards a low carbon economy and in addressing significant risks imposed by nature and biodiversity loss. Therefore, we periodically review our Group Responsible Financing Policy and sector-specific policies amid changing societal and stakeholder expectations.

Sector-specific policies

UOB also established sector specific guidelines for selected high ESG risk sectors to guide our assessment of customers that fall within the eight ESG-sensitive industries as defined by the ABS Responsible Financing Guidelines.