You are now reading:

US: Trade tariff re-escalation

you are in Research

You are now reading:

US: Trade tariff re-escalation

US President Trump unveiled the first wave of tariff letters to 14 countries on 7 Jul, slated to take effect on 1 Aug deadline (extended from 9 Jul). These rates would be “separate from all sectoral tariffs,” meaning, the new tariff will not be stacked on top of any existing/future sector-specific tariffs.

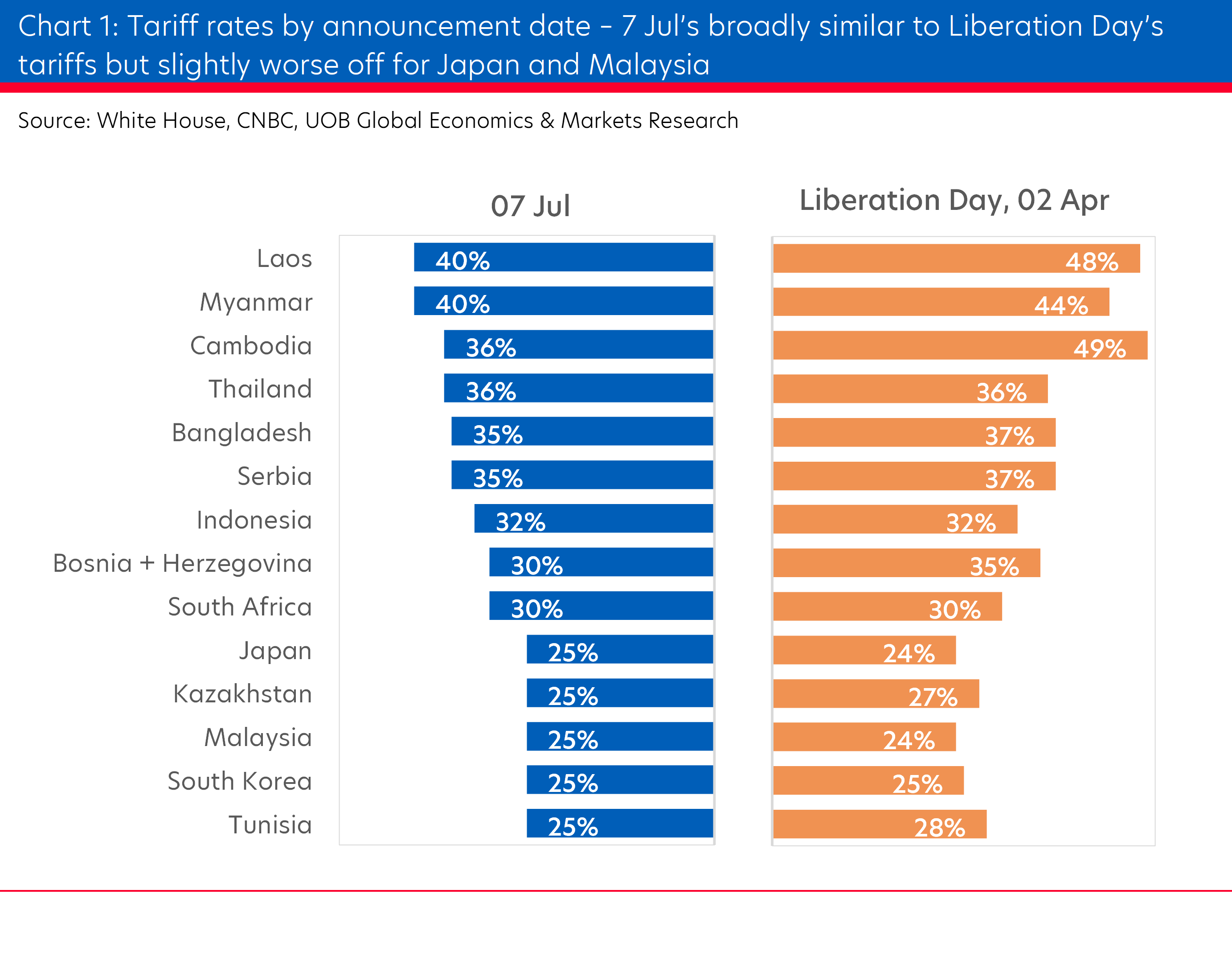

The list contained many Asian countries and included Japan (25%), South Korea (25%), Malaysia (25%), Indonesia (32%), Thailand (36%) amongst others, which is broadly similar (and in some cases slightly worse compared) to the rates announced on Liberation Day. Some of the Asian countries do not run significant trade surpluses with US but are still hit with material tariff rates, likely to mitigate trade diversion/transshipment from China

The US-China 90-day pause in reciprocal tariffs which will end on 13 Aug, will come into view. Trump’s reversion to Liberation Day tariff rates for some economies on 7 Jul has increased the risks for China in addition to US potentially seeking to cut transshipments (targeting goods with Chinese content) through a tiered tariff agreement (such as with Vietnam). We expect a trade deal to be announced (including the tariff rates and finalized terms) or a further extension of the 13 Aug deadline.

On Mon (7 Jul), fresh from his victory in the passage of his “One Big, Beautiful Bill” (OBBB) and ahead of the 9 Jul expiration of the 90-day tariff pause, US President Trump unveiled follow-up letters to 14 countries (mostly Asian) announcing updated rates. These included Japan (25%), South Korea (25%), Malaysia (25%), Indonesia (32%), Thailand (36%) amongst others, which are broadly similar (and in some cases slightly higher) compared to the tariff rates announced earlier on 2 Apr Liberation Day (see Chart 1). Trump also signed an executive order extending the tariff pause from 9 Jul to 1 Aug. According to the fact sheet, Trump may send more letters in the coming days and weeks.

Importantly, Trump said these rates would be “separate from all sectoral tariffs,” meaning the new tariff will not be stacked on top of any existing/future sector-specific tariffs. Trump also warned against tariff retaliation, stating that if countries raise tariffs against the US, the US will add the same amount to the announced tariff levels. That said, Trump left the door open for additional negotiations and extensions, saying the 1 Aug deadline was “not 100% firm” and he remained open to continuing to tweak the rates (Trump: “Maybe adjust a little bit, depending …We’re not going to be unfair.”)

Alvin Liew

Senior Economist

Follow Alvin on LinkedIn

This publication is strictly for informational purposes only and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose, and is also not intended for distribution to, or use by, any person in any country where such distribution or use would be contrary to its laws or regulations. This publication is not an offer, recommendation, solicitation or advice to buy or sell any investment product/securities/instruments. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.