Advantages you enjoy when you start investing from a young age

Published in June 2020

Article Summary

Investing is a journey. Here is why you enjoy many advantages when you start your investment journey earlier.

It’s easy to understand why many only start thinking about investing when they reach an older age.

When you are young and have just joined the workforce, you will likely be drawing a lower salary. Moreover, having just started earning a regular paycheck, it’s not far-fetched for first-jobbers to spend a significant chunk of their salary on things they have always wished they could afford, such as a top-of-the-line phone, holidays and eating out at trendy restaurants, or to save up towards imminent big-ticket purchases such as a wedding banquet, their first home and home renovations.

Investing for the future is not on the priority list for many young people.

However, the irony is that the earlier you start your investing journey, the higher your chances of success at achieving your goals, be it saving up towards an early retirement, creating an additional source of passive income or just building a stable investment portfolio. Here are some reasons why.

Compound interest

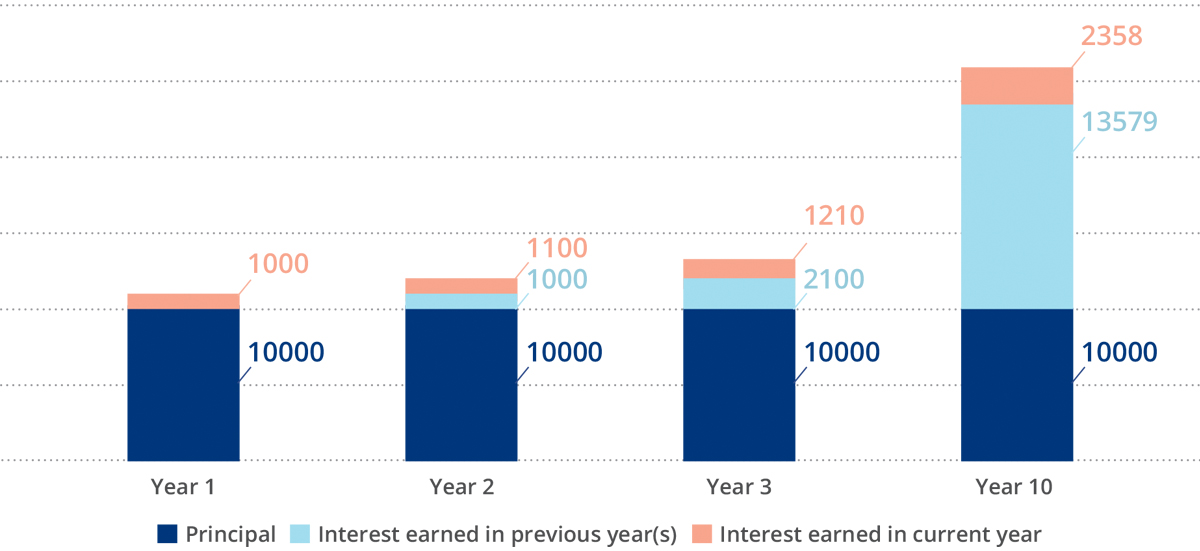

Compound interest can be understood as the interest that you earn on your interest, which is in addition to the interest that you earn on your principal investment.

For example, if you invest S$10,000 today at an interest rate of 5% per annum (p.a.), you will earn S$500 in interest, giving you a total of S$10,500 after your first year. Investing this sum in your second year will earn you interest of S$525, which is S$25 more than the interest you earned in your first year. The additional S$25 that you earn in your second year is due to the effect of compound interest.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”.

The longer you invest, the greater this compounding effect is going to be.

If you invest S$10,000 with an average return of 5% p.a., you would have slightly over S$11,500 after 3 years, but if you stay invested for another 7 years, your returns would grow to more than S$16,200 by the 10th year.

The bottom line is that the earlier you start investing, the more you will benefit from the compounding effect.

Ride out market volatility

A cursory glance at the long-term performance of financial markets may give the impression that markets generate stable and consistent returns. For example, from 1957 to 2019, the average annual return of the S&P 500 has been about 8%.

But it would be a mistake for an investor to assume that the return of 8% applies to each and every year of this period. Investors could have earned significantly higher or lower returns in each individual year during that period, which means their average returns could have differed greatly from the long-term average of 8% p.a. if they had invested for a short period of time.

Markets are always fluctuating, and there have been periods when the S&P 500 has delivered negative returns over consecutive years. From 2000 to 2002, the returns for the S&P 500 were -10.1%, -13.0% and -23.4% respectively. In 2008, the S&P 500 was down -38.5% for the year.

To enjoy average returns of 8% p.a., investors would have had to stay invested in the S&P 500 for the long term, taking both the negative returns and positive returns.

The earlier you start investing, the longer your investment horizon, which enables you to better withstand market ups and downs throughout the years.

Learning from mistakes

Similar to picking up other life skills such as swimming, cycling and cooking, we need to be prepared for mistakes in our investment journey. Nobody, not even investment professionals, will be able to get their investment decisions right all the time.

There will be times when you hold on to losing positions for too long, and other times where you sell off winning positions too early. You will make losses in some investments and (hopefully) gains in other investments. You may also realise after a while that your portfolio isn’t well diversified enough. The best time to learn from your mistakes is when you are young and do not have significant financial obligations, such as a child’s university fees.

As a new investor, you will inevitably make mistakes when investing in particular companies or asset classes.

As a young investor, you will likely also have limited funds to invest. This is perfectly fine. You would want to start small anyway, so that the mistakes you make will not lead to significant losses early on in your investment journey.

Start investing early for long–term success

Similar to many other skills in life, starting to invest early will make you a better investor as you work towards your goal of greater financial security in the long-term. Whether it is harnessing the power of compound interest, having more time to ride out market volatility or having the leeway to learn from your mistakes at an earlier age, there are multiple benefits you enjoy when you start investing early. So if you have yet to embark on your investment journey, there is no better time than now to do so.

The information herein is given on a general basis without obligation and is strictly for informational purposes only. It is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Nothing herein shall be construed as accounting, legal, regulatory, tax, financial or other advice. You should consult your own professional advisors about issues mentioned herein that may be of interest to you as the information contained herein does not have regard to any specific investment objectives, financial situation and/or particular needs of any specific person. United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accepts no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication. This publication (including the video contained in this publication) shall not be reproduced, re-distributed, duplicated, copied, or incorporated into derivative works, in whole or in part, by any person for whatever purpose without the prior written consent of United Overseas Bank Limited. Any unauthorised use is strictly prohibited. The video in this publication is re-produced by United Overseas Bank Limited with the consent of Schroders and shall not be reproduced, re-distributed, duplicated, copied, or incorporated into derivative works, in whole or in part, by any person for whatever purpose.