Owning the student life

Embrace a fresh perspective on banking, one that brings you closer to your life goals. Let our suite of digital tools and innovative solutions help you work towards financial freedom so you can live life on your own terms.

Products for you

Spend

KrisFlyer UOB Debit Card and Account

The debit card and account that are miles ahead.

- For every S$1 spend:

- Earn 1 mile on Singapore Airlines, Scoot, KrisShop and Kris+ purchases

-

Earn 0.4 miles on all other spend

- Plus, get up to additional 6 miles per S$1 spend when you spend and save with KrisFlyer UOB Account.

-

Get S$10 off ChangiWifi

and Grab rides to or from the Airport

and Grab rides to or from the Airport

- Exclusive benefits from Scoot (via flyscoot.com/KrisFlyerUOB) such as priority check-in and boarding, additional baggage allowance and more!

Our digital solutions

Digital Banking

UOB TMRW

The all-in-one banking app built around you and your needs.

Featuring AI-driven insights to better manage your money, rewards personalised to you, and investing made simple through our expert wealth solutions.

Save

Mighty FX

Get more out of your travel, shopping and investment needs

- Convert currencies 24/7 at attractive rates

- Enjoy zero admin fees when you use your Mighty FX or KrisFlyer UOB Debit Card for overseas or online shopping

- Withdraw cash at any overseas Mastercard-enabled ATM

Invest

Wealth on UOB TMRW

View and manage all your wealth holdings in one app. Set and track your goals and capture timely investment opportunities with insights based on your risk profile.

- Choose from four expertly curated fund portfolios on UOB TMRW based on your goals and risk appetite

- Or build your own portfolio from a curated list of over 100 unit trusts

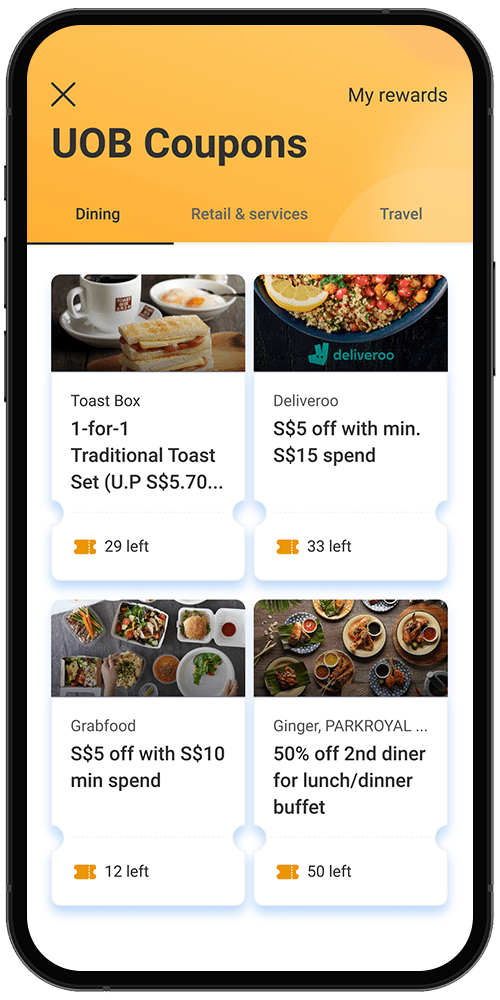

Grab and redeem coupons with UOB TMRW

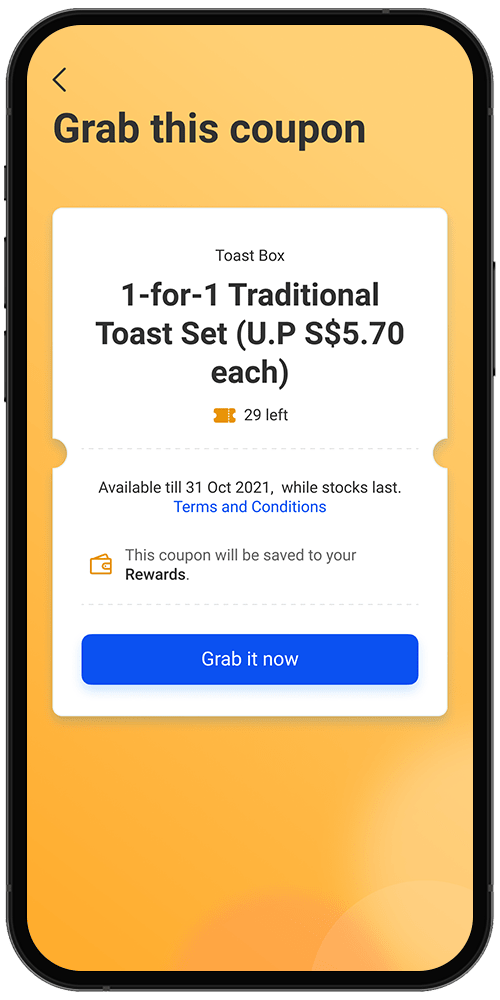

step 1

Browse coupons

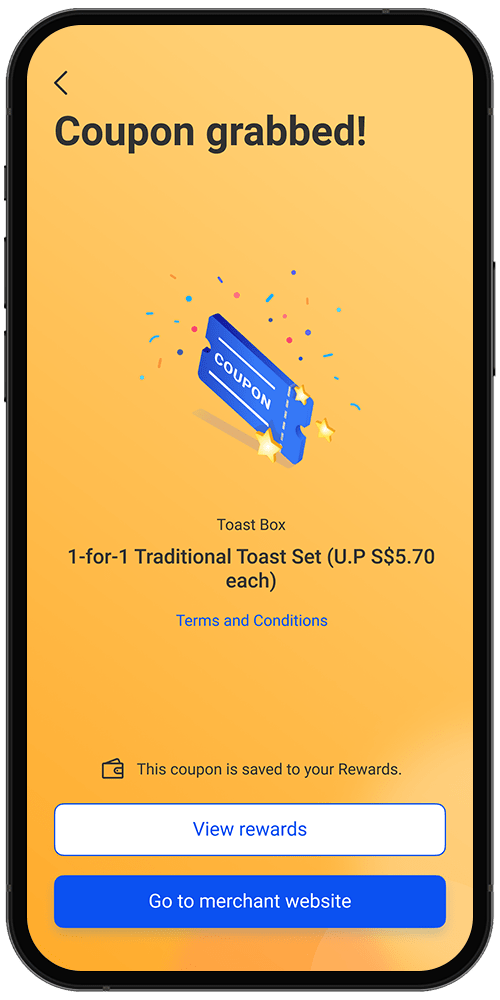

step 2

Grab coupon

step 3

Choose coupon action

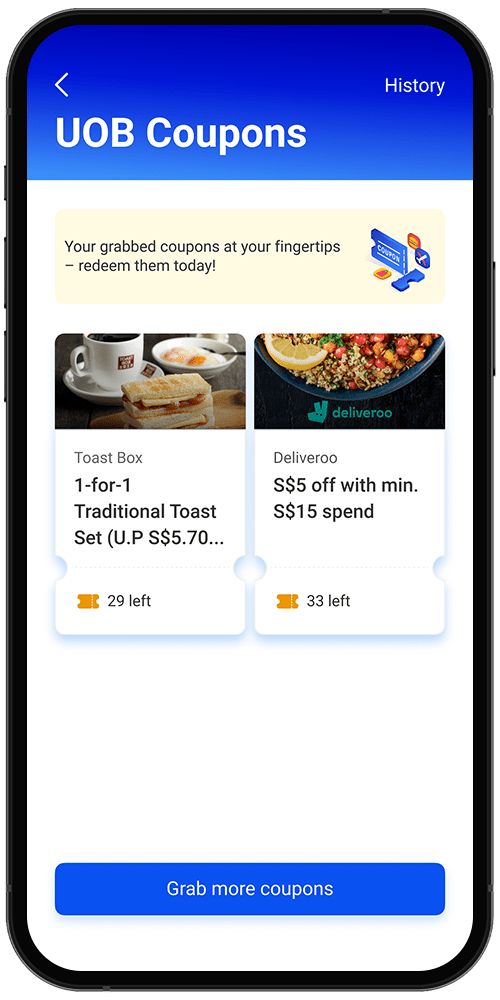

step 4

View grabbed coupons

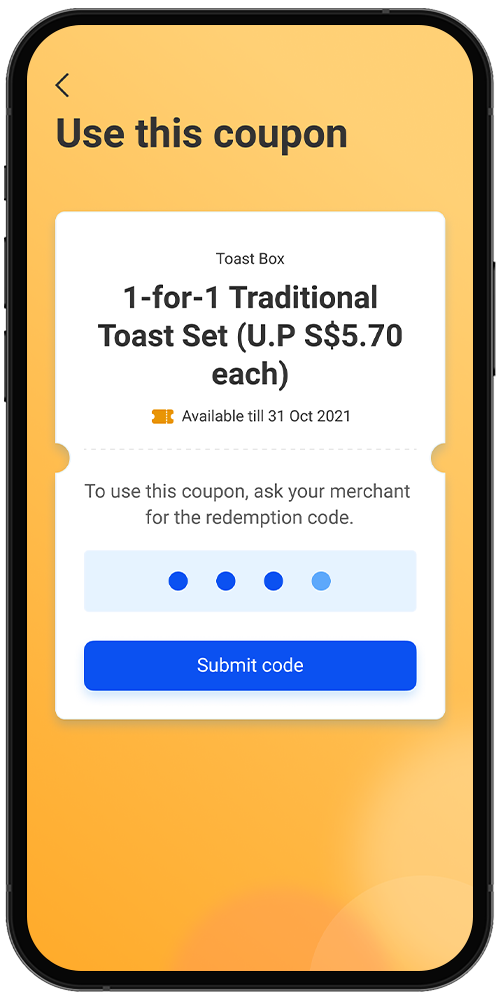

step 5

Redeem coupon

step 1

Browse coupons

Check out available coupons for redemption via Rewards+.

Deals you don't want to miss

Shop

Amazon

Shake it up with the Hangout@UOB community

Join us to get first dibs on exclusive UOB deals, stay updated on the latest Hangout@UOB event, and uncover financial hacks.

Hangout@UOB

Locations

Singapore Polytechnic

Unit FC512, Food Court 5, 500 Dover Road, Singapore 139651Operating Hours

Mon-Fri: 11am to 7pm

Closed on weekends & Public Holidays

Click here to check the MAP

Ngee Ann Polytechnic

Block 58, Level 2, 535 Clementi Road, Singapore 599489Operating Hours

Mon-Fri: 11am to 7pm

Closed on weekends & Public Holidays.

Click here to check the MAP

Exclusive for Singapore Polytechnic and Ngee Ann Polytechnic Students

Calling all students from Ngee Ann Polytechnic and Singapore Polytechnic, kickstart the new school term with exciting UOB activities held on campus!

With exciting giveaways lined up all semester long, stand to win attractive prizes worth up to $10,000 in total from each UOB Clawesome Machine!

What’s more, enjoy up to 10% cashback on your daily spend and selected food merchants on campus.

Promotion ends 30 June 2024. T&Cs apply.

Get inspired

The Dining Advisor

Short-circuit your search for good food with a comprehensive new food guide designed to feed your food obsessions.

The Travel Insider

The new travel portal that inspires, helps you plan and lets you book in one place.

Related life moments

Growing your money

We journey with you to protect and build your wealth, and make your money work harder, so you can focus on achieving your life goals.

Exploring the world

Whether you are making your first solo trip or you are a seasoned globe trotter, every trip starts out with a plan and that begins with us.

National Servicemen

Serving the nation is likely your first step into adulting. It's never too early to start planning your finances – get up to 10% cashback, fee waivers and more.

#YouDoYou

Do Zillennials know what they want in life? Are they a conflicted generation? And what even is a Zillennial?

Watch the full episodes on our Instagram, as we discuss Zillennial stereotypes around individuality, work and money!

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts/products that are covered under the Scheme.