Scam alert

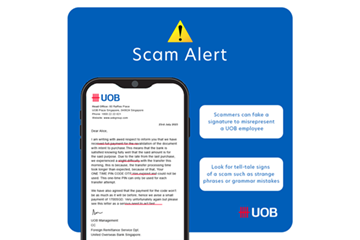

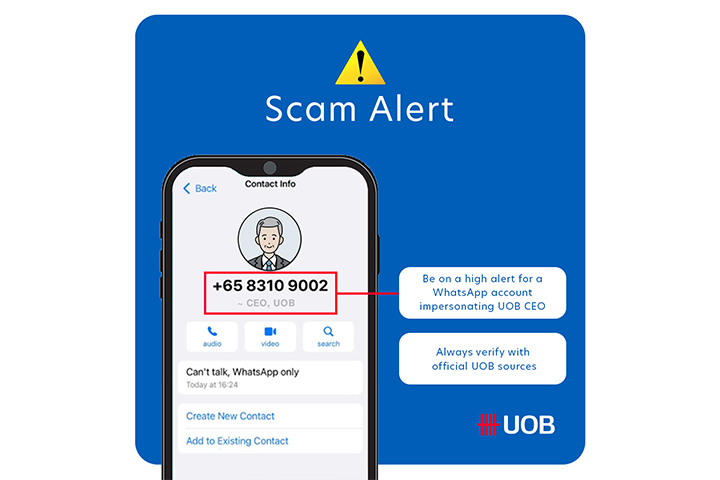

Be on high alert and look out for scammers who are impersonating UOB employees, and sending private messages to persuade victims to invest in fraudulent financial products.

Click here for details. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure. Subscribe to our UOB Facebook page for the latest update and advice on scams.

Security

Your online banking security remains our top priority, and we are committed to protecting you from phishing scams.

Latest alerts and announcements

Alert

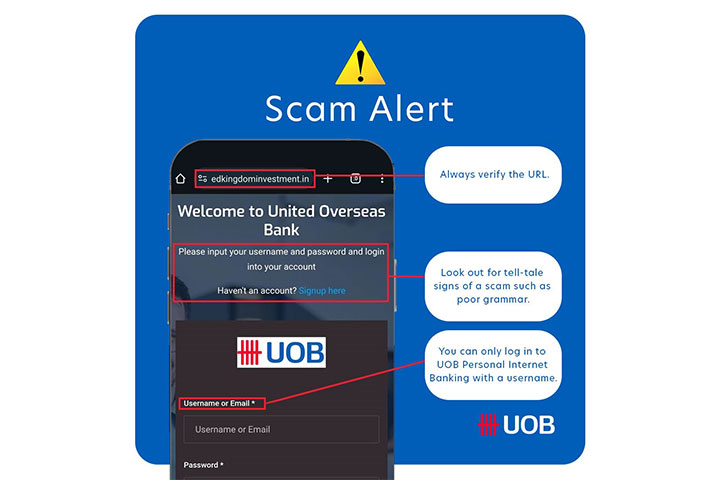

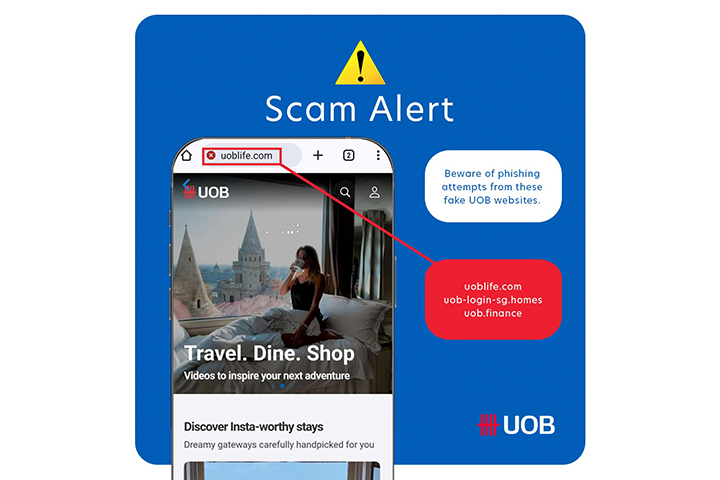

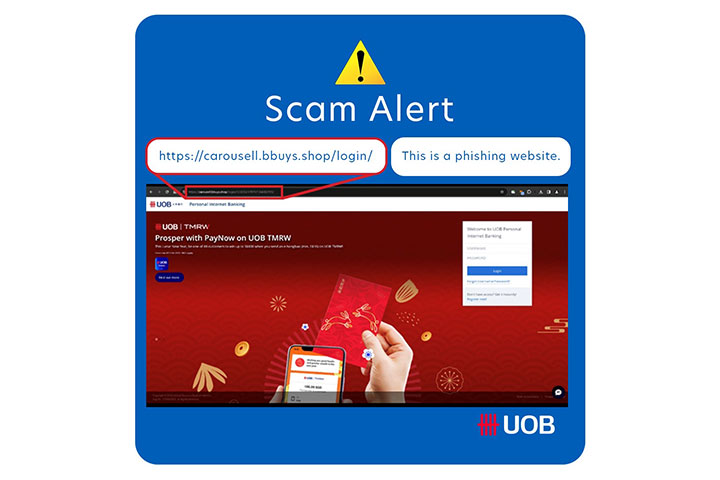

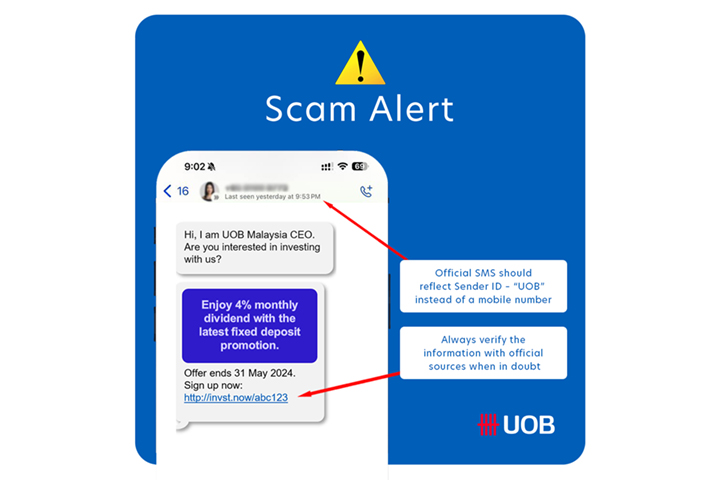

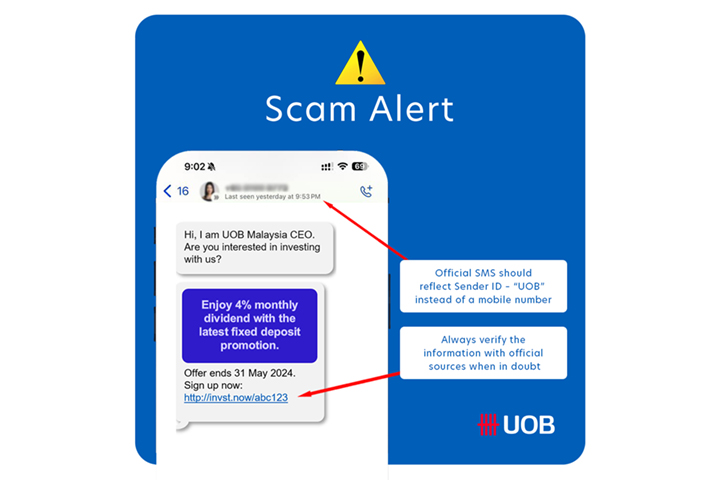

Is this a legitimate message from UOB?

Be on high alert and look out for scammers who are impersonating UOB employees, and sending private messages to persuade victims to invest in fraudulent financial products. If in doubt, always verify with official UOB sources such as our websites or branches.

Alert

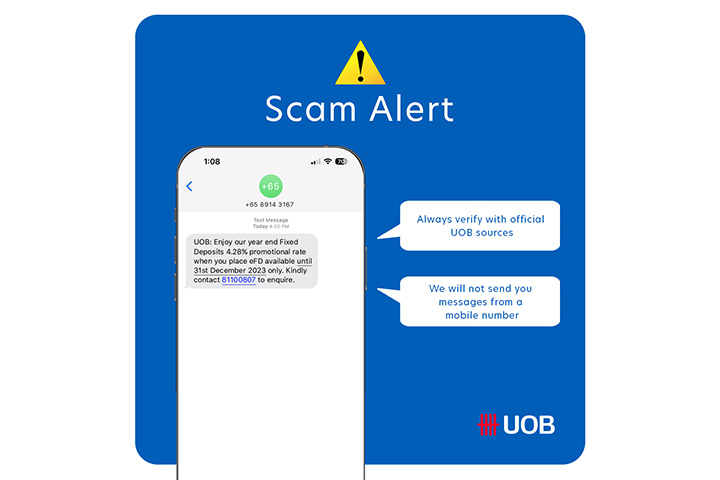

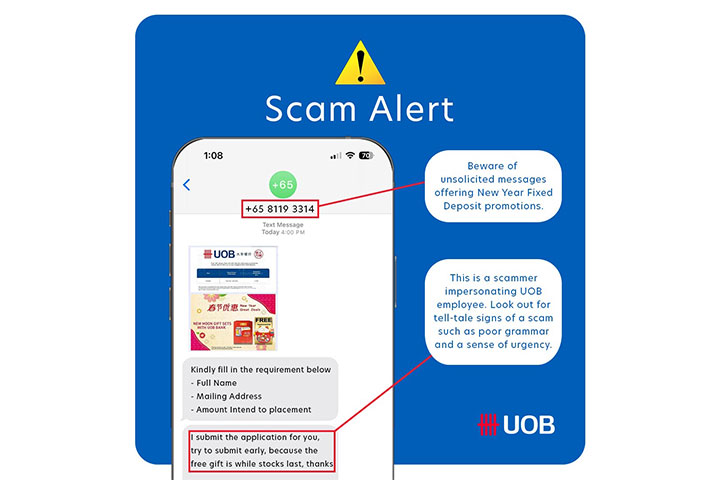

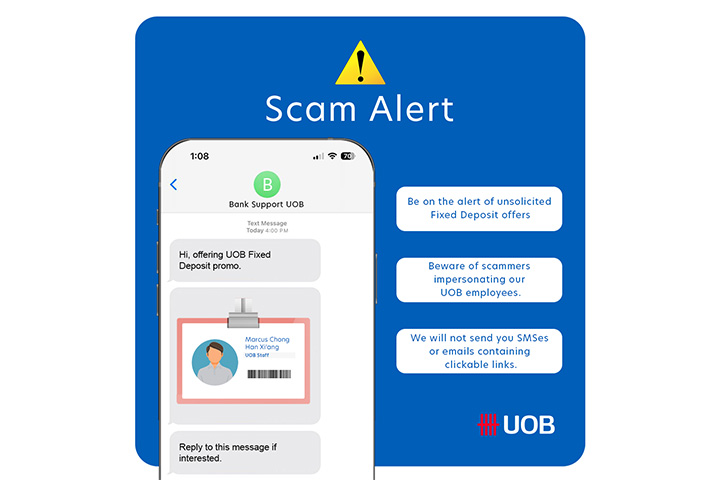

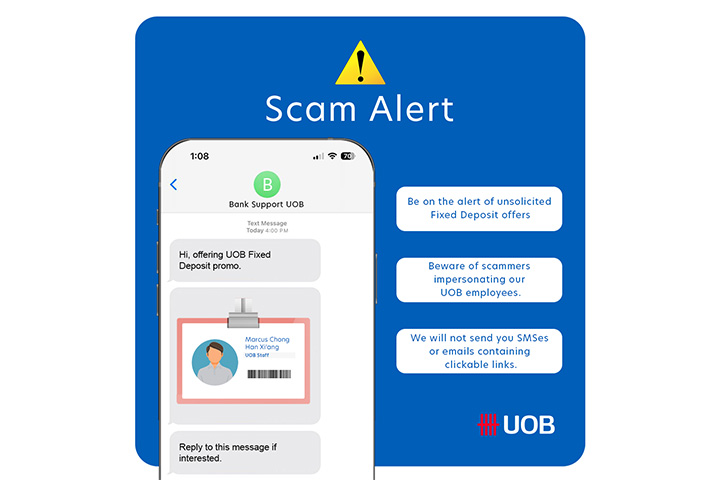

Is this an authentic fixed deposit promotion from UOB?

Be on the lookout for scammers offering fake fixed deposit promotions and sharing fake UOB name cards to impersonate themselves as a UOB employee. We will not send you promotional messages or request for your personal information from a mobile number. If in doubt, always verify with official UOB sources such as our websites or branches.

Announcement

Get extra protection for your money

Digital scams are on the rise. Give your savings an added layer of security with the all-new UOB LockAway AccountTM and transfer in money to keep it locked away from digital scams.

Add on the UOB LockAway Account today for greater peace of mind, for money you don’t need everyday access to. Any withdrawal of funds must be done in-person at any of our UOB branches in Singapore.![]()

Lock away any amount. No minimum, no maximum, no fall-below fees.

Insured up to S$100k by SDIC.

Announcement

Your payment and bank accounts are for your own use only.

- Do not disclose your payment accounts/credentials to anyone else.

- Do not let anyone else access, operate or control your payment accounts.

- Do not receive or transfer money for anyone else using your payment accounts, unless you know him/her and know where he/she is.

A person convicted of an offence under the CDSA may be liable for a fine of up to $250,000, imprisonment of up to five years, or both.

Alert

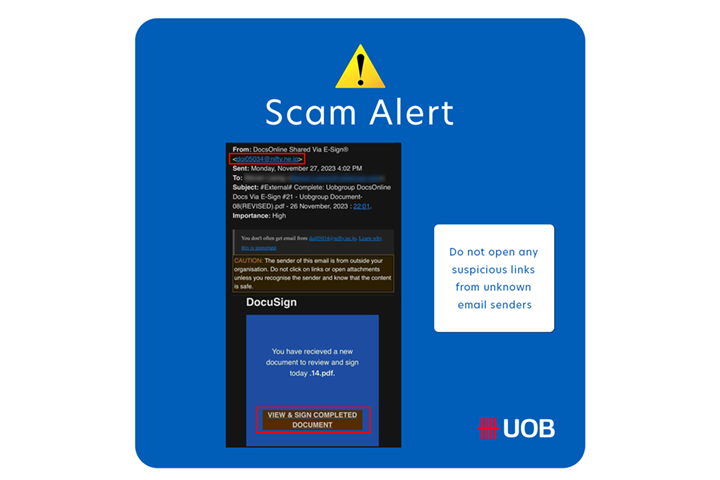

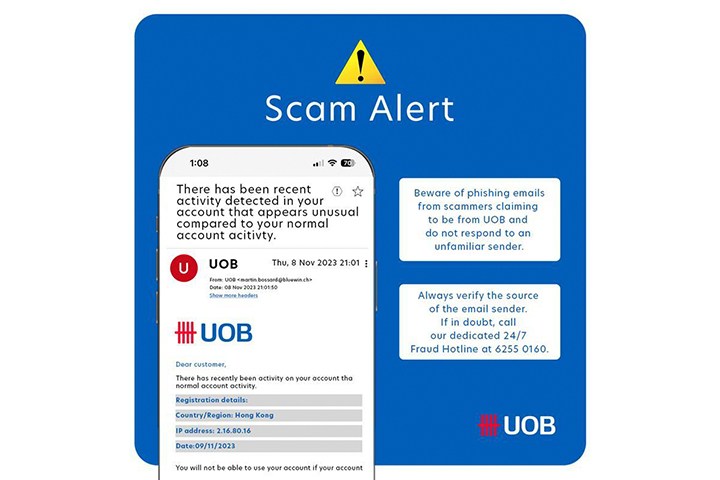

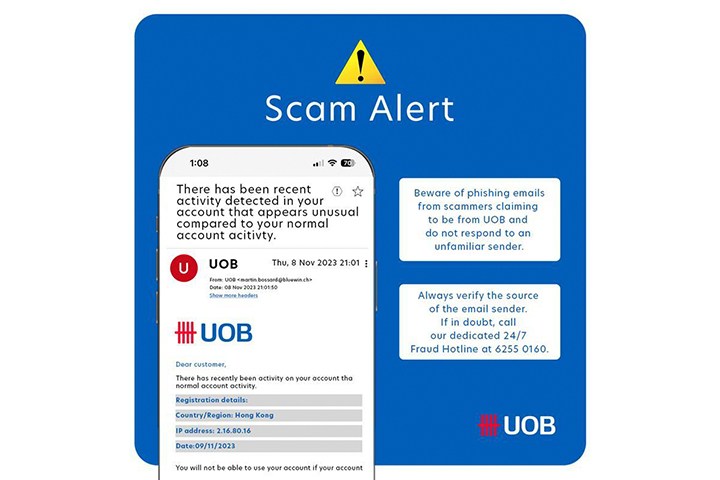

Received a suspicious email about unusual account activities from an suspicious email domain?

Verify the identity of the email sender by hovering over the sender’s name. The sender’s name may not match the email address. Be vigilant as scammers may be spoofing our UOB official email address to do so.

Announcement

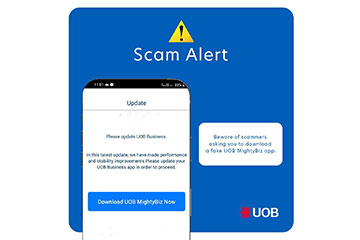

How UOB protects you against malware scams

Malware scams are on the rise. As part of our ongoing efforts to ensure a safe and secure banking experience for you, we will be progressively enhancing our existing anti-scam security features to protect you from malware scams. Read on to find out more.

Alert

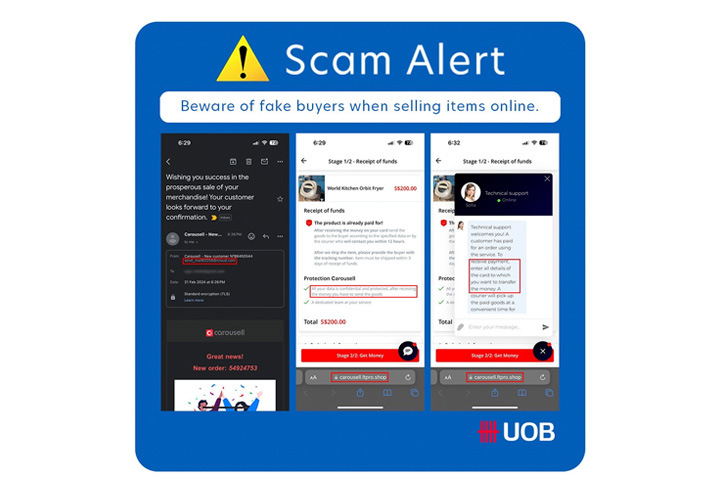

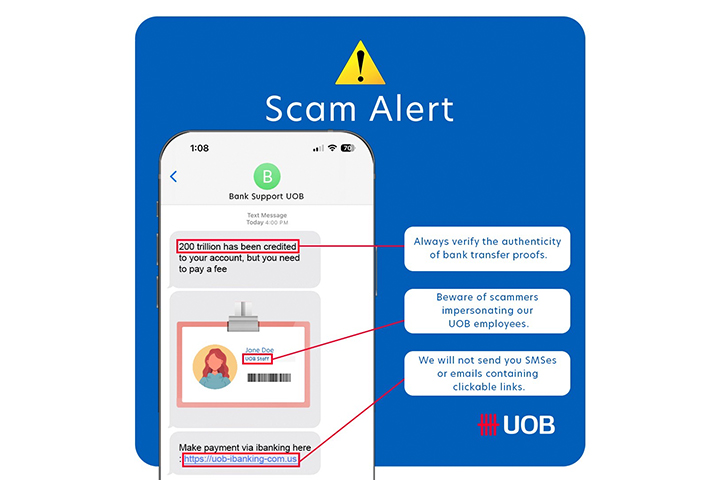

Received a screenshot of a PayNow receipt as “evidence” of a transaction?

PayNow transfers are immediate. Always verify the transaction through UOB Personal Internet Banking or UOB TMRW app. Scammers may forge a PayNow transfer receipt as proof of payment when there is no actual payment made, to deceive you into transferring your funds.

Alert

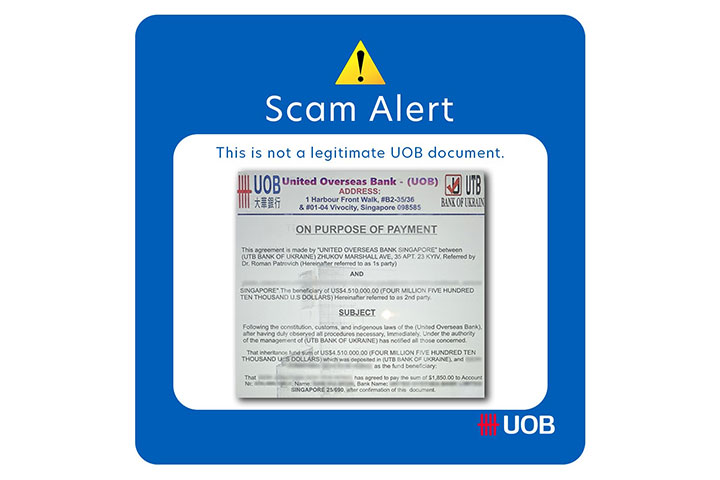

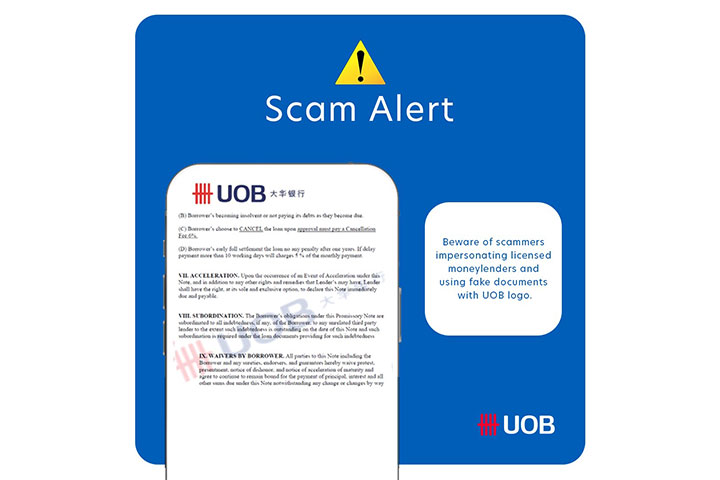

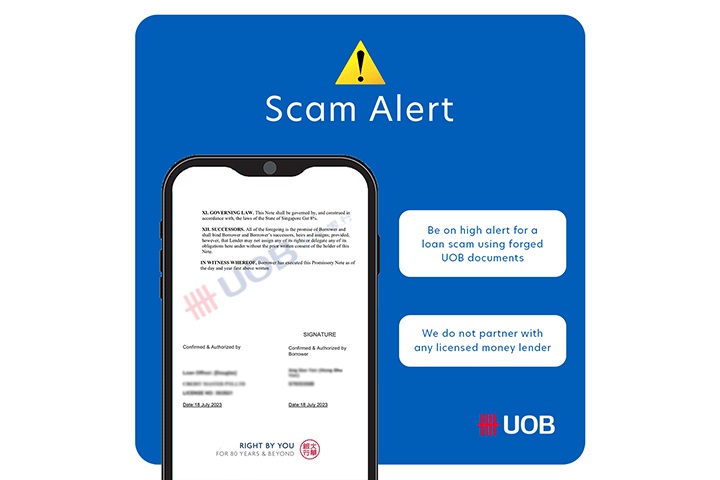

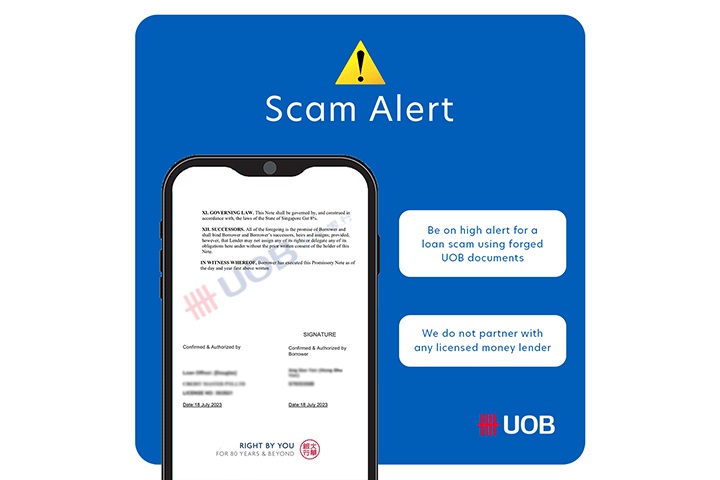

Is this a loans scam?

Watch out for scammers who impersonate licensed money lenders, with the use of documents purportedly issued by UOB, to deceive you into thinking you are signing a legitimate loan agreement. These fraudsters will also request you to make money transfers and claim that they are for “transaction fees” or “loan account activation” purposes.

Alert

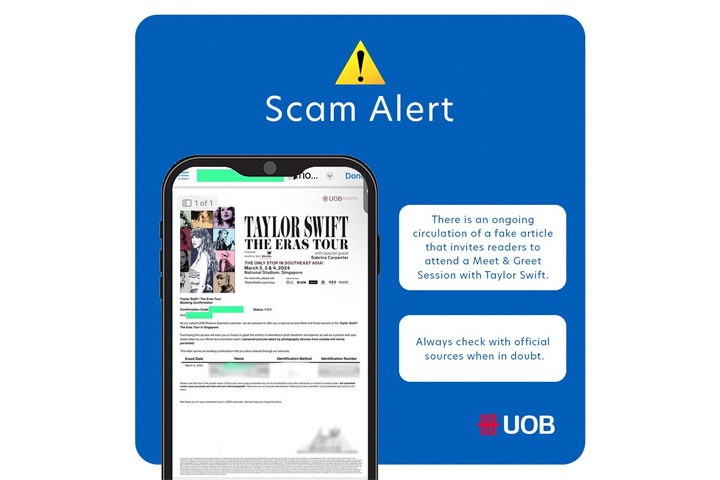

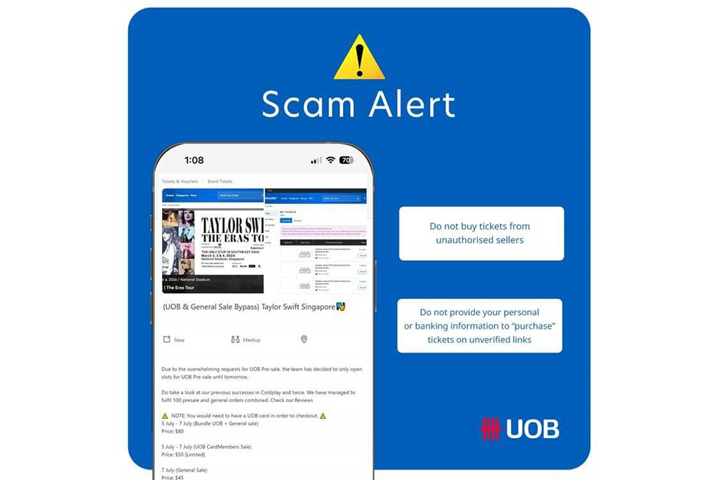

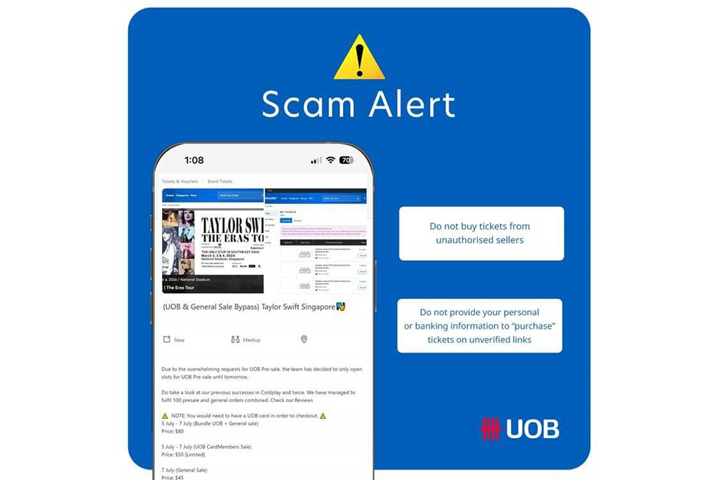

Are these tickets from an authorised seller?

Watch out for scammers who claim that they are selling UOB Presale or UOB Reserved Tickets On-Sale to the upcoming Taylor Swift | The Eras Tour in Singapore and will trick you into providing your personal or banking details to “purchase” them on unverified links. Purchase tickets only from Ticketmaster, the authorised seller.

Latest alerts and announcements

Alert

Is this a legitimate message from UOB?

Be on high alert and look out for scammers who are impersonating UOB employees, and sending private messages to persuade victims to invest in fraudulent financial products. If in doubt, always verify with official UOB sources such as our websites or branches.

Alert

Is this an authentic fixed deposit promotion from UOB?

Be on the lookout for scammers offering fake fixed deposit promotions and sharing fake UOB name cards to impersonate themselves as a UOB employee. We will not send you promotional messages or request for your personal information from a mobile number. If in doubt, always verify with official UOB sources such as our websites or branches.

Announcement

Get extra protection for your money

Digital scams are on the rise. Give your savings an added layer of security with the all-new UOB LockAway AccountTM and transfer in money to keep it locked away from digital scams.

Add on the UOB LockAway Account today for greater peace of mind, for money you don’t need everyday access to. Any withdrawal of funds must be done in-person at any of our UOB branches in Singapore.![]()

Lock away any amount. No minimum, no maximum, no fall-below fees.

Insured up to S$100k by SDIC.

Announcement

Your payment and bank accounts are for your own use only.

- Do not disclose your payment accounts/credentials to anyone else.

- Do not let anyone else access, operate or control your payment accounts.

- Do not receive or transfer money for anyone else using your payment accounts, unless you know him/her and know where he/she is.

A person convicted of an offence under the CDSA may be liable for a fine of up to $250,000, imprisonment of up to five years, or both.

Alert

Received a suspicious email about unusual account activities from an suspicious email domain?

Verify the identity of the email sender by hovering over the sender’s name. The sender’s name may not match the email address. Be vigilant as scammers may be spoofing our UOB official email address to do so.

Announcement

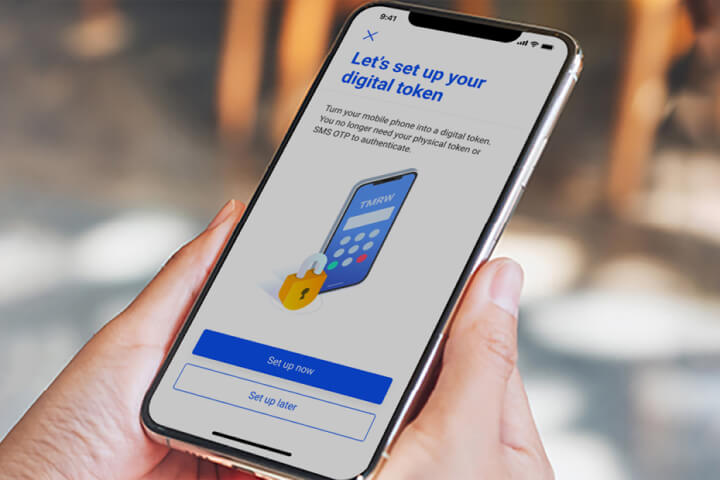

How UOB protects you against malware scams

Malware scams are on the rise. As part of our ongoing efforts to ensure a safe and secure banking experience for you, we will be progressively enhancing our existing anti-scam security features to protect you from malware scams. Read on to find out more.

Alert

Received a screenshot of a PayNow receipt as “evidence” of a transaction?

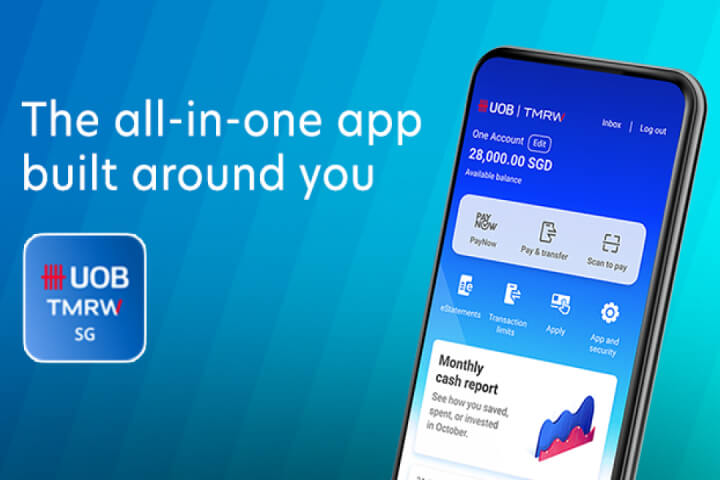

PayNow transfers are immediate. Always verify the transaction through UOB Personal Internet Banking or UOB TMRW app. Scammers may forge a PayNow transfer receipt as proof of payment when there is no actual payment made, to deceive you into transferring your funds.

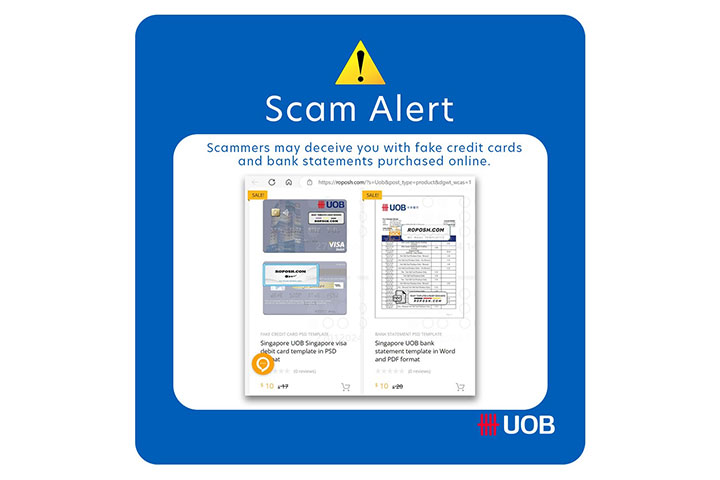

Alert

Is this a loans scam?

Watch out for scammers who impersonate licensed money lenders, with the use of documents purportedly issued by UOB, to deceive you into thinking you are signing a legitimate loan agreement. These fraudsters will also request you to make money transfers and claim that they are for “transaction fees” or “loan account activation” purposes.

Alert

Are these tickets from an authorised seller?

Watch out for scammers who claim that they are selling UOB Presale or UOB Reserved Tickets On-Sale to the upcoming Taylor Swift | The Eras Tour in Singapore and will trick you into providing your personal or banking details to “purchase” them on unverified links. Purchase tickets only from Ticketmaster, the authorised seller.

Funds from the UOB LockAway Account can only be withdrawn in person and not by any other means, including but not limited to online transactions, Personal Internet Banking, Mobile Services, cheque, ATM withdrawals and debit instructions given through the Call Centre Service. For the avoidance of doubt, debit instructions will only be accepted for the UOB LockAway Account if you provide the debit instruction in person at any of our branches in Singapore. Watch this space for more information and refer to our FAQs

Digital banking made safe

How UOB protects you

Enjoy full convenience and peace of mind when you bank online with our multi-layered security programme. Learn more about how we keep your transactions safe.

How you can protect yourself

Stay safe with extra measures that you can do simply from anywhere - at home, at work, from your phone.

Self-service "Kill Switch" feature

Disable your digital access instantly with our self-service “kill switch” feature, if you suspect that your account has been compromised.

3 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › press 2

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) › press 1 (to report a case) › press 2 (to activate Kill Switch)

- Make a report at our nearest UOB branch

Once the digital access is disabled, you will receive a SMS notification and any active login session will be logged out. Upon activating our self-service "kill switch" feature, our UOB Customer Service Officer will contact you within 24 hours to assist with your compromised bank account/cards.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.

Things you should know

Frequently asked questions

Click here to read more.

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.