Tap on insights and research from UOB Private Bank Chief Investment Office

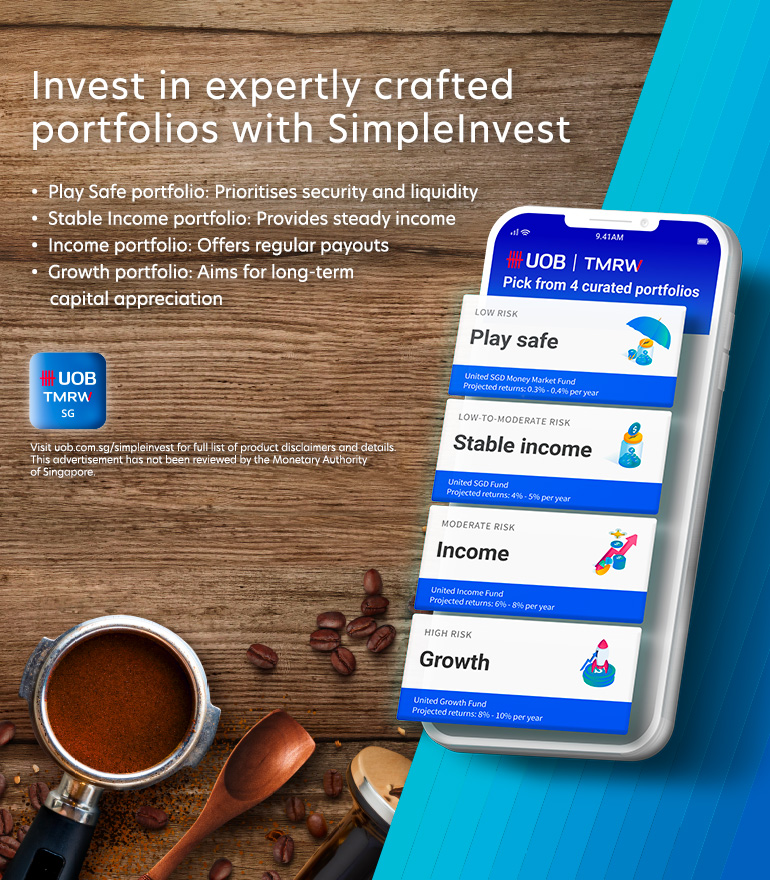

- United Income Fund: Receive regular income from equities and bonds

- United Growth Fund: Capital growth from equities and downside protection with fixed income

Inspire the globetrotter in you with the first one-stop travel portal in Southeast Asia designed by a bank that inspires, helps you plan, and lets you book in one place.

Find out more

Get up to 7.8% p.a. interest in just two steps. Apply for One Account and get up to S$210 cash! T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Get instant cash at 0% interest and low processing fees. Enjoy 0.5% unlimited cash rebate on your approved loan amount.

Find out more

View and manage your portfolio in one place. Invest, insure, and convert FX easily with just a few taps.

Learn more

Get PRUCancer 360 from just S$3.70 per week. Sign up now and enjoy 35% off your first-year premium. T&Cs apply.

Find out more

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

you are in Personal Banking

We understand your needs, long term financial goals and risk appetite. That is why you can rely on our vast range of products and strong market insights to help you achieve a balanced portfolio.

We understand your needs, long term financial goals and risk appetite. That is why you can rely on our vast range of products and strong market insights to help you achieve a balanced portfolio.

Stay up to date with market developments, macroeconomic news and investment trends that matter to your portfolio.

Find out how we help you achieve your wealth goals with our unique approach that puts you first.

Tap on insights and research from UOB Private Bank Chief Investment Office

View and manage all your wealth holdings in one app. Set and track your goals and capture timely investment opportunities with insights based on your risk profile.

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.