Define your rewards for an unstoppable you

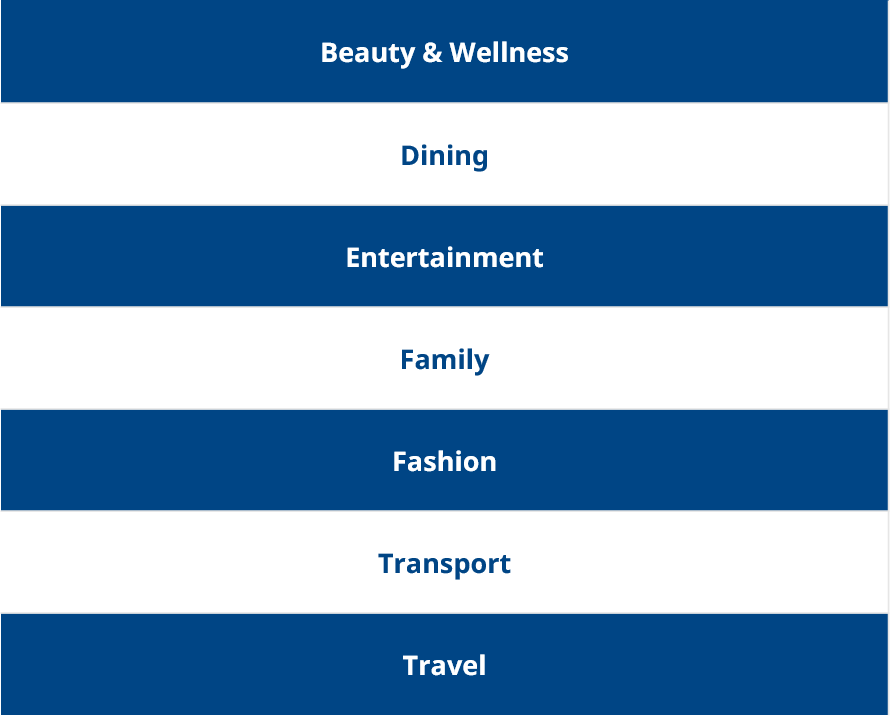

With UOB Lady’s Card, you are free to make the choices that matter. Choose the rewards category(ies) that earns you the most – whether your passion is Fashion, Dining, Travel, Beauty and Wellness, Family, Transport or Entertainment. And feel free to change it every quarter, as your lifestyle and interests evolve – because it’s time to live the life you want.

Choose your preferred rewards category(ies) and earn up to 25X UNI$ (10 miles per S$1)1

Here’s how:

Spend on UOB Lady’s Credit Card

Earn 10X UNI$ for every S$5 spent (equiv. to 4 miles per S$1) on your preferred rewards category(ies)

+

Save with UOB Lady’s Savings Account

Earn up to additional 15X Lady’s Savings Bonus UNI$ for every S$5 spent (equiv. to 6 miles per S$1) on your preferred rewards category(ies)

Here’s how your UNI$ add up

The total Bonus UNI$ earned is based on your UOB Lady’s Savings Account Monthly Average Balance (MAB)  in each calendar month. The more you save, the more UNI$ earned!

in each calendar month. The more you save, the more UNI$ earned!

| When you spend on your Preferred Rewards Category(ies) with your Lady’s Credit Card with no min. spend | When you save with Lady’s Savings Account and spend on your Preferred Rewards Category(ies) with your Lady’s Credit Card | Total UNI$ earned for every S$5 spend in a calendar month | |

| Lady’s Savings Account Monthly Average Balance (MAB) | Lady’s Savings Bonus UNI$ earned [for every S$5 spend] |

||

| Base + Bonus UNI$: 10X UNI$ For every S$5 spend |

< S$10,000 | - | 10X UNI$ (4 miles per S$1) |

| S$10,000 to S$49,999 | 5X UNI$ | 15X UNI$ (6 miles per S$1) |

|

| S$50,000 to S$99,999 | 10X UNI$ | 20X UNI$ (8 miles per S$1) |

|

| S$100,000 & above | 15X UNI$ | 25X UNI$ (10 miIes per S$1) |

|

Illustration:

Jasmine spends S$1,000 on her preferred rewards category with her UOB Lady's Credit Card and maintains S$50,000 MAB in her UOB Lady's Savings Account in a calendar month.

She'll be able to accumulate 4,000 UNI$![]() in a month. Here’s the breakdown:

in a month. Here’s the breakdown:

Base UNI$: S$1,000 / every S$5 spent x 1X UNI$ = 200 UNI$

Bonus UNI$: S$1,000 / every S$5 spent x 9X UNI$ = 1,800 UNI$

Lady’s Savings Bonus UNI$: S$1,000 / every S$5 spent x 10X UNI$ = 2,000 UNI$

If she maintains the MAB and spending for 12 months, she'll be able to earn 48,000 UNI$ in a year!

She can choose to convert the UNI$ into 96,000 KrisFlyer miles![]() .

.

With this, she could redeem a round-trip Business Class ticket to Shanghai, or a round-trip Economy Class ticket to Paris![]() within a year!

within a year!

Alternatively, she can also choose to redeem her UNI$ for rewards across the wide selection of dine, shop and travel merchants on Rewards+.

Lady’s Card and Lady’s Savings Account Calculator

Details

| Lady's Card Bonus 9X UNI$ on preferred rewards category | 1,800 |

| Lady's Card Base 1X UNI$ on other purchases | 240 |

| Lady's Savings Bonus up to 15X UNI$ on preferred rewards category | 1,000 |

| Total UNI$ earned monthly | 3,040 |

Details

| Lady's Card Bonus 9X UNI$ on preferred rewards categories | 1,800 |

| Lady's Card Base 1X UNI$ on other purchases | 240 |

| Lady's Savings Bonus up to 15X UNI$ on preferred rewards categories | 1,000 |

| Total UNI$ earned monthly | 3,040 |

How To Choose Your Rewards Category(ies):

Step 1:

Login to uob.com.sg/ladys-enrol

Note:

- If you have already selected your preferred categories, and wish to subsequently change your preferred categories, any change will only take effect from the next calendar quarter. For e.g. If you are enrolled in ‘Fashion’ category for Quarter 2 (April, May, June) and subsequently want to change to ‘Dining’ category on 15 May, your ‘Dining’ category will take effect from Quarter 3 (July, August, September).

- Lady’s Card Cardmembers may choose one (1) preferred rewards category only; Lady’s Solitaire Cardmembers may choose up to two (2) preferred rewards categories.

- For existing UOB Lady’s Card Cardholders who have applied for a Lady’s Solitaire Card, your existing UOB Lady's Card, will be automatically upgraded upon approval of your application. You may select two (2) preferred rewards categories to take effect in the next calendar quarter. T&Cs apply.

Pair your UOB Lady’s Credit Card with the UOB Lady’s Savings Account

UOB Lady’s Credit Card + Lady’s Savings Account

Unlock up to 25X UNI$ per S$5 spend (10 miles per S$1)

Rewards

Earn up to 25X UNI$ per S$5 spend (equivalent to 10 miles per S$1) on your preferred rewards category(ies) when you save with UOB Lady’s Savings Account and spend on your UOB Lady’s Credit CardNEW!

Protect

Get free coverage of up to S$200,000 for 6 female cancers from the first dollar you save. No medical assessment required.

Dental privileges

Enjoy specially curated dental treatments.

UOB Lady’s Savings Account: Receive a Jo Malone Cologne 30ml (worth S$120)

From now till 30 April 2024, be the first 150 new-to-UOB deposits customers to apply for UOB Lady’s Saving Account online and deposit at least S$10,000 new funds to receive a Jo Malone Cologne 30ml.

Terms and conditions apply.

Things you should know

UOB Lady’s Card eligibility and fees

Eligibility

Age: 21 years and above

Singaporean/PR:

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000#

For Foreigners:

- Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000#

Documents required: Click here

Annual fees:

-

With effect from 1 January 2024:

- Principal card: S$196.20^ yearly

- First year card fee waiver

Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady's Card.

Supplementary card

- FREE for first card

- S$98.10^ for subsequent card

Terms and conditions:

^Inclusive of Singapore's prevailing Goods and Services Tax (GST).

#Terms and conditions apply. Please visit UOB Branches for more information on secured card applications. Supporting documents (NRIC or passport) will be required.

Note: By applying for a UOB Lady's Card, your existing Lady's Solitaire Card, if any, will be automatically downgraded upon approval of your application. T&Cs apply.

UOB Lady’s Solitaire Card eligibility and fees

Eligibility:

Age: 21 years and aboveSingaporean/PR/Foreigners:

- Minimum annual income of S$120,000 is required OR

- Fixed Deposit collateral of at least S$30,000#.

Documents required: Click here.

Annual fees:

-

With effect from 1 January 2024:

- Principal card: S$414.20^ yearly

- First year card fee waiver

Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady's Card.

Supplementary card

- FREE for first 2 cards

- S$196.20^ for subsequent card

Terms and conditions:

^Inclusive of Singapore's prevailing Goods and Services Tax (GST).

#Terms and conditions apply. Please visit UOB Branches for more information on secured card applications. Supporting documents (NRIC or passport) will be required.

Note: By applying for a Lady's Solitaire Card, your existing UOB Lady's Card, if any, will be automatically upgraded upon approval of your application. T&Cs apply.

For existing UOB Cardmembers, kindly ensure that your annual income as per the bank’s record has been updated to S$120k p.a. and above before proceeding with your application. If you have not done so, please click here to update your income.

UOB Lady’s Debit Card eligibility and fees

Eligibility:

- Female only

- Age: 16 years and above

Age: 16 years and above

Singaporean/PR/ Foreigners:

- Hold a UOB Savings or Current account

- No minimum income requirement

For existing UOB Lady's Debit Cardmembers, you can adjust your Debit Card Mastercard spending limit. If you wish to adjust, click here to find out more.

View full UOB Lady's Debit Card Terms and conditions here.

Annual fees:

- With effect from 1 January 2024: S$18.34* yearly (First 3 years card fee waiver^)

- Thereafter, annual fee waiver with at least 12 Mastercard transactions per year.

*Inclusive of Singapore's prevailing Goods and Services Tax (GST).

^First 3 years card fee waiver shall not apply to applicants who have cancelled and reapplied for the same UOB Lady's Debit Card.

Apply & Pay within minutes

Applying for your credit card is now faster, simpler and more secure when you apply via UOB Personal Internet Banking or Singpass (MyInfo) - no more endless fields to fill in and documents to upload. Complete your application journey within minutes!

What’s more, you can digitize your card to enjoy convenience of mobile contactless payment when you receive your card!

Click here to find out more common FAQs about your credit card

Click here to find out more about digital banking solutions

Terms and conditions

W.e.f 1 January 2024, the UOB Lady’s Card, UOB Lady’s Solitaire Card and UOB Lady’s Debit Card annual fee will be adjusted to S$196.20, S$414.20 and S$18.34 respectively (inclusive of 9% GST).

W.e.f. 1 August 2022, payments to IPAYMY, RWS-LEVY, SMOOVE PAY, SINGPOST – SAM, and Razer Pay and payments for utilities will be excluded from the awarding of UNI$.

UOB Lady’s Card Terms and Conditions

1Earn up to 25X UNI$ for every S$5 spent (equivalent to 10 miles per S$1) on your preferred rewards category(ies):

1) Earn 10X UNI$ on your UOB Lady’s Credit Card:

No minimum spend required. Register via uob.com.sg/ladys-enrol and select up to 2 preferred rewards category(ies) for which you will earn 10X UNI$ per S$5 spent in each calendar month. This comprises a base earn rate of UNI$1 for every S$5 spent and a bonus earn rate of 9X UNI$ for every S$5 spent (“Bonus UNI$”) on your selected preferred rewards category(ies). The maximum aggregate amount of Bonus UNI$ you can earn in a calendar month is capped at (a) 1,800 UNI$ which is equivalent to S$1,000 spent, if you are a UOB Lady’s Classic Card, UOB Lady’s Platinum Card or UOB Lady’s World Mastercard Cardmember; or (b) 3,600 UNI$ which is equivalent to S$2,000 spent if you are a UOB Lady’s Solitaire Card or UOB Lady’s Solitaire Metal Card Cardmember#. UNI$ can be converted into air miles at the conversion rate of UNI$1 = 2 miles^. Full Terms and Conditions apply, click here.

2) Earn up to additional 15X UNI$ when you save with UOB Lady’s Savings Account::

You shall be eligible to earn the Lady’s Savings Bonus UNI$ in a calendar month from 1 April 2024 to 31 March 2025 (“Promotion Period”) in accordance with the Monthly Average Balance (“MAB”) in your UOB Lady’s Savings Account if you (1) are a principal UOB Lady’s Credit Cardholder and a primary UOB Lady’s Savings Accountholder, (2) maintain a minimum MAB of S$10,000 in your UOB Lady’s Savings Account in a calendar month during the Promotion Period and (3) selected your Preferred Rewards Category(ies). The Lady’s Savings Bonus UNI$ you can earn in a calendar month is capped at (a) S$1,000 spent on your preferred category if you are a UOB Lady’s Classic Card, UOB Lady’s Platinum Card or UOB Lady’s World Mastercard Cardmember; or (b) S$2,000 spent on your preferred categories if you are a UOB Lady’s Solitaire Card or UOB Lady’s Solitaire Metal Card Cardmember. Full Terms and Conditions apply, click here.

#Note: With effect from 1 April 2024, the maximum aggregated amount of Bonus UNI$ you can earn in a calendar month is capped at 3,600 UNI$ (which is equivalent to S$2,000 spent) if you are a UOB Lady’s Solitaire Card or UOB Lady’s Solitaire Metal Card Cardmember.

^Please refer to UOB Rewards Programme Terms and Conditions here.

If you have already selected your preferred rewards category(ies), and wish to subsequently change your rewards category(ies), any change will only take effect from the next quarter and the bank will take the last entry of categories for the new quarter Bonus UNI$ awarding. If you have not selected your preferred rewards category(ies), your selection will only take effect as of date of enrolment.

*Enjoy an exquisite dining experience for two at Michelin-starred restaurants & receive a Jo Malone Cologne when you apply now!

UOB Lady’s Credit Card: Enjoy an exquisite dining experience for two at Michelin-starred restaurants (worth over S$900):

Be the first 150 new-to-UOB credit card customers per calendar month who successfully apply for an eligible UOB Lady’s Credit Card from 1 April 2024 to 30 June 2024 (both dates inclusive) and spend a min. of S$1,500 per month for 2 consecutive months from your card approval date. Click here for full terms and conditions.

And

UOB Savings Account Promotion: Get a Jo Malone Cologne 30ml and Up to S$130 cash credit:

Jo Malone Cologne 30ml:

Promotion is only valid from 1 to 30 April 2024 (“Promotion Period”). Jo Malone Cologne 30ml is only for the first 150 New-to-UOB deposit customers during the Promotion Period (i) who submit an online account opening application during the Promotion Period for a new UOB Lady’s Savings Account, (ii) whose application is successfully approved by 30 April 2024, and (iii) who deposit at least S$10,000 into their new UOB Lady’s Savings Account by 30 April 2024 and hold the deposited funds till 31 May 2024 (inclusive of the date indicated). Jo Malone Cologne 30ml is available in 3 different scents, namely Red Roses, English Pear & Freesia or Peony & Blush Suede scents. Click here for full terms and conditions.

And

Up to S$130 cash credit for customers who participate in the UOB SalaryPlus Promotion (1 April 2024 to 30 June 2024) by successfully submitting an online participation form at UOB Singapore website and completing any or all of the following actions:

1) S$30 cash credit for customers who successfully perform a bill payment of min. S$30 per transaction from their designated Eligible UOB savings account in this Promotion via GIRO, or/and who successfully perform a loan repayment transaction for their UOB car loan or UOB home loan from their designated Eligible UOB savings account for this Promotion, in each case, within the next two calendar months from the date of submission of the online participation form.

2) S$50 cash credit for customers who successfully credit their monthly salary of min. S$1,600 (for all customers other than full time National Serviceman) or at least S$500 (for customers who are full time National Serviceman) into their designated Eligible UOB savings account for this Promotion via GIRO or PayNow within the next two calendar months from the date of submission of the online participation form.

3) S$50 cash credit for customers who successfully credit their CDP dividends of min. S$50 per transaction into their designated Eligible UOB savings account for this Promotion via Direct Credit Service within the next two calendar months from the date of submission of the online participation form.

4) Eligible UOB savings account: UOB Passbook Savings Account, UOB Uniplus Account, UOB Stash Account, UOB One Account, UOB Lady’s Savings Account or KrisFlyer UOB Account. Full terms and conditions apply and can be accessed here.

Insured up to S$100k by SDIC.

**For full terms and conditions governing the UOB Debit Card 10% Cashback promotion, please click here.

Debit Card Campaign Terms and Conditions

Terms and Conditions governing the UOB Debit Card S$20 GrabFood Voucher Promotion, please click here.

Deposit Insurance Scheme:

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

For existing UOB Principal Credit Cardholders

Alternatively, if you are already a Principal UOB Credit Card holder, you can send an SMS application to 77672:

- Lady’s Card Products

- SMS

| Lady’s Card Products | SMS |

| UOB Lady’s Card | ‹Yeslady›space‹Last 4 digits of existing UOB Card›space‹NRIC#› |

| UOB Lady’s Solitaire Card | ‹YesSolitaire›space‹Last 4 digits of existing UOB Card›space‹NRIC#› |

The limited edition UOB Lady's Solitaire Metal Card, featuring a radiant red rose.

The ultimate definition of luxe and splendour with confidence. By exclusive invitation only.

UOB Lady’s Card + UOB One Account

Earn higher interest on your savings with One Account – up to 7.8% p.a. in just two steps

Skip to the good part with UOB One Account. Get up to 7.8% p.a. interest when you spend min. S$500 monthly on your UOB Lady’s Card AND credit your salary OR make 3 GIRO transactions monthly.![]()

Promotion

Enjoy more privileges when you pair the UOB One Account with UOB Lady's Card. Visit go.uob.com/online-exclusive for the latest sign-up offer!

With effect from 1 May 2024, please be informed that the interest rates for One Account will be revised. Find out more.

Frequently asked questions

1. What are the Preferred Rewards Categories available for selection?

2. Where can I choose my Preferred Rewards Category(ies)?

You may visit uob.com.sg/ladys-enrol to select your preferred rewards category(ies).

For more assistance, you can also reach our Call Centre at 1800 222 2121 (Local) and 6222 2121 (overseas).

3. When can I choose/change upcoming quarter’s Preferred Rewards Category(ies)?

You may choose or change your preferred rewards category(ies) anytime within current quarter. It has to be made by 2359 hours (Singapore time) before the first calendar date of the following calendar quarter.

Please refer to the calendar quarters here:

| Quarter | Month |

| Quarter 1 | January, February, March |

| Quarter 2 | April, May, June |

| Quarter 3 | July, August, September |

| Quarter 4 | October, November, December |

4. Can I change my Preferred Rewards Category(ies) after I’ve selected them?

Yes. If you have already chosen your preferred categories, and wish to subsequently change your preferred categories, you may visit uob.com.sg/ladys-enrol to update your preferred rewards category(ies). Please be informed that any change will only take effect from the next calendar quarter. Bonus UNI$ and Additional Bonus UNI$ will be awarded based on the preferred categories chosen for that quarter. If you have chosen your preferred categories multiple times, the bank will take the last entry of your chosen preferred categories to take effect the next calendar quarter.

If you have not chosen your preferred categories, your first choice will take effect as of date of choice.

First entry: Takes effect as of date of category chosen

Subsequent entries: Takes effect the next calendar quarter and the bank will take the last entry of category(ies) for the new quarter

5. Do I need to choose my Preferred Rewards Category(ies) every quarter?

No, you do not need to choose your preferred rewards category(ies) every quarter if you have already registered your selection before. However, if no selection is made, the previous quarter’s selection will remain.

Please refer to the calendar quarters here:

| Quarter | Month |

| Quarter 1 | January, February, March |

| Quarter 2 | April, May, June |

| Quarter 3 | July, August, September |

| Quarter 4 | October, November, December |

6. I’ve chosen my category(ies) for the next quarter, can I change them again?

Yes, as long as you have chosen before the start of the next new calendar quarter. The bank will take the last entry chosen before the start of the new quarter to determine that preferred category(ies) choice of the new quarter.

For illustration purpose only, for UOB Lady’s Classic/ Platinum/ World Mastercard Cardmembers:

15 April: Selected “Fashion” category.

21 June: Selected “Dining” category.

➔ Category for Quarter July – Sept will be effected as “Dining” as UOB Lady’s Classic/ Platinum/ World Mastercard Cardmembers may choose one (1) preferred rewards category only.

For illustration purpose only, for UOB Lady’s Solitaire Cardmembers:

15 April: Chose “Fashion” and “Dining” categories.

21 June: Chose “Travel” and “Entertainment” categories.

➔ Categories for Quarter July – Sept will be effected as “Travel” and “Entertainment” as UOB Lady’s Solitaire Cardmembers may choose up to two (2) preferred rewards categories.

7. Can a Lady’s Solitaire Cardmember choose just one category instead of two?

Yes. The maximum spend cap of S$2,000 is shared among the two preferred rewards category(ies) of your choice.

If you would prefer to choose only one preferred rewards category, it means you will only be able to earn the Bonus UNI$ for that category. However, you will still continue to earn a base of UNI$1 for every S$5 spent on your UOB Lady’s Card.

Note: With effect from 1 April 2024, the maximum spend cap for your UOB Lady’s Solitaire Card or UOB Lady’s Solitaire Metal Card will be revised to from S$3,000 spend to S$2,000.

8. What happens when I upgrade my Lady’s Card to Lady’s Solitaire Card?

Please visit uob.com.sg/ladys-enrol to choose TWO (2) of your preferred rewards categories. This will take effect the next calendar quarter. However, you may start enjoying the higher cap of S$2,000 spend based on your existing chosen ONE (1) preferred rewards category in the calendar month of your card upgrade.

9. How can you earn up to 25X UNI$ per S$5 spent (10 miles per S$1) on your preferred rewards category(ies)?

By maintaining at least S$10,000 Monthly Average Balance (MAB) in your UOB Lady’s Savings Account, you can now earn additional bonus UNI$, called the Lady’s Savings Bonus UNI$, for all eligible transactions in your preferred rewards category(ies) charged to your UOB Lady’s Credit Card in each calendar month. The Lady’s Savings Bonus UNI$ eligible will be determined based on your account MAB. This Lady’s Savings Bonus UNI$ will be awarded in addition to the Lady’s Credit Card Base 1X UNI$ as well as the Lady’s Credit Card Bonus 9X UNI$.

UNI$ you can earn per S$5 spend on your UOB Lady’s Credit Card when you save in your UOB Lady’s Savings Account:

| Bonus UNI$ earned on your preferred rewards category(ies) on your UOB Lady’s Credit Card | 9X |

| Base UNI$ earned on your UOB Lady’s Credit Card | 1X |

| Lady’s Savings Bonus UNI$ earned on your preferred rewards category(ies) on your UOB Lady’s Credit Card | |

| Monthly Average Balance (MAB) of your Lady’s Savings Account | UNI$ earn rate |

| ‹S$10,000 | - |

| S$10,000 to S$49,999 | 5X |

| S$50,000 to S$99,999 | 10X |

| S$100,000 & above | 15X |

Other useful links

UOB Cardmembers’ Agreement

Click here for a copy of the UOB Cardmembers’ Agreement.

UOB Debit Cardmembers’ Agreement

Click here for a copy of the UOB Debit Cardmembers’ Agreement.

General Information On UOB Cards

Click here for general information on UOB Credit Cards.

UOB Debit Card Fees and Charges

Click here for a copy of the UOB Debit Card Fees and Charges.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts/products that are covered under the Scheme.